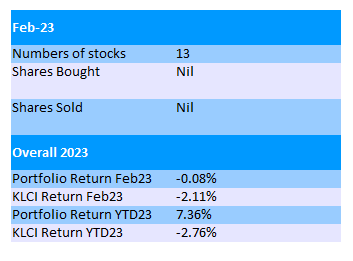

Summary of February 2023

Stock Portfolio @ End of Feb23

Feb23 was not a good month for KLCI as it dropped 2.1%, extending its YTD loss to 2.8%.

My portfolio performance was flat in this month with a slight 0.1% drop in value.

MI was high flying in late Feb23 after it released its FY22Q4 result. Its share price rose 35% in a month.

However, my portfolio was dragged down by other stocks particularly JHM, myNews & Hibiscus.

There was no buy and sell transaction in this month and the total stocks remain at 13.

At least it's not particularly bad like some fellow tech stocks.

There was a net forex loss of RM6.1mil in current quarter compared to RM9mil of forex gain in the preceding quarter.

If we take this into account, then current FY22Q4 profit is extremely good.

Total revenue of RM117mil in the quarter is almost its record high, boosted by the recovery in its SEBU segment.

This is what I have hoped for when starting my investment in MI: Recovery in SEBU and growth in SMBU.

Anyway, demand for its SEBU products seem to fluctuate. Recent reopening of China border should be good news to MI.

In its prospect section, the management mentioned that while first half of 2013 remains challenging, SEBU is expecting another prominent revenue stream in 2023.

According to PB analyst, MI expects SEBU in China & Korea to turnaround this year while SEBU in Taiwan will cease operation after being integrated into China's operation to save cost.

It will also ramp up production lines of its SMBU new Ningbo plant from 3 lines to 4-6 lines as it needs at least 6 lines to breakeven.

MI is planning to increase its stake in Talentek from 22.64% to 35% to gain bigger exposure into semiconductor final test segment in China.

There is a "share of result of an associate" at RM2.216mil in FY22 for MI which should come from Talentek.

Uchitec's FY22Q4 result was good as expected, with net profit of RM32.7mil (EPS 7.2sen).

It has proposed a final dividend of 13sen, lower than 15sen I expected. Anyway, total 25sen dividend for FY22 is already 25% higher than 20sen in FY21.

Management expects flat revenue in FY23 in term of USD. With much higher income tax rate kicking in, I expect its dividend in FY23 to fall back to 20sen.

At share price of RM3.30, it's still a good 6% dividend yield.

I don't have plan to hold Uchitec for too long as it has a risk of being too dependent on its major customer.

Apart from MI, I think JHM also gave me positive surprise.

Its revenue and PATAMI of RM86.8mil & RM2.2mil (EPS 0.39sen) respectively were not particularly good but there was a net forex loss of RM4.3mil in current quarter.

I was initially a bit worried that it might sink into loss in this quarter due to weakening of USD against MYR.

For the whole year of FY22, PATAMI is RM22.6mil (EPS 4.04sen) while the net forex gain is just RM2.6mil.

FY22 is not a good year though as PATAMI dropped 34% from RM34.5mil in FY21 to RM22.6mil despite revenue increased 20% from RM296.6mil to RM355.8mil.

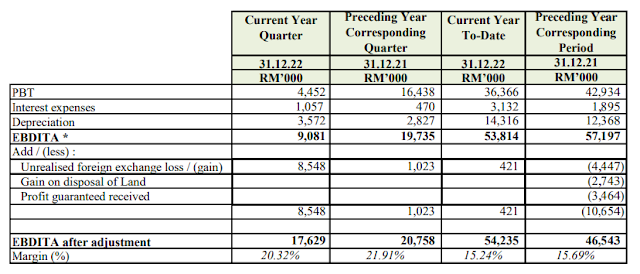

Nevertheless, FY21 has got a quite a lot of one-off gain. If we exclude those special items, EBIDTA in FY22 is actually 16.6% better than FY21, as shown below.

On commentary of its prospect in FY23, management remains "cautiously positive".

Both RHB & Kenanga analysts gave quite a positive notes on JHM after attending the management briefing.

Kenanga

- JHM has been awarded 14 new projects by a prominent American automotive lighting company. The first 6 models have already qualified and will transition into the production stage by 1H23.

