Matrix Concept FY15Q3 Financial Result

| MATRIX | FY15Q3 | FY15Q2 | FY15Q1 | FY14Q4 | FY14Q3 |

| Revenue | 121.4 | 120.4 | 317.6 | 151.0 | 148.8 |

| Gross Profit | 68.3 | 63.0 | 187.1 | 97.5 | 83.8 |

| Gross% | 56.3 | 52.3 | 58.9 | 64.6 | 56.3 |

| PBT | 40.2 | 41.4 | 155.4 | 73.8 | 58.5 |

| PBT% | 33.1 | 34.4 | 48.9 | 48.8 | 39.3 |

| PAT | 31.1 | 29.9 | 115.4 | 56.5 | 45.1 |

| Prop Rev | 116.7 | 117.1 | 315.5 | 150.5 | 148.8 |

| Prop OP | 41.6 | 45.2 | 158.4 | 77.6 | 61.2 |

| Edu Rev | 2.4 | 1.2 | 1.4 | 0.5 | 0.0 |

| Edu OP | -1.2 | -2.1 | -1.8 | -2.9 | -1.9 |

| Club Rev | 2.3 | 2.1 | 0.8 | 0.0 | 0.0 |

| Club OP | -0.3 | -0.2 | -0.6 | -0.4 | -0.4 |

| Total Equity | 808.9 | 774.2 | 758.3 | 686.0 | 643.5 |

| Total Assets | 1167.7 | 1129.6 | 1154.6 | 996.2 | 1000.9 |

| Trade Receivables | 148.6 | 149.4 | 192.6 | 79.5 | 174.9 |

| Prop dev cost | 649.5 | 597.2 | 583.5 | 566.2 | 556.3 |

| Inventories | 2.2 | 2.3 | 2.3 | 2.1 | 0.7 |

| Cash -OD | 52.7 | 75.7 | 84.3 | 58.7 | 23.3 |

| Total Liabilities | 358.9 | 355.4 | 396.4 | 310.2 | 357.4 |

| Trade Payables | 159.1 | 141.0 | 171.8 | 195.7 | 274.7 |

| ST Borrowings | 75.0 | 74.2 | 68.8 | 42.3 | 23.6 |

| LT Borrowings | 74.2 | 75.8 | 82.3 | 35.8 | 21.4 |

| Net Cash Flow | -5.7 | 17.3 | 25.8 | -10.1 | -45.5 |

| Operation | -6.2 | 11.2 | -18.4 | 130.0 | 65.3 |

| Investment | -39.3 | -33.4 | -22.9 | -93.2 | -63.9 |

| Financing | 39.7 | 39.5 | 67.2 | -46.9 | -46.9 |

| Dividend paid | 66.8 | 47.1 | 17.1 | 77.6 | 60.5 |

| EPS | 5.90 | 6.50 | 25.20 | 12.40 | 10.50 |

| NAS | 1.47 | 1.67 | 1.64 | 1.50 | 1.41 |

| D/E Ratio | 0.12 | 0.09 | 0.09 | 0.03 | 0.03 |

Matrix's FY15Q3's result is flat compared to preceding quarter of FY15Q2.

However, it is significantly lower compared YoY to FY14Q3 mainly because of timing of billings.

Some people might be disappointed with this result.

What I am more interested in is how well it sells its property.

Despite a slowdown in property market in the whole country, Matrix actually does very well by bagging in sales of RM245mil in Q3 of FY15, with only RM8.3mil coming from industrial land sales.

For 9MFY15, its total new sales has reached RM612mil, which is 87% of its RM700mil annual sales target for FY15 (including industrial land sales).

Bandar Sri Sendayan alone has contributed RM519.7mil new sales in this period of time.

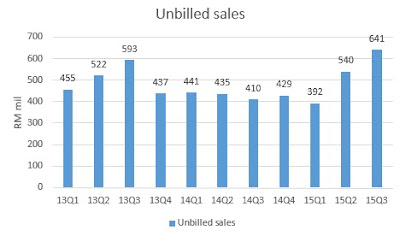

Unbilled sales surge to RM640.5mil (as at 30th Sep 15) from RM540mil a quarter ago. This should be its all time high quarterly unbilled sales.

New projects launched in Q3 include Suriaman 1 (phase 1 GDV RM77mil - 83% sold) & Hijayu Resort Homes (phase 1B) in BSS, and also Impiana Bayu 2 (88% sold) in TSI.

It seems like Matrix will not launch any new projects in Q4. It has delayed the launch of the RM229mil Residency SIGC to Q2 of 2016, may be because it sees no problem to hit its sales target in FY15.

Its high GDV condo near PWTC might be launched in the first half of 2016.

If you still think that Matrix's Q3 result is poor then just have a look at its year-to-date performance below.

9-months comparison YoY: Improvement across the board

Matrix Global School has got 490 students enrolled as at end Sep15 and the management targets 660 students by end of 2015, which is revised downward from 800 students earlier.

Revenue from education arm increases progressively every quarter and its operating loss has narrowed.

Operation of clubhouse is also at loss but the main purpose of these two investment is to increase the selling point of its BSS.

Matrix continues its quarterly dividend payout with a 3rd interim dividend of 3.5sen.

I think Matrix should be able to pay at least 15sen dividend for its FY15. So it might be another 4.5sen dividend after 10.64sen has been paid so far.

This translates into a dividend yield of 6.2% at share price of RM2.45.

For me, Matrix simply looks better than ever.

Hi BD, your 9 months comparison table show impressive resilience, considering the weak property market now....particularly the Net Margin of 31.5%. Will add on price weakness. Thanks for all your analysis..very very helpful.

ReplyDeleteYou're welcomed James. That 9M table I got it from Matrix's presentation slides on its website.

Delete