Summary For March 2024

Portfolio @ End of Mac24

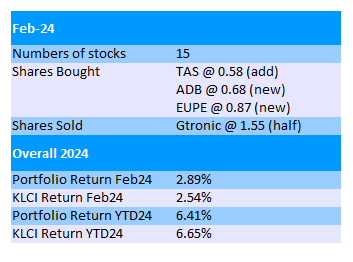

In Mac24, the two newly added stocks ADB & EUPE performed brightly as they rose 37.6% and 9.3% respectively.

This has helped to propel my portfolio to gain 1.6% in Mac24. YTD gain improves slightly to 8.1%.

The share price of ADB inched up almost everyday and I have no chance to add more shares. Thus it only contributes rather minimally to my portfolio despite appreciated 35%.

Meanwhile, the share price of EUPE took a break below RM1 so I took this opportunity to buy more of its shares, with a target price of RM2.