What are the investment themes now?

Export-orientated stocks which sell in USD?

Companies that use crude oil-related derivatives as major raw material?

Export-orientated stocks which sell in USD?

Companies that use crude oil-related derivatives as major raw material?

There is a company which derives 98% of its revenue from export sales, ALL in USD, and also has crude-oil derived resins as its main raw material which makes up about 50% of its product selling price.

This company is super penny stock Jadi Imaging.

Jadi's shares are currently traded at around 5-6 sen level. It makes me think of Frontken and even Hevea which were traded at this level some time ago.

Jadi is an independent toner manufacturer who develops, formulates and manufactures toners for laser printers, photocopiers & multi-function printers.

Being independent means that its products are not original, they are non-genuine but are ciplak or pirated.

Jadi makes dry powder toner and sell them in bulk in aftermerket to be used in all sorts of laser printers and photocopiers such as HP, Canon, Samsung, Kyocera, Brother etc.

Is this ciplak toner against the law?

I understand that there are court cases on-going between independent & original toner & equipment manufacturers.

However, I opine that original manufacturers are not easy to win the case.

First, independent toner manufacturing is considered an environmental-friendly industry as it encourages reuse and recycle of toner cartridges.

Second, independent toner manufacturers need to formulate their own toners to make it compatible to different kinds of OEM products. They are not exactly the same quality as the original one.

Jadi was listed in second board of KLSE in Apr 2006 and transferred to main board in Aug 2007.

Though its market capitalization is only about RM50mil at the moment, to me it is actually not a too small company.

It is the one and only independent toner manufacturer in Malaysia (no competitor) and the largest in South East Asia.

Why is it trading at below 10sen now?

Since listing in 2006, Jadi has been relentlessly expanding its production capacity.

Before listing, it has only one factory in Shah Alam with 3 production lines and total annual toner production capacity of 3,000 tonnes.

Now it has 4 factories housing 8 production lines with total annual capacity of 8,000 tonnes, including a factory with 2 lines in Suzhou, China.

Despite the rapid increasing capacity, Jadi's net profit is rapidly decreasing since year 2011. It even reported loss in year 2012 & 2014.

Jadi enjoyed its best years in the first 5 years after listing as capacity, sales and profit increased.

Its revenue and net profit reached the peak in 2010 and went tumbling down thereafter.

This rather rapid negative turn in fortune is due to multiple factors:

- Lower printing/toner demand due to sluggish global economy after 2008 crisis

- Lower printing/toner demand due to proliferation of smart mobile devices

- Strengthening of MYR against USD lowered its revenue as >96% sales are in USD

- Strengthening of JPY against MYR increased its cost as major raw material resin was imported from Japan

- Lower average selling price of toner due to oversupply in the market

- Higher depreciation charge after new facilities in Klang completed in 2011

Before you want to put your money into Jadi, first you need to decide whether laser printing, photocopying and toner manufacturing is a sunset industry or not.

Everyone knows the trend now is paperless, which directly means less printing and photocopying.

More and more people are sending and sharing information online, through smartphones, tablets, PC etc. This also means less printing.

Can we come to a day when students use tablets to take exam and everyone just holds a tablet during a meeting?

Or when we buy a property and sign sales and purchase agreement, is it possible that there is no paper at all?

Or when we buy a property and sign sales and purchase agreement, is it possible that there is no paper at all?

Nevertheless, the basic need for printing is still there especially in the business environment.

As world population grows, printing demand is also expected to increase.

In my opinion, toner manufacturing is still not yet a sunset industry now, but surely it is not going to grow by leaps and bounds.

Ink-based printing is the one that should face more challenges, which I think will be likely replaced by laser printing in the future.

Will toner demand increase because of this?

If you think that toner-based printing still worth investing in, is Jadi good for investment?

Lets briefly go through the company milestones of Jadi since listed in 2006:

2006

- Listed in second board in Apr 2006

- 4th production line (Suzhou) started in Jun 2006

- 5th production line (Shah Alam new factory) started in Dec 2006

- 95% export to 39 countries

2007

- 6th production line, first colour toner line (Shah Alam) started in Mac 2007

- Total annual capacity reached > 5,000 tonnes, with 300 tonnes for colour toner

- Transfer to main board in Aug 2007

- Gave 1:3 bonus issue

- Bought land in Suzhou to build own factory

2008

- Failed JV in Europe

- Bought land in Klang for expansion

- 96% export to 44 countries

2009

- Suzhou factory relocation completed in Feb 2009

- 97.8% export sales

2010

- Share placement 10% to Mega First Corp in Jul 2010

- 7th production line - monochrome (Suzhou) started in Aug 2010

- Gave free warrants in Oct 2010

- 98.4% export to 52 countries

- Achieved record high in both revenue and net profit

2011

- New factory/R&D lab/warehouse in Klang completed

- 8th production line (Klang) started in Jan 2011

- 99% export to 52 countries

- Net profit shrank tremendously

2012

- Launched Palmotone - world's first bio-based (palm oil) chemical toner in Apr 2012

