After screening through 10 plantation companies with high potential of growth, I finally come out with 3 companies that I like, which are First Resources, Bumitama & TSH.

To know why am I choosing these three companies, you can refer to Part 1 and Part 2 of Plantation Companies With Best Growth Potential.

To know why am I choosing these three companies, you can refer to Part 1 and Part 2 of Plantation Companies With Best Growth Potential.

I know that there may be other plantation companies which are actually better than these three, or some other companies with even higher percentage of immature trees such as MKH and Innoprise etc. There may be also many other good ones listed in Indonesia.

However, I'm not expecting that I can pick up the best from the market. I just study a few of them. As long as it is good enough to meet my selection criteria, I'm ready to bear the outcome of my investment, no matter it is a good or bad decision.

In order to pick one out of three, I have to compare them head to head. Unfortunately, I can't get a lot of information for TSH.

TSH's annual reports and websites are not "investor-friendly" at all, in which some important plantation productivity data such as historical FFB yield, OER etc are missing.

First, lets compare the total planted area, FFB, CPO & palm kernel production of these 3 companies.

Though to me Bumitama is more like a newcomer and First Resources is quite an "established" company in plantation industry, their total planted area are actually quite close and also increase at almost similar rate yearly.

As we will see later, the much lower revenue and profit for Bumitama is mainly due to less percentage of mature trees (less FFB produced) and less superior margin.

TSH is much smaller in term of total planted area.

Bumitama actually has more immature plantation area in hectare compared to First Resources. The immature area makes up 32% of its total planted area. Furthermore, its young mature trees below 7 years old at 43% makes Bumitama a more likely candidate for exponential growth in the next few years.

Both First Resources and TSH have huge unplanted land, which can sustain the companies' growth for many years to come. Bumitama has less but still quite a big number of unplanted land at 60,000ha. If it carries out ~10,000ha new planting a year, it can still last for a good 6-7 years. Anyway, the planned new planting for Bumitama in FY2014 is 8,000ha.

Without surprise, First Resources has the highest number of FFB produced due to its larger mature plantation. However, it is noteworthy that Bumitama's line is slightly steeper than the other two, which means Bumitama's FFB production grows slightly faster.

Bumitama achieves higher 4-Year CAGR (compound annual growth rate) in total planted area & FFB production compared to First Resources. Thus, Bumitama grows faster than First Resources from 2009 to 2013, especially its FFB production which achieves 30.5% 4Y-CAGR.

TSH's FFB also grows at 4Y-CAGR of 24.2% but I don't have its figure for total planted area.

Similar to FFB production, Bumitama's CPO production seems to grow at a faster pace compared to First Resources.

Palm kernel production grows in more even pace between the two.

First Resources has the largest palm oil mill capacity at 4.05mil tonnes per annum in 2013, besides also having downstream refinery facilities which contributed 9% of its total EBITDA in FY2012. Its newly constructed integrated processing complex at Riau even has a private jetty.

Both Bumitama and TSH are pure upstream plantation players.

Both Bumitama and TSH are pure upstream plantation players.

Next, lets look at the efficiency of these companies in term of their plantation management.

The FFB yield of First Resources and Bumitama fell in FY2013 ended 31st Dec 2013, mainly due to biological tree stress. However, Bumitama seems to suffer less and was improving year by year before 2013.

Even though Bumitama's FFB yield figures are not high over 20, they are considered quite impressive as they are achieved from very young trees with weighted average age of just around 6 years. First Resources weighted average tree age is about 8 years.

I don't have TSH's historical 5 years figure but TSH is generally well-known for its high FFB yield among its peers. Its year 2011 FFB yield stood at 24.9 MT/ha, which was the highest among the three. It was reported earlier this month that TSH's trees have a weighted average age of about 8 years.

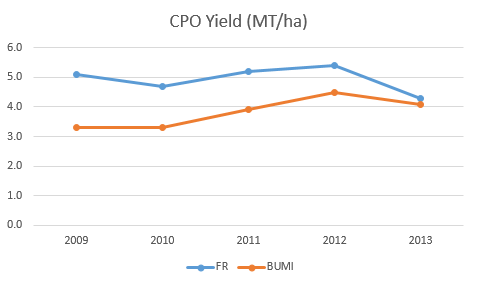

First Resources's CPO yield is not excluded from a fall similar to its FFB yield, so to Bumitama.

It is a surprise that Bumitama's OER has overtaken First Resources since year 2011. First Resources's OER seems to fall slowly throughout the past 5 years.

