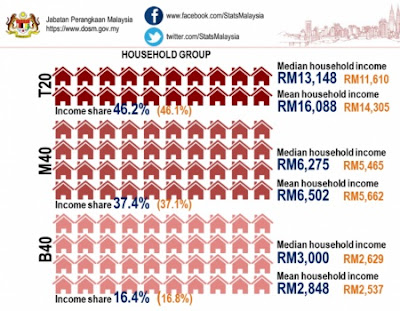

Just imagine that your household earn RM13,000 per month. You are in the median of T20 group. Perhaps to some people, this is nothing to shout about but at this level, you already earn more than 90% of the households in Malaysia.

|

|

|

|

|

|

|

|

Household Income per month (RM) |

|

|

Range |

Mean |

Median |

|

|

B40 |

<4360 |

2848 |

3000 |

|

|

M40 |

4360 – 9619 |

6502 |

6275 |

|

|

T20 |

>9619 |

16088 |

13148 |

|

|

|

|

|

|

|

You are now 36 years old. You are married and have 2 young children, a 6 years old son and a 3 years old daughter. Your wife is a full-time housewife and you alone take home RM13,000 after tax income every month.

You must be a top person and leader in your company!

Being top 10% in the country, can you imagine the lifestyle you will enjoy in this scenario?

What kind of house will you live in?

How tasteful your house will be renovated?

What car will you drive?

What smartphone will you buy?

What brands will you wear from top to bottom?

Where will you dine often?

Let's say you just wish to lead a moderate lifestyle. You don't need a million dollar house and luxury cars.

With such a good income, you will buy a house for yourself. It is everyone's dream and you definitely can afford one.

You need a safe living environment. You choose either a gated & guarded landed house or a condominium.

In certain areas such as Klang Valley and Penang island, a landed property will cost you close to a million Ringgit if not more. However, you just want to spend RM600k the most.

So, it's either a high-rise unit in hot property area, or a landed house in a not-so-hot area.

You decide to purchase a RM600k "luxury" 1200 sq.ft condominium in a decent location. You take a 35-year RM540k loan with 4.25% interest rate. You just need to pay RM2500 installment per month.

Besides, you have to pay maintenance fee every month, as well as fire insurance, assessment tax & quit rent every year. This might add up to be RM350 every month.

You need 2 cars, one for yourself and one for your wife. Let's say you are lucky because your parent has gifted you an 8-year-old Toyota Vios. You give it to your wife and you have to buy a new one.

With RM13,000 take home pay a month, which car will you choose?

OK. You realize that car depreciates with time. You don't want to spend too much on it. It sounds brilliant.

However, remember that you are a top person in your work place. You don't wish to drive a Proton or Perodua.

At last you buy a RM130k C-segment Honda Civic. Not luxury but not bad.

You take a maximum 9-year car loan and pay RM1400 per month.

You still need to take care of those 2 cars. For your new Civic, annual insurance premium is around RM2800. Let's say you move the Vios NCD to this Civic, and end up paying just RM2400 car insurance for 2 cars in a year. It's average RM200 per month.

Your cars need routine maintenance and service. You are not going to use a non-synthetic engine oil for your new Civic for sure, but you just choose a semi-synthetic oil in order to save some money.

Let's say you spend an average maintenance and repair cost of RM1200 & RM600 a year for your Civic & Vios respectively. The average is RM150 per month.

This includes any repair cost especially on the out-of-warranty Vios. A car battery cost above RM200 and need to be changed every 1-2 years. Any spare parts replaced can cost between hundreds to thousands ringgit.

Tyre service (balancing & alignment) cost you about RM40 each time and you do it 2 times a year for each car. It's RM160 a year.

By right every 2-3 years your car's 4 tyres need to be replaced. One piece of your Civic's R17 tyre might cost you around RM500. Cheaper ones are between RM300-400 per piece. Your Vios's R15 tyres might be around RM200-300 per piece.

So, let's assume you spend an average of RM1200 a year or RM100 a month just on tyres.

You pump only RON95 petrol, and both cars consume RM300 petrol a month. You need to pay road tax, toll, parking fee and sometimes car wash fee. Let's give a moderate amount of RM100 a month for all.

Where will you eat if you earn RM13k per month?

Let's say you and your wife spend RM30 per person per day for breakfast, lunch, tea, dinner, supper all combined.

This should be a moderate amount as sometimes a cup of Starbucks coffee, bubble tea cost you more than RM10. A meal of Western food, Japanese food, Thai food, Nyonya food, Chinese restaurant will easily cost RM30 per person per meal.

Your two kids need to eat too. Sometimes baby food is more expensive. You might buy good quality organic stuff for them!

