What is the first thing that crosses your mind when someone mentions about QL?

- A company that sells seafood

- A company that sells chicken and eggs

- A company that operates Family Mart

- A company that grows its revenue and profit annually without fail for more than 10 years

I think most investors with a few years of experience in Malaysia stock market will choose no.4.

Yes, QL is a "legendary" stock in Malaysia which has registered annual revenue and net profit growth every year without fail for at least 17 years (my available data is from FY2003).

It is commonly used as a reference when people talk about fundamental long term investment, consistent growth story and good management team.

While QL is no doubt a great company, how about Scientex?

Not many people talk about Scientex compared to QL. Is Scientex qualified to be in the same league as QL?

In the last 10 financial years, I think only 2 companies in Bursa Malaysia which are able to achieve continuous growth in BOTH revenue and net profit every year.

They are none other than QL & Scientex.

Public Bank, Maybank, Dialog & Allianz are close but they still fall slightly short.

Actually, similar to QL, Scientex also shows consistent growth in revenue and net profit for the past 17 years since FY2003, except a drop in FY2009 during the global financial crisis (as shown in line charts below).

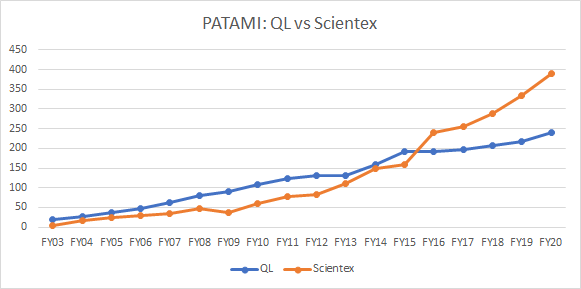

While QL's revenue is always higher than Scientex, we can see that from FY2016, Scientex's profit after tax and minority interest (PATAMI) has surpassed QL and goes from strength to strength from there.

In term of growth rate, Scientex's revenue grows at a CAGR of 16.8% in the last 17 years compared to QL's 11.0%. Its PATAMI achieves an impressive CAGR of 31.7% compared to QL's 16.2% in the same period of time.

Lets see some financial ratios of these 2 companies.

This is just to show that among ALL the parameters listed in the table above, Scientex has better numbers, with higher profit margin & ROE, lower debts, better cash flow and dividend yield.

Please note that it's not very meaningful to compare such figures directly between 2 companies in different industry, as different industry has its own "norm". It doesn't mean that QL is inferior to Scientex.

In its recent FY20Q4, Scientex delivered record high quarterly revenue and PATAMI at RM954.6mil & RM142.1mil respectively at a time when most businesses are being hit hard by Covid-19.

In this quarter the company made write-off and impairment on its PPE & goodwill totaling RM18mil. If not for this, its net profit can be 10% higher.

It is reported that Scientex has decided to demolish its factory for automotive interior products due to poor demand, and converts it into a robotic industrial stretch film facility.

It has allocated RM300mil to add 8 stretch lines over 3 years to increase stretch capacity by 32% to about 245,000 MT per annum.

The success of Scientex is very much associated with its current managing director Mr Lim Peng Jin.

He is the second generation of this family business and joined the board as an executive director at the age of just 27 years old. He then became the managing director in 2001 at the age of 33 years old.

Mr Lim graduated as a chemical engineer in University of Tokyo. The experience in Japan surely helped him as Scientex under his stewardship, established business relationships with various top Japanese companies related to its manufacturing and chemical businesses.

These collaboration and JVs not only helped to diversify and grow its business, but also enabled transfer of technology, skills & technical know-how from Japan.

Throughout the years, Scientex's manufacturing division grows organically through expansion of capacity as well as strategic acquisition.

Below are Scientex's acquisition of plastic & packaging companies in the last 10 years.

- Jan 2013 - acquired 100% of Great Wall Plastics for RM283mil

- Feb 2014 - acquired 100% of Seacera Polyfilm for RM40mil

- Aug 2015 - acquired 100% of Mondi Ipoh for RM58mil

- May 2018 - acquired 100% of Klang Hock Plastic for RM190mil

- Apr 2019 - acquired 61.9% of Daibochi for RM222.5mil

- Aug 2019 - Daibochi acquired 100% of Mega Printing & Packaging for RM125mil

Previously Scientex is primarily an industrial packaging player. Now it has successfully diversified into consumer packaging segment involving F&B and FMCG (Fast Moving Consumer Goods).

Besides, Scientex also expanded its client base and market reach, as well as achieving better economy of scale through such acquisitions.

It has set up manufacturing facilities abroad in Vietnam & USA in 2005 & 2017 respectively. The acquisition of Daibochi allows it to set its footprint in Myanmar.

The share price movement of Scientex is quite "boring" with not much volume every day. Nevertheless, its share price still manage to rise slowly, following the increase in its profit.

It's just that the market doesn't give it a higher valuation, perhaps due to its involvement in property development. In the last few years profit from property development seems to be "illegal" and have to be discounted off.

All the while Scientex has a problem in which its net profit depends too much on its property arm. In FY2013 when I first invested in Scientex, its property segment made up only 25% of its total revenue but contributed 63% to its profit.

In latest FY2020 results, even though property still makes up only 27% of revenue, the percentage of its profit contribution has reduced to 54%, which is almost half. This is a positive development in my opinion.

The table below compares PE & PB ratios of QL & Scientex.

It's still a myth to me why the market gives QL such a high valuation. Various investment banks also seem to justify its share price of around RM9 from their PER, SOP or DCF valuation.

If Scientex is to be given a PE of 67 like QL, it will be worth RM50.

The other reason for the lower interest in Scientex might be its "high" share price. Recent 2-for-1 bonus issue with warrants will cut its share price to one third and surely it will become more appealing to investors.

Regular readers here should know that I own Scientex shares. I regret that I just bought a little and did not top up since 2013. The reason is no other than its heavy involvement in property development.

Anyway, I think I should just keep the shares and see whether it can reach RM10 billion market cap by 2028 as targeted by the management in year 2018.

No comments:

Post a Comment