While reading income statement in a financial report, we will see both basic EPS (Earning Per Share) and diluted EPS at the end of the report.

Basic EPS is simple, which is defined as:

Net profit attributable to shareholders

_____________________________

Weighted average numbers of ordinary shares

Average numbers of ordinary shares is used in the denominator because total number of shares may change in a given period of time.

If more shares are issued in that period (warrant conversion etc), total number of shares will increase.

If the company buy back its shares, total number of shares will decrease.

Calculation of the weighted average shares is a bit complicated. It is best explained with an example.

If company X starts year 2015 with 100,000 shares, issue additional 50,000 shares on 1st Apr15, and then buy back 20,000 shares on 1st Oct15, and end the year of 2015 with 130,000 shares, what will be its average outstanding shares for the whole year of 2015?

As company X has 100,000 shares for 3 months (1st Jan until 1st Apr), which is 25% of one year, its weight will be: 100,000 x 0.25 = 25,000

From 1st Apr to 1st Oct (6 months), company X has 150,000 shares. So the weight it carries in this period of time will be: 150,000 x 0.5 = 75,000

For the last 3 months from 1st Oct to 31st Dec15, company X has 130,000 shares outstanding. So the weight will be: 130,000 x 0.25 = 32,500

If we add up all 3 of them: 25,000 + 75,000 + 32,500 = 132,500, this will be the weighted average shares for company X in year 2015.

We know that when the company issue more shares, earning will be diluted and this is generally not a good news for existing shareholders.

In Malaysia, common securities that potentially dilute the earning are warrants, employee stock options (ESOS) & long term incentive plan (LTIP), convertible loans (ICULS) & convertible preference shares (RCPS).

While the dilution effect of ESOS is basically small, the "damage" from warrants and ICULS should not be overlooked.

For accounting purpose, company must display in its financial report the diluted EPS arising from existing securities which are convertible into ordinary shares.

To calculate the diluted EPS from warrants conversion, commonly "Treasury Stock Method" is used.

This method assumes that all the cash raised from the conversion of warrants will be used to repurchase (buy back) the company's shares and put them under treasury shares.

Treasury shares bought back will reduce the company's outstanding shares in the open market.

Just take Thong Guan as an example:

Thong Guan has about 105.2mil ordinary shares. It issued 26.3mil warrants in Sep14.

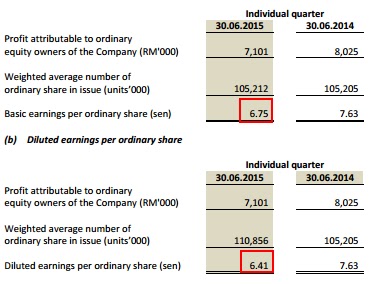

Below is Thong Guan's EPS in its FY15Q2 report ended 30 Jun 2015:

With PATAMI of RM7.101mil and weighted average shares of 105.2mil, Thong Guan's basic EPS is a straight forward 6.75sen.

We know that there are approximately 26.3mil warrants at this time which can be converted into one mother share each.

IF all warrants are converted to mother shares, total outstanding ordinary shares for Thong Guan will be 105.2 + 26.3 = 131.5mil.

So the diluted EPS should be 7.101 divided by 131.5 = 5.4sen right? This is my own way of calculating diluted EPS.

However, the diluted EPS stated in the report is 6.41sen, which is much higher than 5.4sen.

Lets calculate using the "Treasury Stock" method.

There are 26.3mil warrants with exercise price of RM1.50 each.

If all warrants are converted to mother shares in FY15Q2, Thong Guan will get RM39.45mil cash.

On 30th Jun15 which is the end of Thong Guan's FY15Q2, its share price closed at RM1.91 (might use average share price).

If all the cash raised are used to repurchase its ordinary shares from open market, it will be able to get 20.65mil shares.

So, there will be additional 5.65mil shares only after this convert & repurchase exercise (26.3mil - 20.65mil).

To calculate the diluted EPS, the total number of shares used is 105.2 + 5.65 = 110.85mil.

Thus, diluted EPS = 7.101 divided by 110.85 = 6.41sen.

Do you think this is a fair estimation of EPS dilution?

I don't think so.

In real life, we know that it is 100% impossible for a company to use 100% of the cash raised from exercise of warrants to buy back its own shares.

If the company do so, then what is the point of issuing warrants in the first place?

Even if the company does buy back its shares, the amount is usually small and negligible.

I think this "Treasury Stock" method seriously underestimate the EPS dilution effect so personally I won't use it.

Nevertheless, it is also not without flaw using my own way to calculate diluted EPS especially if the expire date of the warrants is still long and the company's earning may increase later.

Anyway, I tend to adopt the "worst case" scenario so I will stick to this at the moment.

Sometimes if a company has a bright future and gives attractive dividends, or the major shareholders want to strengthen their grip on the company, the warrants can be quickly converted into mother shares causing immediate EPS dilution.

For example Inari issued about 202mil of warrant-A in June 2013. Now (Oct15) there are only 9mil Inari-WA remaining in the market even though its maturity date is still long in June 2018.

The rest of 193mil have been converted to Inari shares causing significant earning dilution to Inari.

However, this is not a big concern for Inari's shareholders as its earning was widely expected to improve tremendously.

In conclusion, diluted EPS from warrant conversion is calculated using the "treasury stock method". EPS dilution from ICULS will be calculated with different method though.

Do you know how EPS dilution from ICULS is calculated ?

ReplyDeleteI'm still learning :)

Deletethanks BD for your detailed explanation. I learnt something new today... If you have found out how to calculate EPS dilution from ICULS, please post again to share with us... thanks!!!

ReplyDeleteYou're welcomed :)

Deletei try to calculate weighted shares for hevea..before split up..the total shares are 101,393,000..after the split up 1:4, the shares should be 405,572,000..but the latest report shows the total new shares are 391,339,000..less 14,233,000 shares..how can this happen?i try to check if there is share buy back by the company but can't find one. would you mind to enlight me?

ReplyDeleteHi Azilah, the total new shares of 391,339,000 shown in the Q3 report is a "weighted average" number of shares from July 15 to Sep 15. It does not mean the total number of shares on 30 Sep 15.

Delete