- 98% export to 50 countries

- Suffered first annual loss since listed

2013

- Started to produce own toner resin in May 2013

2014

- 98% export to 55 countries

2015

- Gave bonus issue 1:3 in Apr 2015

- Started to sell finished toner cartridges

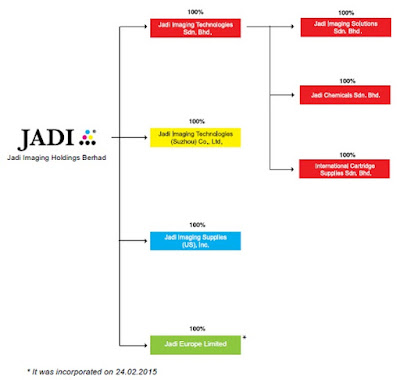

- Set up a subsidiary in Europe

It is notable that Jadi moved to manufacture its own toner resin (raw material for toner) in 2013, which has reduced >90% of its toner resin import from Japan.

According to the management, this move can save the company RM3mil a year and it can even sell the resin to third party in the future.

Basically there are 2 types of toners: the traditional Melt Pulverized Toner (MPT) & latest-technology Chemically Produced Toner (CPT).

Jadi works with Chemistry Department of University Malaya for the R&D of CPT since 2005.

The collaboration has produced world's first bio-based CPT derived from palm oil known as Palmotone in 2012.

Palmotone is available in colours and is an environmental-friendly product like biodiesel. It contains at least 25% derivatives from palm oil, compared to conventional 100% fossil fuel-based toner.

It has obtained patent from US & Japan authorities.

Being in the ciplak toner industry, Jadi need to continue its R&D to keep up with the latest technology used in the OEM toner.

Jadi will concentrate on colour toner and CPT which is the latest trend in the industry. However, I think black toner still form a huge majority of its production.

It is almost certain that strengthening of USD against MYR and low crude oil price will only benefit Jadi.

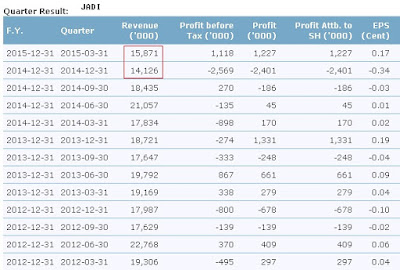

This has been shown in its FY15Q1 financial result in which gross profit margin increased significantly and there was a minor forex gain.

Nevertheless, revenue dropped quite alarmingly in the last 2 quarters of FY15Q1 & FY14Q4.

Nevertheless, revenue dropped quite alarmingly in the last 2 quarters of FY15Q1 & FY14Q4.

This is probably due to lower average selling price of toners as a result of oversupply in the market.

So even though USD has appreciated and sales in tonnage has actually increased, revenue dropped.

This is not good at all and it makes investing in Jadi for short & medium term looks more risky.

Jadi's net gearing is low at 0.12x. However, its quick ratio is just 0.54x with cash at RM3.768mil and short term borrowing at RM21.562mil.

It does not have any long-term borrowing though, and non of its borrowings are in foreign currency.

In other words, Jadi earns USD to pay its MYR loan.

In other words, Jadi earns USD to pay its MYR loan.

Jadi's cashflow is definitely not good, but not too bad actually, given the fact that it has spent more than RM135mil in purchase of PPE since 2006.

Its total cumulative net profit from 2006 to 2014 is just RM54.6mil.

The reason it can still survive until today is because of its relatively high PPE depreciation charge. Its depreciation charge in FY14 is RM11mil, compared to PBT loss of RM3.9mil.

Its operating cashflow actually stays positive for every year since listed.

The reason it can still survive until today is because of its relatively high PPE depreciation charge. Its depreciation charge in FY14 is RM11mil, compared to PBT loss of RM3.9mil.

Its operating cashflow actually stays positive for every year since listed.

The absence of long term borrowing shows that the management is confident to get positive cash flow in the near future.

It can be easily achievable by stepping on the brake of further expansion and minimizing PPE purchase.

Nevertheless, it has to cancel its proposed rights issue to raise fund early this year as its share price has dropped substantially.

Nevertheless, it has to cancel its proposed rights issue to raise fund early this year as its share price has dropped substantially.

Though Jadi has a production capacity of 8,000 tonnes/year, it is only about 50-60% utilized. So there is no need to increase its capacity in the near future.

The major toner manufacturer in the world is Japan, in which most are OEM. Japan makes almost half of whole world's toner.

Jadi is said to have 2% share in global aftermarket.

If Jadi's capacity is fully utilized, it will make up about 40% of overall toner production in the whole Europe.

If Jadi's capacity is fully utilized, it will make up about 40% of overall toner production in the whole Europe.

As stated earlier, 98% of Jadi's toner are exported, and about 80% of the export are to emerging or developing countries in Asia pacific, South America & Eastern Europe.

I think that laser printing & photocopying in developing countries will only grow with time.

One would think that toner demand in US should increase due to economy recovery, but Jadi's export to US is relatively low at <5%.

