Summary For November 2023

Portfolio @ End of Nov23

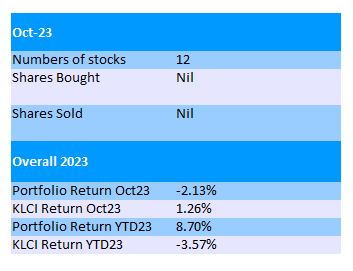

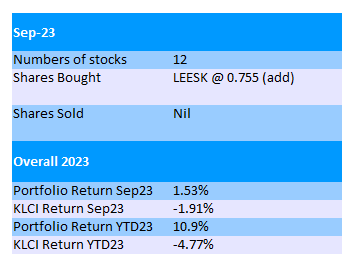

In November 2023, my portfolio value inched up 0.8%. YTD gain is still below 10%.

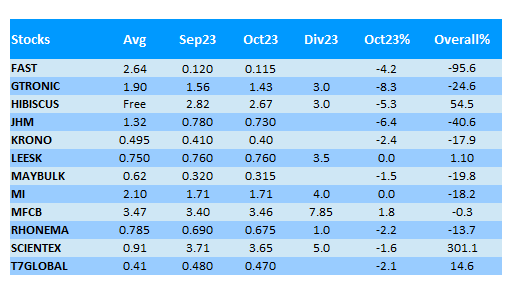

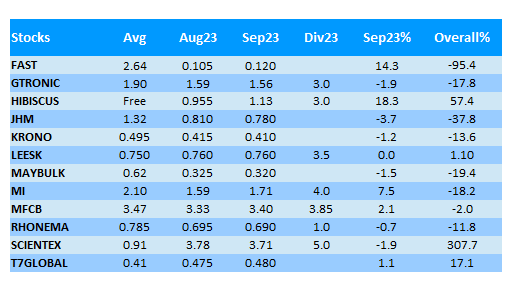

Gtronic's share price moved up the most by 12.6% in the month, and now we know why.

Gtronic's founder will dispose his entire 10.4% shares to APB Resources Bhd at a price of RM2.00 per share.

To me, this is not an exciting news as it's not good to see any founder exiting his own company.

Furthermore, the buyer APB seems to be in oil & gas fabrication industry and I'm not sure whether it can bring growth to Gtronic.