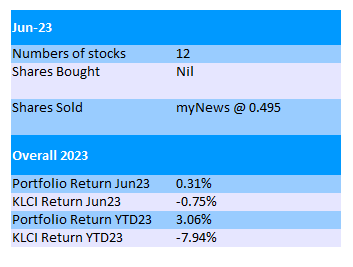

Summary For June 2023

Portfolio @ End of Jun23

My portfolio is rather flat in Jun23 with a marginal gain of 0.3%. Overall YTD still manage to stay in the positive territory of 3.1%.

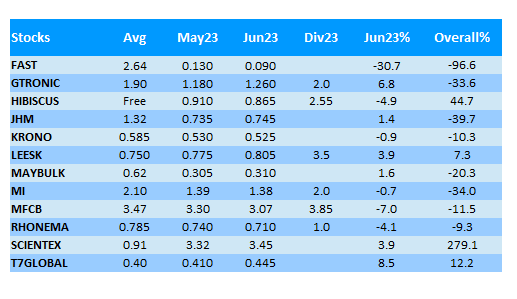

T7Global started to make some move this month with a sudden surge from 41.5sen to 47.5sen in mid June, only to retreat to 44.5sen at the end of Jun23.

Gtronic made good progress as well with a 6.8% gain in the month.

However, MFCB dropped by as much as 7.0% in June which was somewhat unexpected to me.

I thought MFCB's share price should be as steady as rock even if growth might be slow. It has dropped from RM3.60 to almost RM3.00 since earlier this year.

Even though I still manage to gain 4.6% in my investment in myNews, it's yet another example of failure due to poor timing of selling.

I started to accumulate myNews shares in Dec20-Feb21 at around 60sen, its share price shot up to RM1.10 in Apr21 but I didn't sell any of them.

The highest share price I sold myNews was later at 85sen. The rest were sold between 49.5sen & 71sen.

It's a 80% paper gain dwindling down to a mere 4.6%.

Sometimes when you don't sell early, the share price continues to go up, sometimes it goes the other way. This is part of stock market investment.

The FY23Q2 result of myNews was not good as widely expected. LossATAMI increased to RM6.3mil compared to RM3.2mil loss in FY23Q1.

Its FPC loss has worsen slightly this quarter due to increased raw material and electricity cost.

Currently it has 463 myNews, 133 CU & 19 WHSmith outlets. The management expects profitability in the short term to remain challenging.

Recently myNews welcomed a prominent new shareholder Dato Seri Johari Abdul Ghani who is an UMNO parliament member for Titiwangsa.

He is believed to take up all or part of the 68.2mil new shares through recent private placement exercise at 41sen per share.

Even though myNews operating cashflow is decent, the extra fund might come in time for it to accelerate its stores expansion.

It has a plan to open up 48 stores in the next 12 months in Malaysia with this newly injected fund.

Even though I have exited my investment in myNews, I'll put a close eye on it hoping to ride on its next uptrend.

Krono's FY24Q1 result is a disappointing one, especially when compared to preceding magnificent FY23Q4.

Compared QoQ, revenue dropped drastically to RM63mil from RM106mil, while net profit fell from RM12.4mil to RM2.5mil (EPS 0.35sen).

Seasonal factor was said to be the main reason and it's true that most its Q1 had the worst results.

Anyway, there was an one-off share grant expenses of RM1.17mil in this quarter.

Krono has proposed bonus issue with 1 bonus share + 1 warrant for every 5 Krono shares in late Apr23. Such proposal failed to lift its share price.

Recently in early July, its management announced an ambitious target to double its revenue and triple its EBIDTA in the next 3-5 years.

It's good to have a target but we know that there's no guarantee that it can be achieved, just like the case of CMSB.

Scientex's FY23Q3 result was good, at least with YoY & QoQ improvement in revenue and profit.

PATAMI of RM109.8mil (EPS 7.08sen) was 3.3% higher than immediate preceding quarter of FY23Q2.

This set of better result was massively helped by its property division which registered strong progress billing and take-up rates.

Its packaging division suffered like other manufacturers with lower sales and higher cost, resulting in lower profit.

Scientex's aggressive land-banking continues with the announcement of two land acquisition in early July.

The first one is a huge 959.7 acres of freehold land at Mukim Tebrau purchased at second attempt from SP Setia for RM547.6mil.

The second tract is a 550.67 acres freehold land at Mukim Kulai purchased form PNB for RM299.8mil.

As it has good operating cashflow and relatively low net gearing ratio at 0.22, I think the moves to acquire huge tract of land for township development bodes well with the direction of the company.

The board has proposed the first interim dividend of 5sen, which is 25% higher than 4sen in the corresponding period last year.

Total 10sen dividend for FY23 should not be a problem, giving it a dividend yield of 2.9% at share price of RM3.50.

Now we are already half way into year 2023, and our stock market has been lackluster.

Will things change for the better in the second half?

At this point of time last year, my portfolio has already lost 18%. So I should be happy with a small gain of 3% while navigating through rough waters.

A similar performance in the second half will see my portfolio reaching a decent 6% gain.

In the next one month, six of the states in Malaysia will have their state election.

Nevertheless, it's really sad to see politicians trying to win votes by dividing its people.

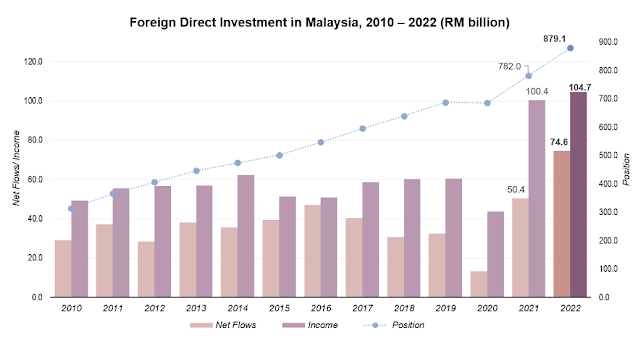

In 2022, Malaysia's foreign direct investment reached an all-time high of RM74.6bil compared to RM50.4bil in 2021.

This is a good sign and hopefully 2023 will be a great year for all Malaysians, irrespective of race and religion.

No comments:

Post a Comment