In year 2019, one listed company in Malaysia has an ambitious 5-year target of reaching RM500mil PATAMI by the end of year 2024.

Its PATAMI in 2019 was just RM160mil, which means it has to grow at a CAGR of at least 25% over 5 years to achieve its target.

It is not an easy task for sure.

However, its highest PATAMI was RM265mil in 2018. This makes its RM500mil target looks a bit more within reach.

It has 1,074mil of ordinary shares, with no future earning dilution except ESOS at the moment.

If it can achieve RM500mil PATAMI, then its EPS will be 46.5sen.

If we simply give it a PE ratio of 10x, it will be worth RM4.65.

Now its share price is trading at RM1.30. Is it attractive?

We know that CMSB is owned by the famous "white hair" Taib Mahmud, who is currently the Governor of Sarawak after serving as the Chief Minister of Sarawak for 34 years from 1981 to 2014.

Some investors might be wary of CMSB as it does not seem to be a company with good corporate governance.

However, how did the market value it in the past?

Its highest share price was in mid 2015 at around RM5.80. Its EPS in FY14 and FY15 was 21.4sen and 22.7sen respectively. That was a PE valuation of more than 20x.

Its share price took the first hit in May 2018 when there was a change in federal government in which it plunged from above RM4 to RM2 level.

It got its second hit in Mac 2020 due to the Covid-19 pandemic when it fell from RM2 to RM1.

Its share price recovered back to above RM2 but was hit the third time lucky in May 2021 when its CFO was suspended during the time of jittery market sentiment caused by the Serba Dinamik saga.

Its FY20 EPS ended in Dec20 was 18sen (PATAMI of RM194.7mil). However, it was heavily affected by MCO, huge disposal gain as well as impairment loss.

Its FY21 EPS in Q1 alone was great at 7.32sen but it was also beautified by huge disposal gain.

To me, its FY21's Q2 & Q3 EPS of 4.4sen (PATAMI RM47.4mil) and 5.0sen (PATAMI RM53.9mil) better reflect its true earnings.

Thus, its annualized "true" EPS will be around 20sen and at current share price of RM1.30, its projected PE is just 6.5x.

The table below shows CMSB's past 5 years financial results and financial ratios. It has a dividend policy of at least 30% of PATAMI subject to minimum 2sen per share.

As a state government-linked company, it's expected that the state will "gift" some construction and maintenance contracts to CMSB.

Those contracts were previously given mainly to its two 51% owned subsidiaries CMS Resources Sdn Bhd (construction materials and trading) and PPES Works Sdn Bhd (construction jobs).

The rest of the 49% were owned by Sarawak state government through Sarawak Economic Development Corporation (SEDC).

In Oct 2020, CMSB sold 2% shares of these two companies to SEDC, making them a 49%-owned companies now.

This seems to be a move to strengthen tie with the state government.

Thus, starting from FY20Q4, the revenue from these two companies were no longer registered under CMSB and the profit was recorded as "share of results of joint ventures".

That's the reason for the massive fall of quarterly revenue from about RM400mil previously to RM200mil since FY20Q4.

The 2% disposal has resulted in massive disposal and remeasurement gain of RM162.9mil registered under FY20Q4.

CMSB is quite of a complicated company with lots of businesses. There are share of significant profits from its associates and joint ventures in its quarterly report.

To better understand the company and its financial reports, I'll categorize its business into main business, joint ventures (share of profit from JV) and strategic investment (share of profit from associates).

Main Businesses (Subsidiaries >50-100%)

Cement Division (100% owned)

- Produce and sell cement and concrete related products.

- Produce its own clinker which is used to produce cement, to lower reliance on imported clinker.

- Main revenue & profit contributor with 62% of total 9MFY21 revenue, ~40% of 9MFY21 PBT.

Construction Materials and Trading Division

- Wire manufacturing for construction industry (69.1% owned).

- Trading of water, electrical, mechanical, construction & telecommunication products (51% owned)

Road Maintenance Division (100% owned)

- Total length of state road maintained by CMSB has been cut to half from 6,168km/month (before year 2020) to 3,322km/month (starting from year 2020).

- Latest contract will last 10 years from 2020

Property Development Division

- Oversees development of 1,128-acre Samalaju Industrial Park (51% owned), including Samalaju Eco Park.

- Has hotels and lodges business in Samalaju Industrial Park.

- Bandar Samariang development (Kuching) since 1997 (100% owned). It has developed 4,619 residential units and 181 commercial units up to 2020.

- The Isthmus development which is the new Kuching CBD extension.

Integrated Phosphate Complex (60% owned)

- Owns 60% in Malaysian Phosphate Additives (Sarawak) Sdn Bhd (MPAS), who will construct Southeast Asian first integrated phosphate complex in Samalaju Industrial Park.

- Construction planned in 2 overlapping phases, but 3 plants under phase 1 (350 acres) which were originally scheduled to be completed by FY2020 was delayed due to MCO.

- RM898mil of investment for phase 1.

- Phase 1 once completed, will have annual production capacity of 48,000MT yellow phosphates, 75,000MT technical grade phosphoric acid and 60,000MT food grade phosphoric acid.

- Offers investment opportunities in downstream manufacturing such as industrial chemicals, animal feed, fertilizer, cleaning & detergent sectors.

- This subsidiary has posted RM15.8mil loss before tax in 9MFY21, mainly due to forex loss (USD loan) and staff cost.

