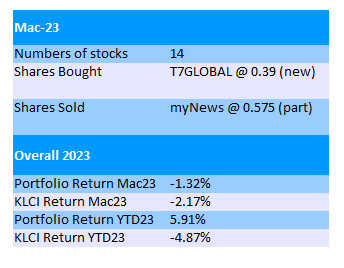

My Portfolio @ Mac23

Portfolio @ End of Mac23

In March 2023, KLCI dropped another 2%, perhaps due to jittery atmosphere caused by bank failure in the US.

My portfolio could not escape the negative sentiment and retreated 1.3% this month, bringing the first quarter return down to 5.9%.

The biggest casualty in Mac23 was myNews which fell 19.4% in the month especially after it released its FY23Q1 result.

The loss-making result of myNews is somewhat expected but it seems like most investors were very disappointed with this set of result.

I sold part of my myNews shares just before it released its result, as I strongly felt that its share price would surely dive after the result was out.

I didn't sell all shares as I still hope for a miracle like most shareholders.

However, due to escalating costs, it was still making LossATAMI of RM3.2mil.

Currently it has 614 outlets, comprises 466 myNews, 131 CU & 17 WHSmith. It is only a net 5 stores increase compared to the previous quarter.

It seems like myNews will slow down its new outlet opening going forward and the management expects fluctuating trend of profitability in the near term.

The bright spot of myNews to me is its positive operating cash flow, which is RM20mil in FY23Q1 since most of its expenses are non-cash item.

For the whole year of FY22 last year, it manage to register RM91.5mil net operating cash inflow.

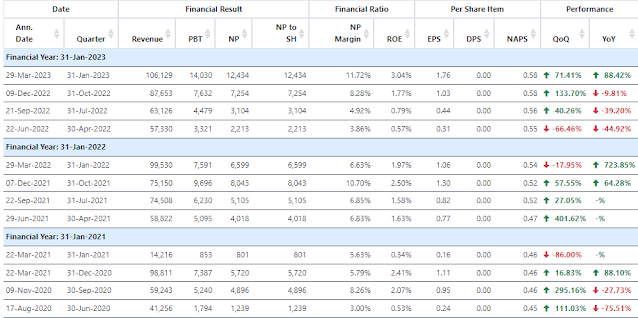

At first glance, Krono's FY23Q4's result (ended Jan23) was magnificent.

Both its revenue (RM106mil) and net profit (RM12.4mil, EPS 1.76sen) are record high especially its profit.

Previous best net profit was RM8mil achieved in FY22Q3.

When we looked more into detail, there was an unrealized forex gain of RM3.4mil and an abnormally low administrative expenses of just RM0.869mil in FY23Q4.

After China's operation was consolidated into its account since FY22Q2, its administration expenses ranged from RM5-6mil per quarter in FY22Q3 & FY22Q4.

However, in the first two quarters of FY23, the admin expenses dropped to RM3.7-3.8mil per quarter. The management did not explain the reason, it might be due to cost-cutting measures or accounting changes.

In FY23Q3, the admin expenses rose back higher to RM6.9mil, only to fall drastically to RM0.869mil in the latest quarter of FY23Q4.

Again, the management did not explain the significant drop in admin expenses this time.

Anyway, for the whole FY23, the average admin expenses per quarter is RM3.8mil, which is about the same amount in the first 2 quarters of FY23.

All in all, this is not an exciting set of result for Krono but it is not bad either. I guesstimate its "core" PBT of FY23Q4 to be RM8mil which is still the highest in FY23.

For Scientex, I have nothing much to say.

In its FY23Q2, revenue increased 2.8% YoY to RM978.4mil while PATAMI increased 13.4% to R106.3mil (EPS 6.85 sen).

Both revenue and net profit are slightly lower compared QoQ though.

Its property division is doing well but industrial packaging gets lower sales due to market volatility.

It is on course to do better in FY23 compared to FY22.

In Mac23, I added a new member in my portfolio which is T7Global.

Previously I told myself to limit my exposure to oil & gas stocks when everyone was chasing renewable energy stocks and made O&G looking like a sunset industry.

