Heng Huat is a "green company" recently listed in ACE market in July 2014. It involves in:

- manufacturing & trading of biomass materials & value-added products

- manufacturing & trading of mattress & related products

I have written briefly about this company during its IPO earlier in July 2014.

Heng Huat mainly buys coconut and oil palm biomass materials and turns them into mattress, geotextiles, briquettes etc.

Does this business model has a future?

I think the world is moving towards energy saving, green and environment friendly kind of things. So Heng Huat should be worth to have a look.

In Heng Huat's IPO prospectus, Protege Associates has given an analysis regarding biomass market in Malaysia.

According to the research, coconut & oil palm EFB fibers market in Malaysia is expected to grow at CAGR of 14.3% from 2013 to 2018.

From the same research as well, Heng Huat is currently a market leader in Malaysia's biomass market by a huge margin, with 47.4% market share in 2013!

It is actually "several streets" ahead of other identified key market players in the country's biomass material market, in term of size, revenue and profit.

Heng Huat has manufacturing plants in southern mainland Penang (Sungai Bakap - palm/mattress), southern Kedah (Bandar Baru Selama - palm) and Kelantan (Bachok - coconut). Most of its production lines are still running far below maximum capacity except for oil palm EFB fiber.

| Lines | Monthly Capacity | 2013 Utilization % | |

| Coconut Fiber | 2 | 546 MT | 53.1 |

| Oil Palm EFB Fiber | 20 | 8,372 MT | 74.1 |

| Briquette | 2 | 3,016 MT | 33.2 |

| Coconut Fiber Sheet | 3 | 491,400 m | 32.9 |

| Mattress | 15,600 pc | 27.7 |

Recently Heng Huat has purchased land which costs RM3.67mil in Gua Musang Kelantan via its newly established wholly-owned subsidiary HK Gua Musang. It plans to build additional 8 production lines for oil palm fiber. This will increase the total monthly capacity by 3,000 MT.

Besides, it also plans to expand one of its plant by 80,000 sq ft and build a boiler turbine system to generate power. It is estimated to have cost saving of RM3mil annually. The construction of the new facility will only commence in Q3 of 2015.

After all these, Heng Huat may not need too much cash for capital expenditure.

After all these, Heng Huat may not need too much cash for capital expenditure.

Oil palm EFB fiber

China is Heng Huat's major market for its oil palm EFB fiber, which makes up 55.2% of its total revenue in 2013.

Its exports to China has more than doubled from RM18.7mil in FY11 to RM40.7mil in FY13.

It has 9 customers in China in which all are intermediaries. Heng Huat plans to set up a subsidiary company in China by Q1 of 2015 to reduce its dependence on those intermediaries and also to improve profit margin.

The chart below shows the demand of coconut fiber in China.

The import of coconut fiber of China is in an increasing trend. However, there is no data on oil palm fiber which is Heng Huat's main export to China.

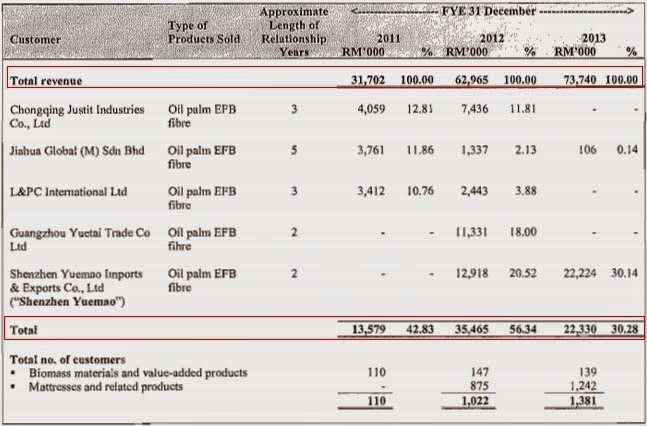

Table below shows Heng Huat's major customers from 2011 to 2013.

As shown in the table, a few major China intermediaries just stop trading with Heng Huat in 2013. Nevertheless, Shenzen Yuemao emerges as the largest customer with huge orders.

