Huayang FY16Q2 Financial Result

| Huayang (RM mil) | FY16Q2 | FY16Q1 | FY15Q4 | FY15Q3 | FY15Q2 |

| Revenue | 150.6 | 142.6 | 152.1 | 155.5 | 139.5 |

| Gross Profit | 50.3 | 51.5 | 53.2 | 59.3 | 45.2 |

| Gross% | 33.4 | 36.1 | 35.0 | 38.1 | 32.4 |

| PBT | 38.2 | 40.2 | 42.5 | 43.2 | 35.2 |

| PBT% | 25.4 | 28.2 | 27.9 | 27.8 | 25.2 |

| PAT | 28.7 | 29.9 | 29.7 | 30.9 | 26.0 |

| Total Equity | 524.4 | 495.8 | 465.9 | 449.4 | 436.9 |

| Total Assets | 941.3 | 944.2 | 923.2 | 877.3 | 828.0 |

| Trade Receivables | 55.3 | 72.9 | 88.9 | 73.3 | 68.1 |

| Prop dev cost | 144.3 | 161.5 | 167.7 | 175.5 | 159.5 |

| Inventories | 19.8 | 10.5 | 9.9 | 9.8 | 9.8 |

| Other Current Assets | 201.3 | 200.7 | 189.6 | 180.3 | 157.0 |

| Cash | 76.1 | 62.6 | 40.9 | 44.1 | 43.9 |

| Bank Overdraft | 6.7 | 4.6 | 7.4 | 14.4 | 10.9 |

| Total Liabilities | 416.9 | 448.5 | 457.4 | 427.9 | 391.1 |

| Trade Payables | 129.5 | 135.1 | 141.5 | 118.2 | 120.4 |

| ST Borrowings | 75.3 | 78.1 | 78.6 | 82.2 | 75.9 |

| LT Borrowings | 170.8 | 195.4 | 192.1 | 187.4 | 161.0 |

| Net Cash Flow | 36.0 | 24.4 | 3.4 | -0.5 | 2.7 |

| Operation | 81.9 | 25.6 | 115.9 | 71.1 | 58.1 |

| Investment | -22.0 | -6.7 | -86.6 | -50.7 | -23.9 |

| Financing | -23.9 | 5.6 | -26.0 | -20.8 | -31.5 |

| Dividend paid | 0 | 0 | 44.9 | 31.7 | 13.2 |

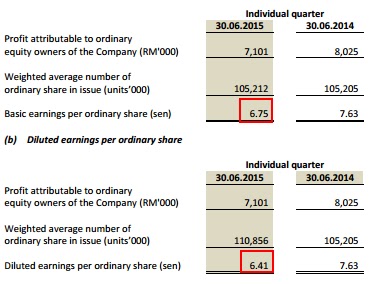

| EPS | 10.87 | 11.32 | 11.25 | 11.72 | 9.84 |

| NAS | 1.99 | 1.88 | 1.76 | 1.70 | 1.65 |

| D/E Ratio | 0.34 | 0.43 | 0.51 | 0.53 | 0.47 |

| Total sales | 93.10 | 82.00 | |||

| Unbilled sales | 607.2 | 660.8 | 701.9 | 733.3 | 717.9 |

I expect Huayang's FY16 (ends on Mac16) net profit to at least match FY15's figure of RM110mil, if not better.

With RM58.6mil net profit in the first half of FY16, it is certainly on track.

However, poorer sales in the first half of FY16 does not do it any good.

Huayang manage to sell RM175mil worth of property so far this FY, despite the lack of new launch.

Its unbilled sales drop further to RM607.2mil as a result.

Its One South Cube & Zeta Residence have achieved take up rate of just 46% as of Sep15.

Its projects face a loan rejection rate of as high as 50%! This means that its sales can be much better if more buyers can get their loans approved like usual.

Anyway, it is good to hear that the management is still confident that its FY16 sales target of RM500mil can be achieved.

In order to do so, it should launch high GDV new projects in the second half of FY16.

These projects include Mines South with a GDV of RM368mil. It is expected to be launched in the last quarter of FY16 (Jan-Mac16).

Mines South beside the lake

It is a surprise to me that Huayang is reported to have acquired 9.5 acres freehold land in Juru, Bukit Mertajam for RM21.7mil (RM52.50psf) in Aug15.

This land should be the land I wrote about in early September. I thought that was part of the land deal announced earlier in Jan15.

Now it looks like this is another new and latest acquisition.

Huayang might launch its project on this land sooner than expected.

It plans to build 90 units of landed gated properties and a 41-storey 268-unit medium cost condominiums which are estimated to carry a GDV of RM180mil.

Recently when I was driving along Jalan Baru, Perai, I noticed a familiar logo at the side of the road.

Guess what, it is Huayang's logo on a recently-completed business complex known as Frontage.

I think this should be Huayang's newly set up sales office in the northern region.

However, I'm disappointed that it is on the highest 4th floor, not the ground floor...

On its latest balance sheet, net debt/equity ratio has dropped to 0.34x which is the lowest in the past 2.5 years.

So, Huayang will continue its landbanking activity and the management expects at least one/more land deal in the second half of FY16.

Huayang paid 12sen (38%) and 13sen (30%) dividends respectively for its FY14 & FY15.

I expect at least 13sen for FY16 which translates into dividend yield of 7.0% at current share price of RM1.85.

For Huayang, we are not talking about growth in short to mid term. It's all about dividends now.