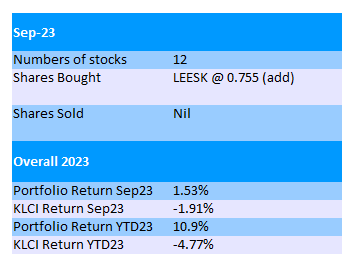

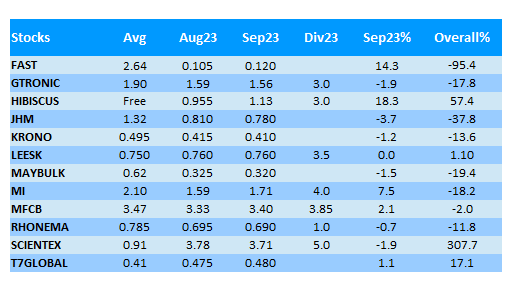

Summary of September 2023

Portfolio @ End of Sep23

In Sep23, Brent oil price went up from USD85 to USD94. As a result, Hibiscus share price soared 18%.

MI also gained a decent 7.5% in the month.

Other than these, other stocks did not change much.

Thanks to the 2 stocks mentioned above, my portfolio manage to gain 1.5% in Sep23, with a YTD gain of 10.9%.

Its net profit of (RM3.04mil, EPS 0.41) was slightly lower YoY due to higher tax expense of 45% of its PBT.

Up to the first half of FY24, it shows good growth in revenue in both EDM infrastructure technology & As-A-Service segment.

Historically its revenue will be better in the second half of the FY. Hopefully this year is not an exception.

Scientex's FY23Q4 registered a revenue of RM1.07bil and PATAMI of RM114.9mil (EPS 7.41sen), which is its best quarter in FY23.

If not because of an impairment on goodwill of RM22.7mil in relation to operation in Myanmar, its current quarter net profit will be much higher.

Packaging division continue to suffer but property sector continue to improve.

Property division contributed almost 70% of its operating profit in FY23, despite only makes up 35% of its revenue.

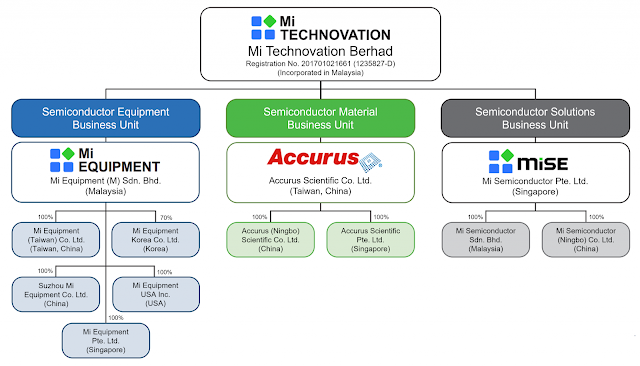

MI has just officially announced that it will set aside USD30mil (RM142mil) for its SSBU (Semiconductor Solution Business Unit) under Mi Semiconductor Pte Ltd (SG).

It is for building a research, development and manufacturing facility for power module and devices in Xiaoshan Hangzhou.

It plans to complete and commence operation of the 1st production line with an annual turnover of around 60,000 pcs high power module, including but not limited to IGBT and SiC power modules with aerospace and automotive grade.

It is expected to commence operation by the end of year 2024.

In earlier Oct23, MI announced that its founder and CEO Mr Oh Kuang Eng has zero involvement in its SEBU now to concentrate fully on SSBU.

The word SiC (Silicon Carbide) which is one of the hottest topics in tech industry, makes this SSBU interesting.

Anyway, the SSBU will start from scratch so it might incur losses in short term.

Gtronic has just released its FY23Q3 result. Revenue of RM34.6mil & net profit of RM9.5mil (EPS 1.42sen) are the highest so far in FY23.

For the first 9 months of FY23, revenue dropped 27% while net profit plunged 40%. This is definitely not a good performance.

Nevertheless, its share has climbed 25% since the start of the year from RM1.12 to RM1.40.

Anyway, it has already fallen from RM3.00 level since 2-3 years ago.

The management again mentioned that the group is expected to experience decline in profitability for FY23.

This is nothing new as in the end of FY22, it already warned about poorer financial performance in FY23.

I just hope that this FY23 will be the year with lowest profitability.

No comments:

Post a Comment