It's too bad I just get to know that Scientex has "Investor Presentation" in its website since Dec14.

No wonder I can't find information about its property sales and unbilled sales in its financial notes submitted to Bursa Malaysia anymore.

I'll just paste a few useful slides here for my reference.

Consumer packaging is currently driving its manufacturing growth. It has a RM300mil capex plan from 2014 to 2016 to increase the production capacity for PE, CPP & BOPP films. The capacity of its consumer packaging division will increase by 140% from 5,000MT/month to 12,000MT/month in 2017.

The construction of new CPP film plant has just started in Jan15 and is on track to be completed in Jun15. Commercial production is expected to start by end-2015.

The new BOPP film plant, which has just commenced its construction in Feb15, is expected to start commercial production in mid-2016.

The management anticipates good demand for its BOPP films as majority of BOPP films used in Malaysia are imported at the moment.

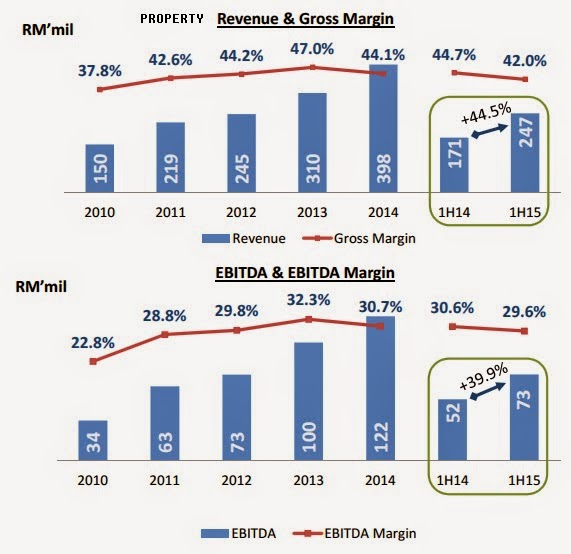

For its property segment, it has current projects worth RM1.5bil, with another RM4.0bil worth of GDV in the pipeline.

It has launched 6 new projects worth RM276.1mil in 1H15 but manage to achieve sales of RM397mil in the same period. Unbilled sales reach RM640mil now, slightly higher than RM631mil last quarter.

It will launch 1,420 units of affordable houses in Pasir Gudang in April 2015 under Johor Affordable Housing Scheme.

I think this kind of project should be able to generate better sales. If average price is RM400k per unit, then it is a potential RM568mil sales.

Is the RM400k price tag too low for "affordable" houses in Pasir Gudang?

Manufacturing segment's growth is slow or minimal for the past one year, dampened by forex loss. However, the exciting part is from 2016 onward.

Property segment continues its impressive growth with probably some pre-GST shopping effect. It's a good sign that unbilled sales continue to move upward.

As mentioned in previous post, Scientex management team has reduced its USD exposure quite significantly in year 2015. I think they have done a good job.

Scientex has a minimum dividend policy of 30%. It paid 31.7% in FY14 with a decent DY of 3.2%. It has a EV/EBITA of 7.6x.

For complete slides of Scientex's investor presentation, please go to its website.

if i not wrong their affortable housing is around 200-500k( i believe 200-300k is major)

ReplyDeletehttp://www.thestar.com.my/Business/Business-News/2013/12/18/Scientex-sees-busy-2014-It-allocates-RM120mil-to-expand-ops-plans-14-property-projects/?style=biz

for available housing u can get their price on their website( those sold out is not showing prices)

Thanks! You're truly a Scientex shareholder.

DeleteI guess 200-300k price is more like a medium cost apartment 700-900 sq ft? Landed should be 400-500k. Anyway I'm not familiar with Iskandar region.