There is no long term contract signed between both parties. So it is good if Heng Huat can sell its products directly to end-users in China through a subsidiary company.

Its total number of customers for biomass materials & value-added products have increased from 110 in year 2011 to 139 in year 2013. Customers in mattress division also increases from 875 to 1,242 from year 2012 to 2013.

Its total number of customers for biomass materials & value-added products have increased from 110 in year 2011 to 139 in year 2013. Customers in mattress division also increases from 875 to 1,242 from year 2012 to 2013.

As for its raw material supply, I don't think Heng Huat will have any difficulty in getting them as coconut and oil palm trees are abundant in Malaysia.

Currently briquette only makes up little revenue from export to China, as Heng Huat has just started commercial production of its briquette since Jan 2013.

With China's recent ban of new coal-fires plants in its largest cities Beijing, Shanghai & Guangzhou, cleaner energy source such as briquette may have more demand in the future.

Besides China, Heng Huat also exports some of its biomass products to UAE, Korea, Japan & Australia.

Heng Huat is yet to penetrate into the western countries, which are supposed to have more awareness on environmental issues and are more keen to use environmental friendly products.

From newspaper report, it has to obtain certain ISO certification before it can enter European & US market. I am not sure when can Heng Huat get the required certification though.

Heng Huat's products of biomass materials which are natural fibers face competition from synthetic fibers, which are derived from petrochemicals and have lower production cost.

With the drop of crude oil price recently, there is a risk that Heng Huat's natural fibers and palm briquettes will become less sought after due to cost issue.

I think this might be the main risk in Heng Huat's business.

Anyway, personally I am hopeful that palm briquettes will help Heng Huat to grow significantly in years to come. The sales of briquette, which is mainly to local customers at the moment, just contributes 2.5% of its total revenue on FY13.

Just imagine how much coal, wood, petrochemicals etc are burnt for energy everyday in the world. If palm briquette is so good like what Heng Huat says, I can't think of any reason why people don't want to change to briquette. It's actually cheaper & more efficient than coal & firewood!

More details of palm briquette can be found in Heng Huat's website.

Anyway, personally I am hopeful that palm briquettes will help Heng Huat to grow significantly in years to come. The sales of briquette, which is mainly to local customers at the moment, just contributes 2.5% of its total revenue on FY13.

Just imagine how much coal, wood, petrochemicals etc are burnt for energy everyday in the world. If palm briquette is so good like what Heng Huat says, I can't think of any reason why people don't want to change to briquette. It's actually cheaper & more efficient than coal & firewood!

More details of palm briquette can be found in Heng Huat's website.

Besides palm briquette, another new products Geotextile which is used in civil engineering work to prevent soil erosion, is expected to begin commercial production in the end of FY14.

If you think Heng Huat has a good business model and its products have a good future, is it worth to invest in the company right now?

Lets check on Heng Huat's past financial results.

If you think Heng Huat has a good business model and its products have a good future, is it worth to invest in the company right now?

Lets check on Heng Huat's past financial results.

| RM mil | FY13 | FY12 | FY11 |

| Revenue | 73.7 | 63.0 | 31.7 |

| Gross profit | 32.0 | 30.6 | 17.6 |

| PBT | 11.4 | 13.6 | 13.7 |

| PATAMI | 9.7 | 12.2 | 10.5 |

Revenue increases over the years but net profit drops in FY13. However, this is mainly due to depreciation. Its EBITDA actually improves marginally from RM18.3mil in FY12 to RM18.6mil in FY13.

Heng Huat has released its financial result for the first half of FY2013.

| HHGroup (RM mil) | 1H14 | 1H13 |

| Revenue | 45.4 | 32.5 |

| PBT | 7.4 | 5.7 |

| PATAMI | 5.7 | 5.0 |

| Gross % | 44.3 | 46.5 |

| PBT % | 16.3 | 15.4 |

| Cash | 6.2 | 5.5 |

| Borrowings | 36.0 | 36.8 |

| Net D/E | 0.69 | 0.84 |

| NTA | 0.27 | 0.23 |

| CFO | 6.5 | 1.4 |

| CFI | -5.1 | -6.6 |

| CFF | -1.1 | 4.7 |

| Net CF | 0.4 | -0.4 |

For the first half of FY14, revenue and PATAMI increase 40% and 14% respectively.