- It expects orders from existing automotive and industrial customers to improve going into FY23.

- The impact of higher electricity tariffs is marginal on JHM.

- Expects earning to recover significantly in 1H23 on fulfillment of backlogged orders from its largest client in automotive.

- Expanding Plant 6 facility to include 2 high-end surface mount tech lines (existing 7 lines) to support LED module production for a new Japanese customer (aggregate revenue RM200mil for FY23-FY26).

- 55%-owned JHM-Dekai Auto Lighting will commence full lamp assembly for national car brand by Q3FY23 with estimated RM10mil in FY23, set to grow to RM30-40mil in FY24-25.

- In industrial segment, major project win includes the transfer of a new PCBA project from JHM's Singapore customer with an annual growth of RM15-20mil.

- Overall utilization rate remains healthy at 70% while margins are set to remain stable.

- Batu Kawan plant expansion will be delayed, as potential clients are unable to commit on the loadings amid market uncertainties.

Gtronic's FY22Q4 revenue of RM43.1mil and net profit of RM12mil (EPS 1.8sen) are not too bad.

PAT dropped 5.7% QoQ but there are net forex loss of RM2.4mil and write-down of inventories of RM1.6mil in current quarter.

Another 1sen interim dividend is declared. Total dividend in FY22 will be 6sen, giving it a DY of 5.6% at share price of RM1.08.

Anyway, management expects lower financial performance in 2023 so that's it.

Maybulk FY22Q4 result was not particularly good, even though revenue (RM37.9mil) and net profit (RM11.4mil, EPS 1.14sen) stayed relatively flat compared QoQ.

There was a huge forex gain of RM6.5mil in current quarter, and the interest income of RM3.1mil was also significant due to the RM322mil cash in short term deposit.

BDI suffered badly since the turn of the year as it dropped from 1600 to just 500+ in Feb23, before rebounding to current level of 1300+.

The acquisition of the entire stake in E Metall System for RM70mil was completed on 30 Jan23, so it will contribute to Maybulk's top & bottom lines for 11 months in 2023.

There are profits guarantee of RM6mil net profit per year for FY22 & FY23 which does not seem very exciting.

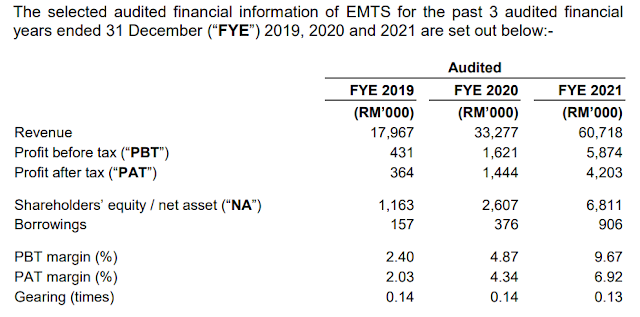

However, the growth of E Metall in the past 3 years from 2019 to 2021 was quite phenomenal. Its revenue and net profit doubled every year.

If E Metall were to go for an IPO, surely it will gain more attention with this set of results.

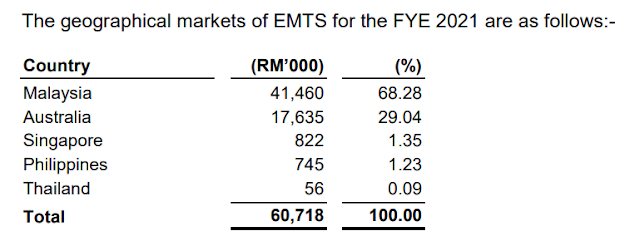

It has a good presence overseas as well especially in Australia.

E Metall is an end-to-end racking system, logistic storage and retail display solution provider. Its name is very similar to another listed steel company Eonmetall Group.

Dato Goh Cheng Huat, who is the founder and executive director of both listed companies Eonmetall & Leader Steel, is now the managing director of Maybulk.

He is currently the largest shareholder of Maybulk with 32% shareholding after significantly increased his stake in the company last month.

Interestingly, Eonmetall also seems to do the same business as E Metall which is the racking system.

It seems like both Emetall and Leader steel did not perform too well though. Lets see what the new MD will bring to Maybulk.