Also, as most emerging countries' currencies depreciate against USD, Jadi's export volume to those countries might be negatively affected.

One would think that toner demand in US should increase due to economy recovery, but Jadi's export to US is relatively low at <5%.

Also, as most emerging countries' currencies depreciate against USD, Jadi's export volume to those countries might be negatively affected.

This year, Jadi started to collect recycled toner cartridges and will start to sell finished cartridges. I don't think it can bring significant contribution in the near term.

For Palmotone, though it is an environmental-friendly product which most developed Western countries should love to use, I'm not sure whether it is well-accepted so far as it surely sells at a premium.

Jadi produced a commendable FY15Q1 result lately with net profit of RM1.23mil. The management credited it solely to improved productivity, even though revenue stays lowish.

Operation in China continues to register minor operating loss at -RM202k while Malaysia operation turns profitable at RM1.56mil.

If we annualize its FY15Q1 net profit of RM1.227mil, we can get RM4.9mil for FY15, which means projected EPS of 0.52sen base on 941.7mil shares.

So, currently at 5sen now, it is trading at forward PE ratio of 9.6x, which is fair.

In term of net asset value, it is currently trading well below its latest NTA of 21sen.

It still has 464mil warrants which will expire soon in Oct15 but they are nothing but trash papers with an exercise price of 13sen.

One of its major shareholder Mega First Corp has started to dispose Jadi's shares since early 2015, which saw its shareholding fell from 22.3% to 8.5%.

However, Jadi's founder & CEO Mr Liew KS is collecting more shares at the moment but another executive director Mr Eu is disposing his shares.

Mr KS Liew - CEO

I like Jadi as an innovative company with impressive R&D and continuous expansion.

However, has it over-expanded?

It faces tough challenges brought by lower printing demand and oversupply of toner due to recent worldwide over-expansion in capacity especially in China.

Recent depreciation of MYR against USD and low crude oil price might give it a breather though.

At about 5 to 6sen now, every bit up and down in share price will be about 8%. So the risk is higher.

If the subsequent quarterly results are not as good as expected, its share price can easily drop to 3-4sen level, which means 35-50% loss.

It still has 464mil warrants which will expire soon in Oct15 but they are nothing but trash papers with an exercise price of 13sen.

One of its major shareholder Mega First Corp has started to dispose Jadi's shares since early 2015, which saw its shareholding fell from 22.3% to 8.5%.

However, Jadi's founder & CEO Mr Liew KS is collecting more shares at the moment but another executive director Mr Eu is disposing his shares.

Mr KS Liew - CEO

However, has it over-expanded?

It faces tough challenges brought by lower printing demand and oversupply of toner due to recent worldwide over-expansion in capacity especially in China.

Recent depreciation of MYR against USD and low crude oil price might give it a breather though.

At about 5 to 6sen now, every bit up and down in share price will be about 8%. So the risk is higher.

If the subsequent quarterly results are not as good as expected, its share price can easily drop to 3-4sen level, which means 35-50% loss.

In an interview with The Star published in July last year, Mr Lim said "We will get back to our double-digit net profit margin".

It made loss in FY14 while its net profit margin in FY13 was merely 2.7%.

Lets see how credible this CEO will be.

DengQ DengQ BD, i looked at Jadi a few times but still dun hv the conviction to make the call, ur analysis will be my only and vip reference

ReplyDeleteThis one is risky

Deletemost of the western developed countries take "original" very seriously... their products will be difficult to sell at developed countries like USA, CND, Germany and etc... If China market started to make order, then this company will be shining... else, depending on 3rd world or developing SEA countries, it will be difficult...

ReplyDeleteThanks for your valuable feedback :)

DeleteBD, Mind to share email address? :)

ReplyDeleteHi Jason, bursadummy@gmail.com

DeleteHi BD,

ReplyDeleteCan help to look at Sign and Econbhd ? Sign 's management bought back share recently and their EPS are double from previous year. Econbhd have 500 million order book in hand.

Hi. I'm not going to study both in detail... but I can just share my shallow view.

DeleteSIGN looks cheap in term of projected PE. Its splendid results may persist til next year. There's worry that SIGN will be affected as property sector started to slow down. It has its niche market but I think the barrier of entry for its business is rather low.

I'm not too familiar with Econpile. It looks like a steady company on its way up. I just think that construction activity might also slow down next year.

Thank you very much for your input. Cheers

DeleteDear Bursadummy

DeleteUsually you dont go in such early stage. What is the sign of new market for Jadi ? Chances of success in Europe?

If Jadi can find a merger and acquisitions , what kind of candidates suited them?

Thank you

Hi kcwong,

DeleteI "feel" that this company can turnaround (albeit not in an impressive style) in mid-long term, if it stops its expansion and sales remain stable. If sales drop, then different story. I bought its share bcoz I think current situation (strong USD & low oil price) should benefit it. A little impulsive to be honest.

I don't know how well will it do in Europe. What makes it different from others is its Palmotone. I'm not sure how well market will accept it. It seems not too encouraging though. About M&A, I'm not good at this, so no comment. But I do hope that someone can acquire it at its NTA :)