Kernel extract rate remain flat for both First Resources and Bumitama.

Since CPO price was depressed from mid 2012 to 2013, it is good to see how did it affect the companies' revenue and profit. The gross margin and net profit margin also show how efficient these companies are managed.

It is quite surprising that TSH's revenue in 2009 (RM980mil) was higher than First Resources and Bumitama, as its FFB production is only half of the latter and way way below the former in 2009.

Actually TSH has contribution from other businesses such as cocoa, timber and wood products. Its revenue from sales of palm products in 2009 was actually RM770mil, but this was still more than First Resources (RM722mil) & Bumitama (RM414mil).

Anyway, TSH's revenue was almost flat around RM1 billion from 2009 to 2013, while both First Resources and Bumitama achieved persistent growth in revenue.

First Resources's revenue seems to grow faster than Bumitama. This might be due to the effect of locked-in CPO forward sales at a high average selling price of RM2850/MT throughout year 2012-2013. Bumitama should also have its own locked-in CPO forward sales, but analyst did not point this out so I think it might not be that significantly high. The CPO average selling price for Bumitama in 2013 is estimated to be RM2500/MT only.

Thanks to its extraordinarily high margin, First Resources enjoys much higher net profit compared to Bumitama & TSH.

The PATAMI presented here is WITHOUT the gain in biological assets value for First Resources and Bumitama. Other than the dip in 2010, Bumitama achieves a decent growth in PATAMI.

It is important to note that there is a special one-off gain amounting to RM85.3mil in TSH's FY13Q3 profit through disposal of stake in Pontian United. However, it also suffered a forex loss of RM43.7mil in the same period.

However, TSH's overall FY13 core profit of RM140.2mil, which is only slightly lower than its reported PATAMI of RM153.1, still beats consensus estimates.

All three seem to weather the period of low CPO price quite well with their growing FFB production.

Overall from 2009 to 2013, First Resources and Bumitama have the same growth in revenue, but Bumitama beats First Resources in PATAMI growth.

Even it drops a bit for the past 2 years, First Resources's gross margin is still far superior than the others. Bumitama's gross margin is flat while TSH improves significantly in year 2013.

Lastly, lets compare their debt level and ROE.

It is clear that First Resources is able to control its debt well, while both Bumitama and TSH have almost similar net debt/equity ratio in 2013. However, with the expectation of more profit due to higher FFB production and CPO price, the gearing ratio is expected to ease in coming years.

Anyway, all three will still carry out quite aggressive new planting and acquisition, which may need lots of capex.

First Resources undoubtedly has the highest ROE which is improving from year to year. Bumitama and TSH are also excellent at around 15. Profit arising from fair value gain in biological assets is excluded in the calculation of ROE here.

I think that First Resources's earning will still grow in the next few years, but there is a concern that it might not grow as well as the other two even though CPO price is trending up. I predict Bumitama and TSH to have better earning growth and thus better share price appreciation.

Nevertheless, First Resources is currently trading at lower PE ratio compared to the other two. So this may somehow make all of them equally attractive to investors at the moment.

About which one to choose, I think three of them have their own plus and minus. If you are more conservative, then can go for more established & "stable" First Resources. If you want more growth, then can go for either TSH or Bumitama.

Bumitama has more percentage of young mature trees but less percentage of immature trees compared to TSH. It also has better margin and growth story. Both companies' gearing ratio and ROE are quite similar in 2013.

However, TSH should have better FFB & CPO yield compared to Bumitama. Also, don't forget its Wakuba ramet planted commercially since 2012. Research shows that it can improve the yield (and thus, profit) substantially.

In conclusion, First Resources, Bumitama & TSH Resources are all good.

It is important to note that the Indonesian government has passed a new regulation in Oct 2013 which restricts oil palm planters to no more than 100,000ha of plantation in the country. Those who already have plantation land more than 100,000ha now are allowed to plant more than 100,000, but will not be able to buy further land for new planting.

This will surely affect many plantation companies negatively especially those with more than or close to 100,000ha oil palm plantation but with very limited land reserved for new planting. However, those overseas companies who still yet to venture into Indonesia may benefit from it as there will be less competition.

Thus, those affected companies may look elsewhere to further expand their plantation. They may move to Papua province which they can have plantation area up to 200,000ha, or pursue new planting in other countries such as Papua New Guinea and Africa.

In this circumstances, I think those companies with good management and comfortable gearing may have the upper hand in future growth.