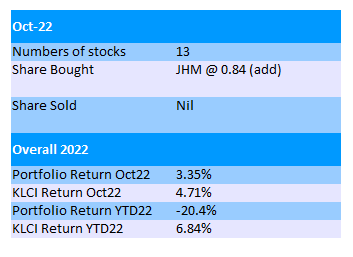

Summary For November 2022

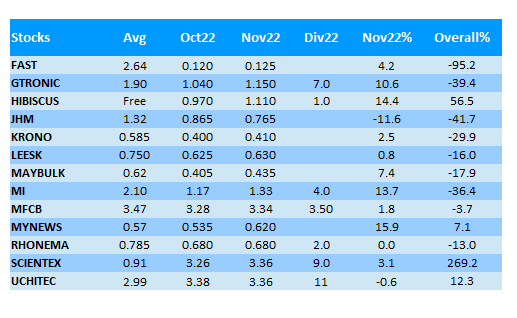

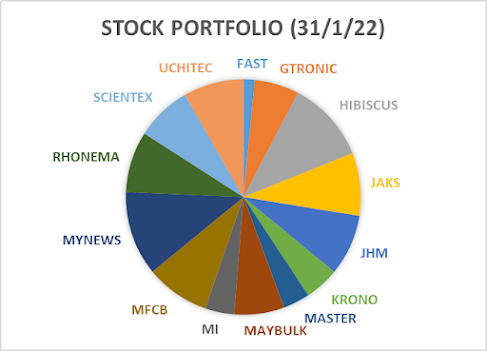

My Portfolio @ End of Nov22

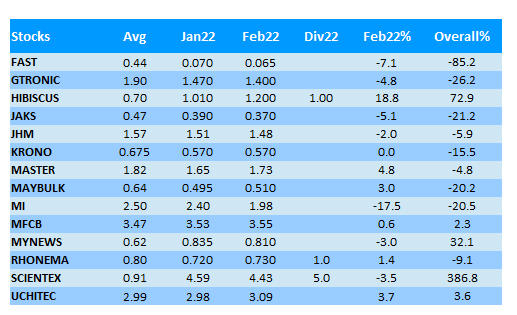

In the month of Nov22, tech-related stocks staged a good rebound. MI & Gtronic both rose 13.7% & 10.6% respectively but JHM dropped 11.6%.

The downtrend of JHM continues and it has already lost 25% in two months.

Meanwhile, the share price of Krono and Uchitec stay relatively flat.

MyNews is the top performer in my portfolio this month with a 15.9% gain, followed closely by Hibiscus at 14.4% gain.

Overall, Nov22 was dominated by General Election 15 and it was a good month for Malaysia's stock market.

The outcome of the election with the resulting "Unity Government" seems to be welcomed by most investors.