T7Global was once known as Tanjung Offshore which was plagued with money laundering scandal, boardroom tussle and later hostile takeover by current management led by TSDS Tan Kean Soon who holds 19.8% of its shares now.

Since then, it has successfully diversified into construction and aerospace, even though O&G still remain as its main revenue contributor.

It returned to asset-heavy model in its O&G division by building and leasing Mobile Offshore Production Unit (MOPU).

It has secured 10-year MOPU lease contract from Petronas Carigali Bayan Field and 5-year (with 2-year extension) MOPU lease contract from Thailand Busrakham G11 for Nong Yao field.

The former should have just started in Q1 of 2023 while the latter is scheduled to start by FY24.

According to analyst (RHB), MOPU in Bayan field might provide average recurring PBT of RM13mil per year, and MOPU in Nong Yao might contribute average RM8mil PBT per year.

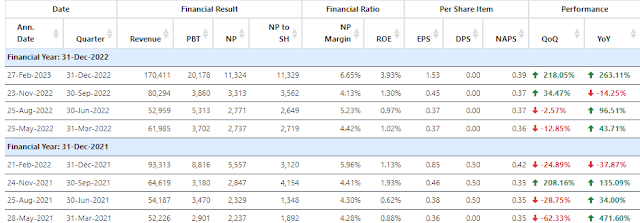

T7Global reported an extremely good quarter report of FY22Q4 in which its revenue rose almost 100% YoY to RM170.4mil.

Its PATAMI jumped 242% to RM11.3mil (EPS 1.53sen) YoY.

It seems like this set of magnificent result was partly contributed by MOPU but I think its MOPU is still yet to start in FY22Q4.

In its FY22Q4 report, the management seems to keep its lips tight by not addressing the sudden surge in revenue and profit in detail.

Even though T7Global has 3 business divisions namely Energy, Aerospace & Defense and Construction, it still reported its quarterly result into two segments of Engineered Packages and Products & Services.

For the past 2 years, T7Global has been awarded quite a lot of O&G contracts. However, most of the contract values are not disclosed.

The good result in FY22Q4 might be simply due to the execution of these projects.

I think the contribution from Aerospace and Construction is still negligible.

T7Global is said to have RM2.6bil - RM2.8bil worth of orderbook as at the end of FY22, in which >50% come from the two MOPUs.

Recent notable contract win includes the design and construction of Baggage Handling System at KLIA which is a JV with Siemens. This project will run for a period of 3 years from Jan23 to Dec25.

This might be its first significant contract in its construction division.

Apart from this specialty construction project, it also has the capability to take up building and infrastructure construction projects.

Besides, T7Global also owns a fully automated aerospace metal surface treatment facility in Serendah with a capacity of 10,000 parts per month. It is currently running at 30% utilization rate.

The list of services provided by this aerospace division include surface enhancement & cleaning, chemical processing, painting & part marking, non-destructive testing and lab testing.

The management expects the division to grow in tandem with recovery in air travel.

The "side effect" of constructing and leasing MOPU would be the high debts.

As at the end of FY22, T7Global has RM638mil of total borrowings compared to RM32mil of cash. Its debt equity ratio stands at a staggering 2x.

Nevertheless, this is a common scene in such business as Yinson also has D/E ratio close to 2x.

Since the management targets one MOPU contract every 2 years, it is possible that it will ask for more cash in the future.

T7Global's upcoming FY23Q1 result is highly anticipated as Bayan MOPU should contribute for the first time.

It would be good if its profit could better FY22Q4. If it's not, then investors might not be happy I guess.

The estimated annual PBT of RM13mil from its Bayan Field MOPU by analyst does not seem to be very high, but it equals to the total PBT of the first 3 quarters of FY22.

Anyway, despite diversification, it's still an O&G company and its share price will be inevitably affected by crude oil price.

I hope that it can secure some building and infrastructures construction contracts going forward.

Apart from Tan Kean Soon and DS Dr Nik Norzrul Thani, T7Global is currently led by the two sons of Tan Kean Soon namely Tan Kay Zhuin (CEO) & Tan Kay Vin (ED) who are still in their early thirties.

It remains to be seen how high both can lead the group to reach.

No comments:

Post a Comment