Summary For October 2023

Portfolio @ End of Oct23

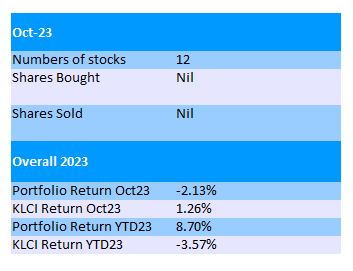

Even though KLCI inched up 1.3%, October 2023 was not a good month for my portfolio as it lost 2.1%.

Almost all the stocks in my portfolio suffered loss except MFCB who manage to gain 1.8%, while MI & LEESK were unchanged.

Many stock market investors are hoping for a much better second half but at the moment it seems hard to come by.

Year-to-date, KLCI retreated 3.6% while my portfolio still gain 8.7%.

I'd be happy if my portfolio can end the year with >10% gain.

Although the profit is lower compared YoY & QoQ, there is much lower forex gain of RM2.8mil in this quarter compared to RM11mil & RM15mil forex gain in FY22Q3 & FY23Q2 respectively.

Current lower net profit is also partially contributed by RM3.58mil withholding tax paid in relation to the dividend received from its Taiwan subsidiary.

Sales in both SEBU & SMBU improved quite significantly compared to the first half of FY23.

The management seems to be optimistic in the future prospect of the company:

In SEBU, the effort of diversification has successfully led the BU from being a single WLCSP sorting process equipment vendor with single factory in Penang in 2018, to one that offers additional bonding and final test equipment solutions with multiple factories in Suzhou China and Gyeonggi Korea. Our flagship Mi Series from the Penang factory expends its application scope from WLCSP sorting process to EMI (electromagnetic interference) process and advanced multi-bin sorting process for 5G and CPU/GPU chips, with good prospect for this sale in FY2023. Our Si Series final test handler which is locally designed and manufactured in Suzhou factory has proven its capability and stability in optical sensor and automotive chips testing process. The BU expects its Suzhou factory to be in the black in FY2023 due to strong market demand for Si Series. The BU’s state-of-the-art Ai Series bonding equipment, namely LAB, LCB and Laser Pin Bonder, which are locally designed and manufactured at the Gyeonggi Korea factory, are gaining traction in the market. These state-of-the-art products will drive the BU's participation in the HPC, Memory and Artificial Intelligence (AI) segments and will benefit from its high growth trend in the coming decades.

In SMBU, amidst positive business developments with new product launches from key customers, we see a stronger demand in 2H2023. Our Tainan factory is the world’s top advanced solder balls supplier in the niche market with our cutting-edge manufacturing technologies to produce microsolder balls from our patented alloy. The leading position of our technology and product quality brought the BU to enlarge the market share in the past 2 years and accelerate in FY2023. Despite the uncertainty of the US-China technology and trade war, our Ningbo factory remains confident to be one of the key solder balls suppliers in China domestic market with a large scale of product qualification process on-going in FY2023. The tip applications in Mobility & Wearables, Automotive and AI segment continues to be the focal points that will enable the BU to grow in FY2023.

In SSBU, with the positive outlook for the EV and renewable energy market associated with the government’s policy to achieve carbon neutrality in the coming decades, SSBU is poised to become the most important and promising business unit within the Group. The official launch in October 2023 of our investment in Hangzhou for a new R&D and manufacturing factory for power modules and devices will have marked the start of an accelerated growth period for SSBU.

For FY23Q3, JHM's revenue of RM80mil dropped QoQ but increased YoY. Net profit of RM5.4mil (EPS 0.89sen) was lower by almost 20% compared to FY23Q2.

Revenue from industrial segment picked up slightly but it's still in red.

Contrary to MI, there seems to be lack of catalyst & positive development for JHM in the near term.

Rhonema's FY23Q3 revenue (RM54.6mil) & PATAMI (RM3.0mil, EPS 1.37sen) were higher compared to preceding FY23Q2.

However, this result is disappointing to me. There is a RM0.9mil gain on disposal of investment property.

Its main business animal health products & equipment suffers from lower sales & higher cost throughout the year.

The dairy business continue to suffer loss but food ingredients segment improves and manage to compensate the loss of profit from animal health segment.

Hibiscus registered a strong result in FY23Q3 with revenue of RM746.6mil & net profit of RM154.3mil (EPS 7.67sen).

As it only completed 5 to 2 share consolidation exercise in mid Oct23, the actual EPS post consolidation for FY23Q3 is 19.2sen.

The current share price after consolidation is RM2.60. This makes Hibiscus rather cheap in term of PE ratio.

Average realized oil price were quite high at USD90-100 per barrel. There seems to be without anything bad happening to the company at the moment.

Before this I guesstimated an average quarter net profit of RM150mil after acquisition of Repsol assets. Hopefully it can at least stays above RM100mil every quarter.

T7Global's FY23Q3 result is good but not as good as I'd expected.

Revenue increased 32% to RM137mil, PBT jumped by 68% but PATAMI only rose 25% to RM8.0mil (EPS 1.12sen).

Current result should include contribution from its first MOPU T7 Elise which is said to have achieved first gas on 11th Jul23.

According to Rakuten analyst, T7 Elise MOPU achieved an average uptime of 95%, 3% higher than the targeted uptime.

The second MOPU, Nong Yao MOPU which is 70% completed is expected to commence its first gas production in Mac 2024. This MOPU should deliver higher margin since it is a refurbished & modified MOPU.

Current quarter marks the first revenue & profit recognition for the Airport Baggage Handling System project, which is at 26% completion stage.

For its aerospace segment, the company recently successfully secure new clients from Vietnam, Singapore & Taiwan.

Parts processed almost doubled MoM in Oct23 and the management is confident its aerospace segment is primed for high growth trajectory from FY24.

No comments:

Post a Comment