This year will still be a good year for property developers. There is no doubt about this.

So far I do not feel any slowdown in property market. Developers are still launching their products in great pace and buyers are still "sweeping" properties like buying vegetables.

Furthermore, more and more unknown and even listed companies start to join the property business.

Is it a sign of prosperity in property sector, or a warning sign of pending property collapse?

Tropicana recently sold RM600mil worth of property in just 6 weeks. This amount matches its whole FY12's revenue and is almost half of FY13's revenue. Just 6 weeks.

Eco World has also launched the first phase of Eco Majestic at Semenyih in May. It offers 612 units of double storey terrace house in which 95% are snapped up. Buyers still queue up for days before the launch.

This might be Pre-GST property shopping spree.

As we know, GST will be implemented in April next year. How will it affect the property price?

There are generally 3 types of GST:

- Standard-rated GST

- GST 6% charged at every stages of supply chain

- eg. cloth, car, fruits

- Zero-rated GST

- No GST charged

- eg. basic food item

- Exempt-rated GST

- GST is not charged to only final consumer

- eg. residential property, healthcare services

A great schematic explanation of GST can be obtained at loanstreet.com.my website.

For standard GST, manufacturer & retailer who pay the 6% GST while receiving the goods/service can claim back 100% from the government. So the final consumer is the one who will bear the entire tax burden of GST.

In other words, GST does NOT result in extra expenses for most manufacturers and retailers. So their financial result should not be affected.

For exempt-rated GST which includes residential property, manufacturer (contractor) can claim back 100% GST paid to construction material suppliers.

However, retailer (developer) cannot pass the GST to consumer (buyer) and cannot claim back from the government. So developers have to bear the entire tax burden of GST.

This sounds like developers are loser while house buyers are winner, but it is actually not necessary so.

Inevitably developer's cost will increase as it cannot claim back GST paid to contractor from government. In order to maintain the profit margin, developer can increase the selling price of residential property.

So basically the profitability of developer is not really affected as the profit margin remain the same, unless developer is forced to sell at lower price because of low demand.

As a result, new residential property price will increase, as shown below (extracted from loanstreet.com.my)

In summary, GST will not affect developer very much but new house buyers will need to bear higher house price. Government is a clear winner as it collects more tax compared to current tax system.

So consumer is not a winner but a loser.

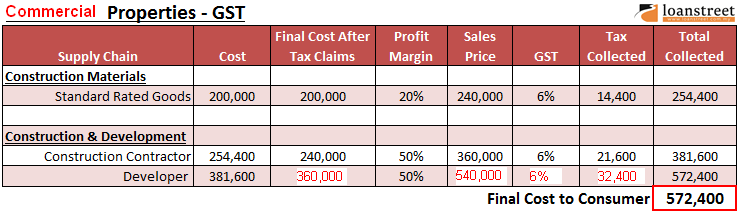

How about new commercial property?

Commercial property is in the category of standard-rated GST, which means buyers have to bear the entire tax burden of GST throughout the supply chain. This sounds scary.

If a developer sell a new shop office at RM1 million, should a buyer pay 6% GST of RM60,000 on top of the RM1 million paid to developer?

I have modified the residential GST scheme table above for commercial property. Lets assume they have the same cost and profit margin.

Even though the 6% GST is applied to commercial property buyer, the final cost of the property to buyer (RM572,400) is still same as the residential property.

This means that the final price that buyers pay (include tax) for new commercial property will also increase after GST, and it is at the same rate as residential property.

The difference is, when selling commercial property, developer can claim back the 6% GST charged to it by contractor from the government. Government will collect more tax because there is an extra 6% tax in the end of supple chain compared to residential property.

It sounds like developer will earn more by selling commercial property because it can claim back the GST charged to it. It is not necessary so as the profit will depend on the margin. Actually in the example above, developer earns less in absolute amount by selling commercial property (sales price - final cost after tax claim).

After all, the pre-GST property shopping spree is warranted as property price will increase after GST implementation.

However, property developer's profit should not be affected directly by GST but it may suffer indirectly should the demand of property drops as a result of increasing property price.

These are what I know and it might not be totally right. Please correct me if I'm wrong.

.png)

No comments:

Post a Comment