Can I buy tech stocks now?

I think most stock market investors in Malaysia will have this question.

Year-to-date, most tech-related stocks have seen their share price dropped between 30-50%. Their previous optimistic PE valuation of 40-60x has fallen to 20-30x currently.

PE ratio of between 20-30x seems to be fair and not expensive in recent tech super cycle.

However, will the PE valuation ever go back to 40-60x again when the sentiment in stock market improves later?

I really don't know. Who knows the PE might go back to 15-20x region when the worry of semiconductor oversupply emerges?

Anyway, tech related companies with high growth potential should be a safer bet.

The table below shows the most severely affected casualties in term of year-to-date (until 4th Mac22) drop in share price, and their actual trailing 12-months (TTM) PE ratio.

Greatec, MI and Kobay see their share price cut into half in merely 2 months time.

The list above is not a comprehensive list that covers all the tech-related stocks.

I mention tech-related stocks here instead of tech stocks because some of them are in the "industrial products and services" sector, not technology sector.

Dufu is in industrial sector while JCY is in technology sector.

FPGroup is in industrial sector while JFTech is in technology sector.

QES is in industrial sector while MMSV is in technology sector..

SAM is in industrial sector while JHM is in technology sector.

Other than these, those categorized in industrial sector include ATech, Coraza, KGB, Kobay & Uchitec. The rest in the list are in the technology sector.

Pure EMS players such as VS, SKPRES, ATAIMS etc are not included as tech-related stocks here.

The table below is similar to the earlier one, just that it's sorted from the lowest actual PE to the highest.

I think different companies deserve different PE valuation, depending on their size and growth potential.

Thus, low PE in this table does not necessarily indicate "cheap" or value buy to me.

Should we give different PE to those listed in technology & industrial products sectors? This is tricky as well.

Semiconductor boom started in the second half of 2020 and the trend seems to have leg to continue for a couple of years more.

Year 2021 is an extremely good year for tech-related companies as almost all of them registered growth in sales and profit.

The most notable one include D&O, Genetec, JFTech, QES, KGB, Vitrox, MPI, Greatec, Inari, Kobay, Dufu, UWC, Unisem, Aemulus etc.

The year-on-year improvement in their net profits range from close to 50% to even 100%.

The question is, can they sustain this type of growth rate going into year 2022?

I think most of them will still grow in year 2022, just that they might not achieve such impressive growth rate.

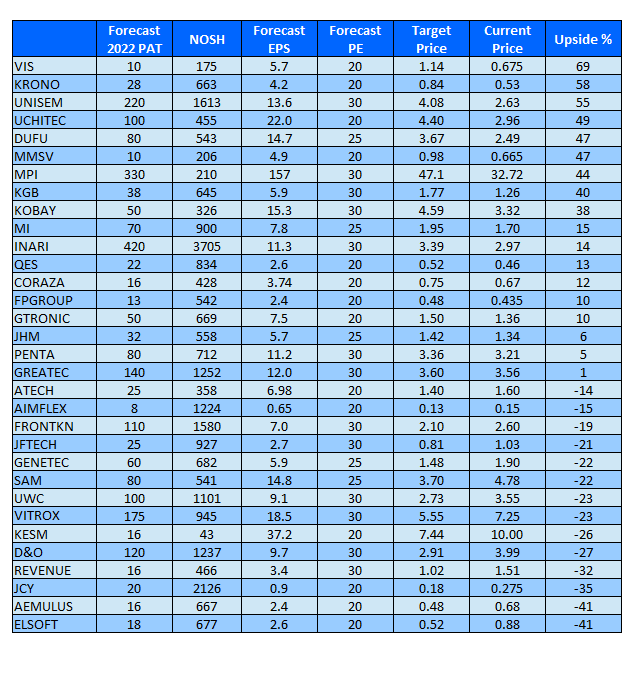

To determine which companies are "undervalued", I try to predict their bottom line in calendar year 2022, and then assign a "fair" PE to them to derive a target price.

In this 2022 profit forecast list above, some of the companies I know better but some I don't. So this forecast is just my personal opinion and can be very wrong.

However, those numbers are not just pluck from the air as it involves some research.

For the fair PE, I will use PE between 20-30, higher for those companies which are more established and have good growth prospect.

It's not right to assign a same PE ratio for all of them.

After comparing the target price with their latest share price, I get my upside potential for each of them.

The table below shows my roughly guesstimated target price of tech-related stocks sorted from highest potential upside to the lowest.

Don't be too upset if you see the target price of your favourite tech stocks are lower than your expectation here.

As I mentioned earlier, I don't know all the companies in detail.

Furthermore, this prediction is for calendar year 2022 only. Some companies have big expansion plans but they might only be ready to contribute in year 2023 onwards.

If you think that my year 2022 profit forecast for certain company that you know inside out is too high or too low, please correct me and I'll be happy to get the feedback here.

All the information here are just for sharing purpose and there is definitely no buy or sell suggestion.

Love the coverage of this post, at least from big picture stand point, it is providing some good overview. And yes, i am long for tech stocks overall. Previously their valuation was too high for my liking (overvalue), but now, even if they are not undervalue, they should be at least at fair value. So now it is just about looking for "good company at fair price" or "average company at cheap price" kind of game.

ReplyDeleteI think many tech stocks are "great company at fair price" now.

ReplyDeleteFor me, I am accumulating slowly and gradually.

Thanks Gem & value88 for your comment. I'm a bit wary of tech stocks actually, as their valuation might not reach previous high, but like you said, in long term certain tech companies look really good.

ReplyDelete