Yesterday, Tropicana has signed an MoU with Marriott International to develop a 15-storey 200-room hotel called Courtyard in its Penang Tropicana 218 Macalister.

Besides this hotel component, Tropicana 218 Macalister comprises 211 units of commercial suites, 88 units of service residences and 20 high-end retail outlets. The overall GDV is RM511mil and will be completed in year 2018.

The first phase of Tropicana 218 Macalister, Neo Suites, has been launched and achieved an encouraging take-up rate of more than 85% even though it is priced at quite a premium.

During the press conference, Tropicana's CEO Datuk Yau said that to date (mid-Nov 2013), the company has recorded total sales of more than RM2 billion and unbilled sales amounted to RM2.2 billion.

If we can recall, Tropicana achieved RM1.06bil sales and RM1.65bil unbilled sales at 1H13. This means that it has achieved more than RM1bil sales in less than 5 months from July 2013.

For FY2013, Tropicana has a plan to launch RM3bil worth of projects and target RM2bil sales. Now it seems like it has surpassed the sales target.

The figures may be pushed up some more as Tropicana is expected to launch Tropicana Metropark phase 2 Paloma Service Residences (GDV RM465mil) in end of November and soft launch Tropicana Heights Kajang in early Deecmber.

Below are some slides extracted from Tropicana's presentation published in November 2013.

Up to 1HFY13, revenue and net profit from property sales (excluding fair value gain) have already surpassed full FY2012's figures. I expect more sales in 2HFY13 and better operating cash flow in FY2013.

Up to mid-November 2013, the unbilled sales have reached RM2.2bil!

More land sales will be recognized in 2H13.

In 2H13, Paloma Serviced Residences @ Tropicana Metropark & phase 1 Tropicana Heights will be launched.

Commercial properties (shop offices) at Oasis 2 & 3 of Tropicana Danga Cove are planned to be launched in Q4FY13.

Phase 1 Penang World City Tropicana Bay Residence & Tropicana 218 Macalister have been launched in Q3FY13.

You can get the full presentation slides here.

Tropicana's share price has been in a "sliding mode" from June 2013, where the bottom is no where to be seen.

It seems to me like some parties are deliberately depressing its share price since the last 6 months. Current share price of RM1.33 gives it a PE ratio of 8.7x. I believe that Tropicana can at least match last year's performance in term of net profit.

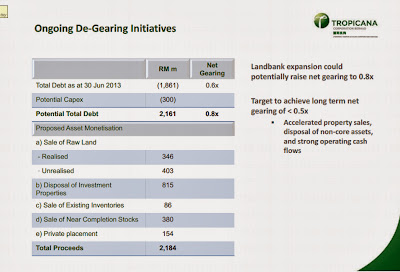

However, its escalating debts and suffocating finance cost will be the major concern, apart from the property cooling measures taken by the government.

Though the proposed disposal of Tropicana City Mall & office Tower fell through, its very much improved property sale and land sale should help to ease its balance sheet.

Hopefully the partnership with Marriott will materialize soon.

No comments:

Post a Comment