Just to be moderate, you spend ONLY RM10 for each of them each day.

So, your food bill will be an average of RM80 per day, or RM2400 per month.

You might spend less if you cook at home. However, with the level of income, you tend to get more expensive rice, meat, fish, prawn, sauces etc. The cost of cooking one meal for 4 might not be less than RM20.

You need to buy groceries & consumable household items such as milk, cereals, Milo, cheese, bread, biscuits, chocolates, jam, ice cream, sauces, cooking oil, detergent, diapers, shampoo, toilet papers etc.

You are not going to get a Tesco brand or some never-heard-of brands for sure. You are going for more branded & better quality things.

Lets say you spend RM500 a month for those things. This is a conservative assumption. Don't forget that you have 2 kids who are still taking formula milk and one is wearing diapers everyday.

You buy clothes only once a year for new year. One working shirt RM60, two T-shirts RM70, one long pants RM80, shorts RM40, two pair of shoes RM150 (either slippers, sandals, leather shoes, sports shoes).

Your wife buy one dress RM80, two T-shirts RM70, a skirt RM60, shorts RM40, two pair of shoes RM150 per year.

Kids' clothing are not cheap, sometimes they are more expensive than adults'. They grow up fast and will need to change the size frequently.

Anyway, you only spend RM200 per child per year. This makes total spending on clothing to be RM1200 per year, or average RM100 per month.

Is this budget enough to spend in Uniqlo? I doubt so.

This does not even include things like belts, ties, handbags, wallets, socks, underwear, inner wear, sportswear etc.

Every adults must have a smartphone with data. You subscribe to Maxis postpaid RM98 with a share line RM48.

You also need a home WiFi for your computer and smart TV etc. You only get the slowest Maxis 30Mbps for RM89 per month. RM235 is paid to Maxis every month.

You have to pay utility bills such as Electricity, water & sewerage. Lets assume all of them added up at RM250 per month.

If you have RM13k per month, would you subscribe to Astro, Netflix or Spotify? Would you subscribe to magazines, newspaper, online news portal or your favourite football clubs? Would you consider to become a member of gyms or recreational clubs?

I bet you will put your money into some of these things, perhaps RM100 for Astro and RM100 for others per month. So the money spent for entertainment and subscription membership is RM200 per month.

At some point you and your family members can get sick and need to see a doctor. You yourself might not want to see a doctor even though you are half dead, but you will bring your kids to see a specialist even with a slightest of cough.

Each visit to a clinic might cost you around RM50-100. Even if you won't get sick frequently, you might be taking some health products or supplement, and buy some over the counter medicines from pharmacies.

Good health products are not cheap. With your income, you surely think that you can afford better products. You and your family members may take multivitamins, omega 3, probiotics, B complex, liver tonics, fibers, essential oils, traditional herbs, whey protein, slimming products etc.

You and your wife might go for annual medical check up. Basic blood test is around RM100-200 per person, while more advanced and thorough health-related tests such as ultrasound, X-ray, CT scan, Treadmill stress test etc might cost RM1000-2000 per person!

As such, it is possible to spend an average of RM500 a month on 4 persons' health, including seeing a doctor, using health products and doing health check.

You have to pray hard that you and your wife will not have those chronic diseases such as hypertension, diabetes mellitus, high cholesterol etc which require daily medication.

You must have life and medical insurance for sure. As you are the sole bread winner and earn big, you have to have higher life insurance coverage to protect your spouse and children.

Assume that you pay monthly premium of RM600 for your own insurance. I think most insurance agents will see this amount as under-insured. Your wife and two children are mainly insured for medical needs which might cost RM400 + 200 + 200 per month.

Altogether you pay RM1400 per month for life & medical insurance.

Your 6 years old kid will go to kindergarten, which easily cost RM600 a month nowadays. If you need a more special one, be ready to fork out RM800-RM1000 a month.

Never mind, you want to save and just choose the RM600 one. Your 3 years old daughter can go to nursery as well, but you prefer your wife to look after her first so that you can save RM600 of nursery fee per month.

Luckily your wife is willing to take care of your daughter, and doesn't need a maid. If she is sent to a caretaker, it will cost another bomb.

Most parents want their children to excel and learn some special skills such as piano, violin, ballet, swimming, badminton, tennis, taekwondo, drawing, singing, English language etc.

Your children might be sent to learn something which withdraw another RM200 from your pocket a month.

You have to give some pocket money to your parent, since you're not staying together. RM500 a month to your parent is not a problem for you.

Despite already having most furniture and electrical appliances in your house when you move in, you still need to add or replace something year after year.

You might get a new or replace or upgrade a desktop computer, laptop, laser printer & ink, smartphone, vacuum cleaner, iRobot, smart TV, speakers, washing machine, airconds, air fryer, bread maker, oven, sofa, mattress, pillows, wardrobes and other home appliances.

