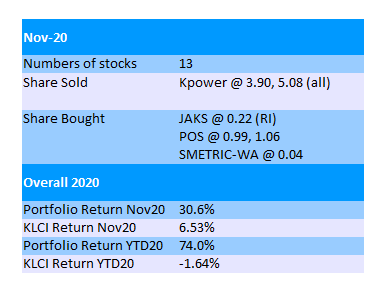

When I saw Jaks's Bursa announcement on rights issue on 13/7/20, I thought that it has finally fixed the price and date for its rights issue.

To my surprise, Jaks revised its original proposed rights issue in order to raise more money, from min/max RM130mil/RM160.9mil to RM200mil/RM289.6mil.

Most shareholders expect Jaks to be cash rich in a couple of years time, so they might be "shocked" by this increase in cash call.

For me, I actually don't feel particularly disappointed. I just think that Jaks needs the extra money to do something, be it to expand its business, pay the debts or compensation whatever.

Compared to private placement and huge bank borrowings, rights issue with "free" warrants might be a better way. However, I'm not too comfortable with the large amount of warrants.

I believe that the money raised will be put into good use. It will be superb if it is to subscribe to the remaining 10% of the power plant sooner to make it 40%.

I don't know the directors and I'm not sure whether they are credible, cunning or selfish. Perhaps I'm too naive.

The original plan is 4 existing shares entitled to 2 rights shares (est 40sen) with 1 warrant.

The revised plan is 5 existing shares entitled to 8 rights shares (est 22.5sen) with 4 warrants (ex 50sen).

If you have 1,000 Jaks shares now, you are entitled to 1000 x 8/5 = 1600 rights shares and 800 warrants. You need to pay 1600 x 0.225 = RM360 to subscribe in full.

The new TERP is RM0.50 based on 5-day VWAMP of RM0.9443. So the illustrative rights share price of 22.5sen represents 55% discount to TERP which is almost similar to the original plan (53%).

A total of 888.8mil issued rights shares stated in the table above is based on minimum RM200mil. If all rights shares are fully subscribed from existing 651mil ordinary shares, the number of rights shares will be 1,041mil in which RM234mil can be raised. So the total shares will reach 1,692mil before conversion of warrants.

The table below shows Jaks original rights issue proposal for comparison purpose.

As mentioned in previous post

"Jaks Worth Only 40sen?", even though the number of shares increase substantially and EPS will be adjusted lower, there will be no dilution to existing shareholders who subscribe to the rights issue fully.

If Jaks is able to generate the anticipated RM200mil annual net profit (from 30% shares), its projected EPS will be 11.8sen base on total shares of 1,692mil. Refer "

Jaks: Cash Cow In The Making?" for estimated profit and cash flow from its Hai Duong power plant.

Following the rights issue, Jaks share price will be adjusted lower accordingly. If its share price stands at 88sen on the ex-date, it should be adjusted to around 48sen if I'm not wrong.

This calculation is based on "before = after", p = adjusted share price.

(0.88 x 5) + (8 x 0.225) = (5+8)p + 4(p - 0.50)

p = 0.48

Base on projected EPS of 11.8sen, if fair PE ratio is 10x, target price will be RM1.18. This represents a potential 150% upside from 48sen.

When Jaks achieve 40% shares in the power plant, then potential annual net profit could be RM260mil with a projected EPS of 15.4sen. This is a potential 220% upside from 48sen if PE of 10x is given.

At 30% shares, a potential cash inflow of approximately RM300mil per year into Jaks is expected from the power plant operation. If the management is to give out one third or RM100mil to Jaks shareholders as dividend, it will be 5.9sen per share. This is a 50% payout from its net profit of RM200mil and a 12% dividend yield from share price of 48sen!

If Jaks choose to distribute only 20% cash from its power plant as dividend which is RM60mil, it will be a dividend payout of 30% from its net profit. Dividend per share will be 3.5sen per and dividend yield is 7.4% from 48sen.

If the dividend yield is consistently high, then the market might give Jaks a PE higher than 10x.

How much will Jaks distribute if its shares in the power plant rise to 40%? At this level, potential free cash flow attributable to Jaks might reach RM400mil annually.

Nevertheless, these calculations do not factor in the conversion of warrants in the future.

At this time the power plant in Vietnam has already fired up according to plan and the bleeding Pacific Star project should be able to be completed in 2020. Investors have to wait for year 2021 when both units of power plant run at full steam.

However, there are risks as well, such as:

- further delay or failure of the power plants operation

- net profit & cash flow contribution from power plant turn out to be way lower than expected

- management of Jaks refuse to pay reasonable dividends

- management of Jaks burn the cash with bad investment

Once the power plants are up and running in full throttle, not even a 10th wave of Covid or further global recession or stock market rout can prevent Jaks from making consistent profit and receiving fantastic cash flow for 25 years.

Please note that this is not a buy/sell call on Jaks. I can't guarantee all the calculations and information here are correct and accurate. Invest at own risk!