I used to subscribe to Inari rights issues before in 2015. At that time I used a nominee account. So my broker helped me to do everything and I just needed to ensure that I had enough money in my account to pay for the rights shares.

Now I mostly use direct trading account. That means there is no one to help me and I have to do it all by myself.

As it's my first time subscribing for rights shares on my own (current Jaks rights issue), I contacted the investment bank and they were kind enough to give me the instruction on what I should do.

Travelling to 2 places (bank & post office) and queuing up during this very moment is both time-wasting and risky.

If I were to receive it tomorrow after work, then I can only send it back next Monday (9 Nov) which is very close to the last date of 12 Nov.

I can only go to bank or post office during my 1-hour lunch break and it's very possible that I can't get it done in a day even I skip my lunch. So most probably I can only send it back on 10 Nov.

If there is any delay by pos laju and I can't subscribe the rights shares on time, who is to blame?

Luckily I have all these done 2 days ago.

I am aware that application of rights issue can be done online through Tricor nowadays. So I decided to give it a try since it will save a lot of time and effort.

Now I have successfully subscribed to my rights online. It's as easy as ABC and can be done in 5 minutes, seriously.

You can do it irrespective of which investment banks you have your trading account with.

First, you have to sign up with Tricor Investor & Issuing House (TIIH Online)

After signing up, you should be able to receive a verification email within one business day. You activate your Tricor account through that email, reset your password and then login.

Once you have logged in, choose the company from the drop-down list as shown below. In this case it's Jaks Resources Berhad.

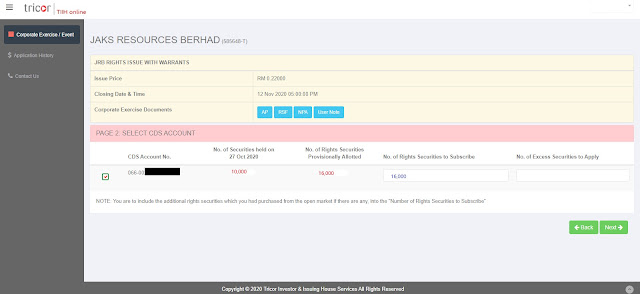

If you are entitled to Jaks rights shares, the system will show your CDS account, how many Jaks mother shares you have on entitlement date and how many rights shares you are entitled to.

For example, if you have 10,000 Jaks shares on entitlement or ex-date, then you are entitled to 16,000 rights shares. You need to type in the amount of rights share you wish to subscribe, then click Next.

For "No. of Excess Securities to Apply", you can just leave it blank if you don't wish to apply more rights shares in case it is under-subscribed.

After this, the system will show how much money you need to pay for the rights shares. On top of this, you have to pay a RM10 setem hasil and RM5 handling fee.

Then you choose the method of payment and follow the instruction. Payment can be done through FPX from any banks in Malaysia.

Just like all online transfer and payment, you will be guided to your internet banking page in which you have to key in your username and password, then mobile OTP.

Just make sure that your payment amount does not exceed the limit of your bank transfer.

After successful payment, you will receive an email informing you that the online payment is successful.

It's just that simple and the RM5 handling fee is well worth it.

If you have this Tricor account, you can also register for AGM/EGM and submit proxy forms online.

It definitely makes the world a lot easier for those who have direct share trading accounts!

Thanks for the info.

ReplyDeleteYou're welcomed

DeleteFor your reference:

ReplyDeletei) The analyst reported that Perodua recorded the highest quarterly sales performance ever with a total of 70.8k units sold from July to Sept'20. The Oct-Dec'20 sales is also expected to be good due to the sales tax exemption given from Jun-Dec'20 by government. MBMR should post good quarterly earnings in coming Q3 and Q4 FY20.

ii) The recent Budget 2021 announced government is to restrict the transhipment of cigarettes to battle illegal cigarettes and to impose duty on electronic cigarettes. This bodes well to BAT as its greatest business threat comes from illicit tobacco trade.

MBMR is in my close watch list. There are so many stocks that I'm interested to buy at the moment, sigh... Already missed a few as their share price already jumped. Agree with you that MBMR's Q3 and Q4 results are going to be very good, and make current share price looks very cheap in term of PE ratio. It might pay very good dividend too and DY might be >6% anytime. Anyway, the only concern is that such good results might be not sustain as soon as next year, and currently Perodua has maxed out the production output of 25k per month. MBMR is still a great stock at current price of <RM3 IMO.

DeletePersonally I don't think the gov can effectively curb the illegal cigarettes, and with vaping seems to be more popular among the young people, even with electronic cig tax I think it's not going to change much. BAT is not my cup of tea..

DeleteThanks for your sharing, appreciate it very much.

is that all the company right issue can found in Tricot?

ReplyDeleteI think not all, only for those companies who appoint Tricor

DeleteHi bursa dummy,

ReplyDeleteAppreciate ur help on the question below:

1) so can I conclude that as long as the company appoint tricor, the erights above can be used to subscribe right issue?

2) do you have any idea to go for the right issue (erights) if the company does not appoint tricor?

Hi,

Delete1) Yes I think so

2) I'm not too sure, may be other share registrars other than Tricor also provide erights

Hi dummy,

ReplyDeleteI really appreciate your respond.

I also wish to clarify that the option to exercise via tricor, must it be only if ur share is in public bank or affin?

Hi, you're welcomed, your shares can be with any investment banks

DeleteGood day. This is very information. In addition, I would love to know more, how soon are the new subscribed right shares will be credited into our CDS account? Or it need to wait until the Final Announcement of Right Issue?

ReplyDeleteHi, yes we need to wait until the announcement of the dates of the right issue which include the ex-date and entitlement date. The entitlement date should be the day the right shares credited into CDS account.

DeleteI see. Thank you for the info

Delete