Summary For August 2023

Portfolio @ End of Aug23

It's been a flat month of Aug23. KLCI dropped marginally (-0.5%) while my portfolio gained 0.7%.

Gtronic gained the most at 10.4% while LEESK suffered the most with a 11.6% loss, probably due to its poor quarter result.

I planned to dispose all my Krono warrants on the first day of trading but I just missed the date.

Thus I only manage to sell off at lower price of 15sen on the second day of trading.

I don't have any potential new stocks to invest in at the moment. I'll consider to top up on a few existing stocks in my portfolio.

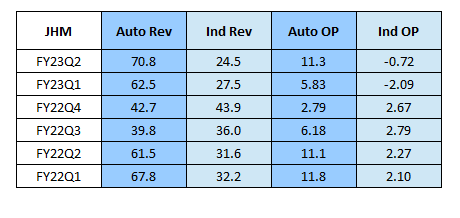

JHM's FY23Q2's result was so-so. Revenue of RM95.4mil improved both YoY and QoQ, while PATAMI at RM6.71mil (EPS 1.1sen) was much better than RM1.75mil in immediate preceding quarter.

However, there was an approximately RM5mil gain of Forex in current quarter. Without this, it's just about the same as FY23Q1.

Its industrial segment with its declining revenue, continues to make loss in the last 2 quarters. It's only operating at 50% of its capacity.

Automotive segment's revenue has picked up recently to reach RM70mil in its most recent quarter.

Operating profit of JHM fluctuates in the past few years due to some one-off items and forex changes. Its revenue will give a clearer picture of its "performance".

Anyway, it's not exempted from increased cost pressure with squeezed profit margin like most other businesses.

It seems like the road ahead is quite tough for JHM. I hope that its new ventures such as hermetic glass seal business & headlamps assembly will take off successfully without incurring further loss.

Hibiscus's FY23Q4 revenue and net profit were RM503.6mil & RM123.3mil (EPS 6.13sen) respectively.

There was a reversal of Sabah state tax for its North Sabah (RM25.4mil) and Kinabalu (RM3.6mil) operation in this quarter.

Without this item, I think its still a good result.

Until the end of Jun23, operation in Vietnam just registered one crude oil offtake in Oct22 since being acquired from Repsol.

I'm not sure whether this is "normal" as other oilfields have average one offtake every quarter.

Brent oil has climbed back to USD90 level recently, which is the highest level in year 2023. This might be due to continuing production cut by Saudi Arabia and Russia.

High crude oil price will keep the inflation high, thus it's not a good news to the world in general.

Maybulk's FY23Q2 plunged into red for the first time since 2020, making net loss of RM1.53mil.

However, there was a forex loss of RM9.1mil in this quarter. Without this, it should be a good result for Maybulk.

Shipping's revenue dropped as expected due to the lackluster bulk shipping rate but revenue from shelving & storage registered encouraging growth from RM10.6mil to RM14.4mil from FY23Q1 to FY23Q2.

Anyway, PBT of shelving & storage segment actually dropped from RM1.57mil to RM1.17mil despite the increase in revenue.

Besides, Maybulk has found a buyer for its Kamsarmax Alam Kekal for RM140mil and is expected to register net gain of RM23.6mil from the disposal.

The cash will be used to acquire a piece of RM165mil freehold land measuring 23.48 hectares in Kapar, Klang.

Maybulk will undertake an industrial development on the land via a 60:40 JV with Golden Valley Ventures Sdn Bhd. This will mark its diversification into property development.

Meanwhile, the company proposed to change its name to Maybulk Bhd from Malaysian Bulk Carriers Bhd.

Perhaps it should change to a more meaningful name...

MFCB's FY23Q2 revenue fell by RM21.7mil QoQ mainly due to absence of revenue from the disposed Tawau power plant.

PATAMI improved from RM70.5mil to RM88.6mil (EPS 9.38sen) as previous quarter was affected by tax penalty.

Profitability improved across all segment but Edenor suffered a RM8.4mil share of loss.

The management expects progressive margin improvement for Edenor in the next two quarters following extensive upgrading works and a new facility installation in 1H2023.

However, the overall oleochemical industry is expected to remain subdued.

Expansion plan in its packaging division and the 5th turbine of Don Sahong dam remain on track.

T7Global registered RM104mil revenue and RM6.4mil PATAMI (EPS 0.82sen) in FY23Q2. Both are better compared to YoY and QoQ.

Again there was no mention about its Bayan MOPU in its quarter report.

From announcement earlier, the Bayan MOPU (TSeven Elise) has achieved its first gas on 11th July 2023 so I guess it will start contributing to its topline in the upcoming FY23Q3.

There were quite a lot of announcement of contracts won last year by T7Global. However, this year it seems hard to come by.

I overheard some rumours about certain new contracts won but it just stays as rumour.

I've just come back from an oversea trip and it's the first time I take a plane since the start of Covid-19 pandemic.

What I can see is that air travel is robust.

I did think of investing in airport and airlines stocks since last year to ride the theme of air travel recovery.

Nevertheless, I'm scared of Capital A & AAX's balance sheet, and felt that Airport's PE ratio is still on the high side.

In hindsight, it's not a good decision not investing in them as all these stocks perform brilliantly, especially AAX which saw its share price multiplies 4.5x from 55sen to RM2.50 since Jan23.

Capital A also jumps from 62sen to RM1.10 in the same period of time.

Did I learn a lesson or something from all these? I really don't know... may be I'll just do the same next time.

No comments:

Post a Comment