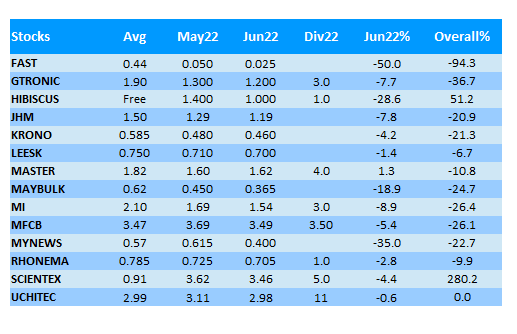

In Jun22, things go from bad to worse as KLCI plummeted 8%.

My portfolio inevitably performed badly as it shrank 10.7% in this month alone, bringing the year-to-date loss to 18.4%.

Currently the world is still overshadowed by inflation with the recession risk looming.

Year-to-date, Nasdaq index already lost 30%, while S&P 500 and DJI retreated 20% & 15% respectively.

It seems like we are already in a small bear market.

KLCI lost "just" 7.9% so far this year. The reason is because it has never really gone up in the past 4-5 years or so.

If we are going to witness a real economy recession soon, KLCI still has much room to fall from current level of 1,450 points.