Joint Ventures (49% owned, 51% owned by Sarawak state through SEDC)

Construction Materials and Trading Division

- Owns 5 quarries across Sarawak, with 4 operational at the moment.

- Premix Operation has 5 fixed drum mixed asphalt plants and 5 mobile drum mixed asphalt plants.

- Added 2 new premix sites in 2020 for Pan Borneo Highway project.

- Serve approximately 50% of the asphaltic concrete and bitumen emulsion markets in Sarawak.

Construction Division

- Waiting for new infrastructure construction projects handed out by the state government.

- Order book in reducing trend from RM1.03bil (Mac21) to RM0.89bil (Jun21) to RM0.79bil (Sep21).

Strategic Investment (Associates <30% owned)

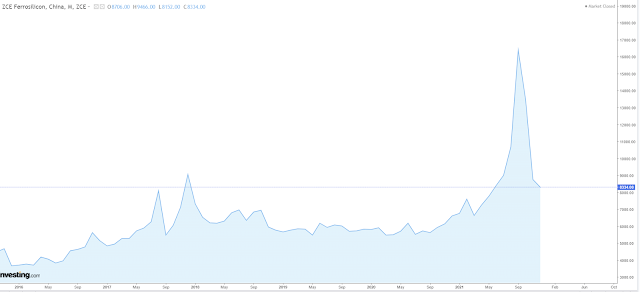

Ferrosilicon & Manganese Alloy Smelting: OM Materials Sarawak/Samalaju Sdn Bhd (25% owned)

- Another 75% owned by OM Holdings Ltd listed in Australia, recently dual-listed in Bursa in Jun21.

- Planned production facility with 200,000 - 210,000 MTpa ferrosilicon capacity and 250,000 - 300,000 MTpa manganese alloy capacity.

- Used mainly in steel production industry.

- Benefit from low electricity cost from Sarawak's hydroelectric and 10 years tax holiday.

- Has 16 furnaces but operates 12 of them currently since the MCO (16 fully operational before MCO).

- Sinter plant commissioned in FY20Q4 which can reduce the manganese alloy production costs.

- Under planning for phase 2 with construction of additional 2 to 4 sets of manganese alloy furnaces targeted for completion by 2023.

- Future plan includes the conversion to metallic silicon to produce higher value added products.

- OM Materials (Sarawak) recent financial results, fluctuating wildly

- FY20: Revenue RM1.52bil, loss after tax of RM94.91mil

- FY19: Revenue RM1.9bil, loss after tax of RM3.15mil

- FY18: Revenue RM2.38bil, profit after tax RM254.3mil

- FY17: Loss before tax of RM18.3mil

- At the moment it is surely profitable despite lower production due to the escalating FeSi price.

Information & Communication Technology: SACOFA (50% owned)

- CMSB acquired 50% shares in SACOFA from Sarawak government in Apr15. Sarawak government holds 20.5%, Celcom Axiata holds 15.1% in SACOFA.

- Owns 1,900 telecommunication towers and 11,000 fibre optic cable throughout Sarawak.

- Over 55% towers in 2020 are 5G-ready.

- Built 94 towers in 2019 and 84 towers in 2020.

- SACOFA recent financial results, as stable as rock

- FY20: Revenue RM254.6mil, PBT: RM114.3mil

- FY19: Revenue RM242.3mil, PBT: RM112.6mil

- FY18: Revenue RM232.6mil, PBT: RM105.0mil

- FY17: Revenue RM205.0mil, PBT: RM105.8mil

- SACOFA made RM38mil PBT in FY21Q1, so it's RM19mil PBT to CMSB in 3 months.

Investment Banking: Kenanga (18% owned)

- Sold shares off market to reduce stake in Kenanga from 25.2% to 18% in Feb21.

- Kenanga JV with Japan-based Rakuten Securities Inc to launch Rakuten Trade in Malaysia since May 2017.

- Kenanga posted RM86mil PATAMI for 9MFY21 (RM15.5mil to CMSB in 9 months)

Steel Fabrication & Construction: KKB Engineering (20%)

- KKB is involved in civil construction, steel fabrication, steel pipes manufacturing, hot-dip galvanising & LP gas cylinder manufacturing.

- It gives CMSB exposure to oil & gas sector with its onshore fabrication jobs for offshore facilities.

- KKB registered PATAMI of RM21.6mil in 9MFY21 (RM4.32mil to CMSB in 9 months).

Education

- Has 23% stake in Tunku Putra-HELP International School in Kuching.

- New 1,500-student capacity campus opened in Jan 2020.

- Loss before tax of RM7.9mil in FY2020.

As mentioned earlier, CMSB targets RM500mil PATAMI by year 2024. The breakdown given by the company is as follow:

- RM250mil from core businesses (cement, construction, construction material & trading, road maintenance & property development)

- RM100mil from OM Materials

- RM100mil from MPAS

- RM50mil from SACOFA

The analysis is systematic, clear and comprehensive, thanks for your sharing.

ReplyDeleteMy calculation shows the annualized core EPS for FY21 is 18.4sen. If given 10x PE, the fair value would be RM1.84 per share. The upside from RM1.28 now is 44% which is attractive.

If all stars aligned, and the sentiment towards construction industry turns positive, the tp at >RM2 is also achievable within 2022.

You're welcomed. If overall market is bullish, I think it will surely go up

Delete