Summary For November 2025

Portfolio @ End of Nov25

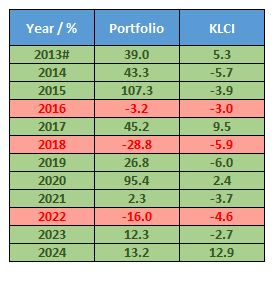

November was a bad month to me as my portfolio was down by 5.3%, deepening the YTD loss to 8.9%.

The faint hope to end 2025 with a positive gain has officially gone.

The main culprit for the poor portfolio performance in Nov25 was MMSV, which plunged 41% after a poorer than expected FY25Q3 result.

Initially I didn't hold a lot of MMSV shares but I added more at 60sen before the result announcement.

It was not an extremely bad quarter result actually with net profit of RM1.85mil (EPS 0.94sen) but the market expected it to beat preceding FY25Q2 net profit of RM2.8mil.

Furthermore, the management painted a "challenging" future quarters which was exactly the opposite of what was said 3 months ago.

Together with major correction in tech sector globally, MMSV could not escape the heavy sell down.

I sold part of its shares at 55sen though, only to regret not selling all of them.