The FY22Q4 result of MFCB was so-so as expected. The PBT of all 3 major divisions dropped in the quarter compared YoY.

FY22Q4 PATAMI of RM95.2mil (EPS 10sen) was 20% lower compared QoQ.

On its prospect, average EAF for its Don Sahong hydropower plant was 94.6% in 2022, and expected to drop 2% in 2023 due to deferment of turbine maintenance from 2022 to 2023.

The management expects earning from Resource, Packaging and Edenor to improve YoY in 2023.

Construction of 2 new factories for its packaging division will proceed as planned and are expected to be completed by the end of 2023.

MFCB proposed second and final dividend of 3.85sen for its FY22, bringing total FY22 dividend to 7.45sen (FY21 6.75sen).

Dividend yield stands at 2% at share price of RM3.60.

LEESK ended FY22 on a rather high note by achieving its record quarter revenue (RM35.3mil ) and almost record high net profit (RM3.8mil, EPS 2.35sen) in its FY22Q4.

Current quarter of FY22Q4 included impairment loss of RM1.392mil. If we exclude this impairment, then easily it will be record profit for LEESK.

For the whole year, FY22 is definitely a record year by a huge margin, with revenue of RM129mil (+23.3% YoY) and PATAMI of RM13mil (+71.5% YoY).

Sales in local market is good probably contributed by collaboration with Cuckoo. However, export markets remain weak.

FY22's EPS is 8.07sen. At share price of 80sen, PE is about 10x.

Its FY22 dividend will be 3.5sen, higher than 2.5sen in the previous year. Dividend yield will be a decent 4.4%.

If the management can find a way to improve its export sales, then FY23 might be another record year.

Rhonema recorded a record quarterly revenue at RM53.7mil in its FY22Q4 but PATAMI dropped 2.5% YoY to RM3.1mil (EPS 1.38sen).

There was a write back & write off on inventories of RM1.5mil and RM0.7mil respective, with a forex gain of RM0.6mil.

Overall it's not a very good quarter for Rhonema as it continues to face cost pressure.

For its FY22, revenue improved across all segments but PBT in Food ingredients and Others (dairy) fell.

I don't have high hope on Rhonema at the moment, just hope that its share price can stay above 70sen.

At the first glance of Hibiscus FY23Q2 net profit of only RM70.5mil (EPS 3.5sen), I was quite shocked.

It was too far lower than approximately RM150mil net profit per quarter I have hoped for.

Fortunately there was an one-off additional deferred tax liabilities recognized amounted to RM106.7mil under its UK assets in Anasuria.

This is due to the change to the EPL regime recently by the UK government, demanding for some extra tax it seems.

Without this, its net profit in FY23Q2 could easily exceed RM150mil

It seems like this amount will be fully reversed to the profit or loss during the window for which the EPL regime applies up to 31 March 2028.

Meanwhile, the malfunction of a component which negatively affected Anasuria production since May21 has been fully resolved in Sep22, which significantly improved its efficiency.

I don't understand why Hibiscus needs to pay the EPL tax since it does not own any football team in England.

Out of the 9 companies that released the quarterly result in Feb23, I think all of them are not too bad.

There is no extremely good results but I think MI, JHM, LEESK & Hibiscus are not bad and seems to have brighter prospect in 2023.

Of course Hibiscus will depend heavily on the crude oil price, which currently manage to stay above USD80 at USD82.50.

The US Fed is widely expected to hike interest rate in May. So the stock market might not be very good up to the middle of the year.

Anyway, I heard that the worry of economy recession is getting lesser, and probably the chance of "soft-landing" is higher.

Nevertheless, the news of the collapse of Silicon Valley Bank (SVB) in the US last week will surely send anxiety across the market.

SVB is specialized in providing financial services to tech startups. Its collapse is the largest US banking failure since the financial crisis in 2008.

I'm not sure how serious it would turn out to be. Will it cause domino effect and negatively affecting other banks and businesses?

Later in Mac23, Scientex, myNews and Krono will announce their quarter results.

Based on the most recent results of their peers, I don't think Scientex and myNews will do well. The latter might slip back into the red.

I guess the stock market will not be too good until the SVB crisis is sorted out...

No comments:

Post a Comment