Profit margin remain good, with effective tax rate at only 12.2% in this period of time due to products granted pioneer status with tax exemption.

Profit margin remain good, with effective tax rate at only 12.2% in this period of time due to products granted pioneer status with tax exemption.

| Company | Products | Years | Tax Exemption Period |

| HK Fiber | Coconut Fiber Sheet | 5 | 1 Apr12 – 31 Mac17 |

| HK Kitaran | Palm Biomass Fiber | 10 | 1 Jul10 – 30 Jun20 |

| HK Kitaran | Palm Briquettes | 5 | 1 Feb13 – 31 Jan18 |

As cash from IPO in July will only appear in its balance sheet in Q3, net debt/equity ratio stands at an uncomfortable 0.69x.

However, with RM20.93mil cash from IPO, its gearing is expected to fall to approximately 0.3x.

For FY13, sales in oil palm EFB fiber was stagnant but new product palm briquette starts to make meaningful contribution.

Revenue from coconut fiber division remain flat in FY12-FY13, while mattress sales improves significantly though this division is still struggling to generate profit.

Table below shows the latest segmental result of Heng Huat (6 months into FY14). These figures are before elimination of inter-segmental transaction.

Revenue and PBT of biomass materials registers healthy YoY growth at 40%+.

For FY13, sales in oil palm EFB fiber was stagnant but new product palm briquette starts to make meaningful contribution.

Revenue from coconut fiber division remain flat in FY12-FY13, while mattress sales improves significantly though this division is still struggling to generate profit.

Table below shows the latest segmental result of Heng Huat (6 months into FY14). These figures are before elimination of inter-segmental transaction.

| RM mil | 1H14 | 1H13 | Change % |

| Biomass Revenue | 36.4 | 25.3 | 43.9 |

| Biomass PBT | 7.7 | 5.5 | 40.0 |

| Mattress Revenue | 18.3 | 14.5 | 26.2 |

| Mattress PBT | 0.14 | 0.45 | -68.9 |

Revenue and PBT of biomass materials registers healthy YoY growth at 40%+.

If Heng Huat is able to sustain its earning momentum, it may post a PATAMI of RM12mil for its FY14. With 205.8mil paid-up shares, projected EPS will be 5.8sen.

At current share price of 48.5sen, its PE ratio will be 8.4x.

During its IPO in July, projected EPS of FY14 given by a few analysts are as below:

During its IPO in July, projected EPS of FY14 given by a few analysts are as below:

- Kenanga - 5.22 sen

- Maybank IB - 5.0 sen

- Inter-Pacific - 5.8 sen

Heng Huat does not have a fixed dividend payout policy but it may give out up to 20% of distributable profit as dividend to shareholders.

If it were to achieve RM12mil PATAMI for FY14 and pay 20% as dividend, this means it will pay RM2.4mil or about 1sen per share, which translates into an unattractive yield of 2% at share price of 48.5sen.

Nevertheless, we can't actually rule out that it will give negative surprise in its quarterly results later.

Nevertheless, we can't actually rule out that it will give negative surprise in its quarterly results later.

Heng Huat will certainly fulfill the criteria for main board soon after it was listed in ACE market. It may apply for a transfer to main board as early as next year.

Although the husband & wife combo of Heng Huat does not have a good reputation like Boilermech's directors, Heng Huat does make me think of Boilermech. Can its share price behave like Boilermech as well?

Lets see its financial results of subsequent quarters.

Lets see its financial results of subsequent quarters.

Excellent sharing, thanks

ReplyDeleteWow there u go BD effect on today's shoot up :)

Thanks wachxe. I prefer its revenue & profit to shoot up :)

Delete"With the drop of crude oil price recently, there is a risk that Heng Huat's natural fibers and palm briquettes will become less sought after due to cost issue."

ReplyDeleteI think it is a good news since the supply of oil palm trunk r getting more n cheaper.

Cheap fibre mattress r really an affordable prod for working class.

Agree wit u that HH has a good n sustainable biz model