Your airconds need to be serviced every year for RM100 each unit as well.

If you ONLY spend an average RM2400 on those items a year, it's RM200 per month.

Buying a computer or smartphone might already cost some people more than RM3000.

Of course it is a must to have water filter in your house. You earn so much and wish to have a nice all-in-one water filter with cold & hot water dispenser at home. Such water filter system in your kitchen might cost you more than RM60 per month.

You must have another filter at the point of entry as well. Either you buy in lump sum and replace at interval, or pay monthly fees, it can be around RM40 per month.

Water filters alone can cost you RM100 per month.

If you don't travel overseas, who else will? However, you wish to save more so you decide not to go as far as Europe or other Western countries which can easily cost RM10k per person.

You set aside a budget of RM6000 per year for holiday. It means a travel to South East Asian countries for two persons. The kids are being left to someone else to take care of. You have to save RM500 a month for this travel plan.

There are lots of other expenses such as money you give away while attending a wedding or funeral, compounds or summons, hairdressing, hobby (playing badminton can easily cost you more than RM50 a month), watching movies in cinema, buying toys for kids, bicycles, books, house cleaning service, house repair or minor renovation, care for your pet and the list goes on... For eg:

Jan: Buy a few investment books RM100

Feb: Your wife goes for hairdressing RM100

Mac: You buy toys for kids RM100

Apr: Tomb-sweeping fee RM100

May: Call a plumber RM100

Jun: Attend a relative's funeral RM100

Jul: Call house cleaning service for a day RM100

Aug: Make a donation to charity RM100

Sep: You knock on somebody's car and settle with RM100

Oct: Your son's piano performance fee RM100

Nov: Attend a friend's wedding dinner RM100

Dec: Christmas gifts for children & wife RM100

Looking at the list above, we know that it is almost impossible to spend an average RM100 a month for those special expenses.

By the way, you are lucky and somehow manage to spend just RM100 a month.

Altogether, in this scenario, do you and your family lead a good life? Definitely Yes, although with some limitation here and there.

You have your RM600k condominium, a Civic and a Vios. You use higher end smartphone, have a above average computer and all kinds of branded electrical appliances at home. You have enough phone data and WiFi at home. Your kids attend decent kindergarten and are able to learn some skills. Your family members take quality health supplement and do annual health check. You can travel to South East Asia once a year.

Do you live a luxury lifestyle? Definitely No.

You don't have a BMW or Mercedes or Vellfire, not even a Honda Accord. You don't have an over a million Ringgit property. You don't have membership of golf club or other upper class recreational clubs. You don't have a maid. You can't have luxury watches & jewelries. Your kids are not in international school. You don't have the budget to travel to places further from Asia more than once in a year.

Are you considered "RICH" then?

It depends on how you define "rich". For me, it's about the NET assets you own in long term, and how much you can save in short term.

Driving a BMW 5 series doesn't necessarily mean that someone is rich.

In the scenario above, have you calculated how much you spend a month?

|

|

|

|

|

Monthly Expenses |

RM |

|

|

Property loan |

2500 |

|

|

Maintenance fees |

350 |

|

|

Car loan |

1400 |

|

|

Cars related expenses |

850 |

|

|

Food & dining |

2400 |

|

|

Groceries & Consumables |

500 |

|

|

Clothes |

100 |

|

|

Telecommunication |

235 |

|

|

Utility fees |

250 |

|

|

Entertainment |

200 |

|

|

Health |

500 |

|

|

Life & medical insurance |

1400 |

|

|

Children education & tuition |

800 |

|

|

Parent |

500 |

|

|

Household items |

200 |

|

|

Water filters |

100 |

|

|

Travel |

500 |

|

|

Others |

100 |

|

|

Total |

12885 |

|

|

|

|

|

The total expenditure is RM12,885 a month!

You take home RM13,000 and spend RM12,885 a month. So, you save only RM115 a month.

Can saving RM115 a month enough for educational fund of your two children, buying an investment property or investing meaningfully in stock market?

It is not even enough to buy cigarettes if you do smoke.

How many assets do you have? The house belongs to the bank, and you may end up paying RM1.2mil for your RM600k house. It doesn't generate any income and you probably need to refinance it later to fund your children's education.

Your cars are worse, which keep on burning your cash.

Finally, can you achieve early financial freedom and retirement? It's almost impossible even with good income and EPF money.

Most people might see you as successful and enjoying a good life. It's true that you are enjoying life even though not an extravagant lifestyle.

Nevertheless, you are definitely not RICH.

You are a middle class that pay the most tax but get zero financial aids from the government.