A reader asked me how do I filter the stocks to buy. It's not easy to answer.

To make it short, I don't have a systematic way when it comes to selecting a company for investment.

I'm not sure whether there is any established or better way to select or filter from a list of close to one thousand listed companies.

Basically, I have done it in many ways and I'll briefly discuss about them here.

First, I'll start with how I come to know a stock.

Screen through every single companies painstakingly

This was the method I used when I first joined the stock market back in year 2005. At that time, internet information was scarce.

There was a thick book like a "Yellow Pages", which contained the information of all the listed companies in KLSE such as the business nature, historical revenue/profit, financial ratios such as EPS, ROE, PE ratio, debt/equity, as well as historical price chart.

I can't remember the name of this white & green colour book now as I have lost it many years ago.

Before I bought my first shares, I read a few investment books and I decided to follow their suggestion by looking at the fundamentals of the companies. So I made a stock selection criteria of ROE >15%, EPS growth >15% for at least 3 years & PE <10.

With these criteria, I screened through every companies in that thick book one by one. At last I came out with a few companies that matched the criteria. I still remember that the first 2 stocks I bought were Mahsing & WCT, and I made a profit from them.

Anyway, that kind of book is not published anymore due to the abundance of information which can be easily obtained on the internet.

Use KLSE Screener

Many years ago I came across this tool. I'm sure that most readers know what is it all about. You just need to key in your selection criteria (PE, ROE, DY, EPS etc) and the software will filter for you.

This is very easy and fast, and you can do it on your computer or smartphones. However, I seldom use it and don't really use it to select stocks since I started this blog.

From articles and news

Basically I do not actively look for a stock to buy, as investing in stock market is not a big part in my life, yet. I am quite passive.

I don't read business news and watch the stock market everyday. I do it sporadically when the interest comes and when I have the time.

You know, there are many articles that promote a stock in investment forum such as i3investor, some are very good and some are not.

When a company secures a contract, reports good profit, ventures into new business or encounters headwinds, the news will certainly appear on online news portal such as The Star, The Edge and for Chinese, Sin Chew & Nan Yang.

If the headlines of an article or news catch my attention, I will read them and sometimes it will lead me to study the company and then invest in it.

Analyst reports

I have trading accounts with Public Investment Bank & Hong Leong Investment Bank. However, I do not login to view all the reports because I only login when I plan to trade.

I read those analyst reports from i3investor, thanks to all the people that share them there.

Analyst reports are a very important and useful tool for me. There are many information that retail investors like us have no access into. So, we need to depend on professional analysts who attend the company's AGM, investor briefing session or interview the management.

Regarding the target price derived by analysts, just take it as a reference and come out with your own target price.

Of course different people have different opinion, and no one can predict the future with 100% accuracy. For Bumi Armada as example, someone gives it a target price of 10sen, while some value it at 56sen. That's a huge difference.

Now that Armada is at 26sen, who do you want to follow?

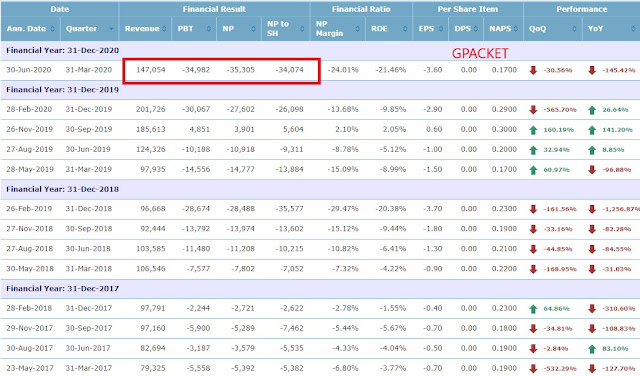

Quarterly Financial Reports

A listed company must release financial report every 3 months, we can get a lot of information from it.

Besides the revenue & profit, we can have a glimpse at its latest balance sheet & cash flow. The management will also explain the performance of the quarterly results and give a prospect of its business.

When a company has a good financial quarter, sometimes it catches my attention to further study it, IF I happen to bump into it as I only read 10-20 of those quarterly reports every 3 months.

I think this is a very common way for me to identify a stock to buy.

Before 2013, I only looked at the revenue and profit, EPS, ROE & PE ratio while making a decision.

After that, I include the balance sheet and cash flow, although not in a very detail fashion. I don't have accounting background, and have no one to ask except Mr Google when I have doubts.

I don't read annual reports unless from my invested companies or companies I plan to study.

There is another way that can help me to find a good stock which I haven't use yet, which is subscribing to fundamental-based "Sifus" or other experienced investors.

I know that it might be a very good way to earn quick bucks from doing this. Many newbies and speculators pay the fee, and will surely buy when a stock is recommended as "buy call". This might push up the share price and quick profit can be made just like that.

Subscribing to such service can increase my chance of catching a stock with good potential, as I mention earlier that I'm quite passive in stock market and can't screen through all those listed companies and read all the announcement by myself.

At the moment, I still haven't join such groups. I'm still all alone.

How do I filter those stocks to decide whether to invest in them or not?

There are no strict rules now like I used to have in the past. Last time I set criteria for EPS growth, PE ratio, ROE, D/E ratio, DY etc. I usually don't go deeper into ROIC, FCF, PEG ratio & EV as I'm not a true value investor.

Let me show a few real examples of how I bought a stock in the past, if I still remember them correctly.

Latitude Tree

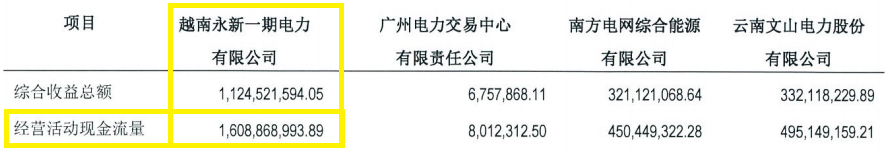

I first noticed Latitude after it released a very good quarterly results in Nov 2013. Then I studied its previous quarterly reports, annual reports and company website. I checked its previous announcement from Bursa Malaysia website. There was no analyst cover and not many news on this company. I found out from Bursa announcement that it was in the process of acquiring the remaining shares of its very profitable Vietnam operation. I projected the future earning and it's a no-brainer.

Inari

If my memory serves me right, I first knew about Inari from a news article in Jun 2013. At that time, Inari was still a small little-known company and had proposed to acquire much bigger Amertron of the Philippines. It certainly caught my attention and the same process started. I checked its previous quarterly & annual reports, previous Bursa announcement, searched for online news and visited the company website.

I remember that before I bought Inari shares at around 70sen (22sen now after adjustment), its share price has just rallied from 30-40sen to 70sen in a short period of time. Most investors commented that since it had already gone up 100%, it was very risky to buy at that time. I bought it anyway. Sometimes we have to ignore the noise of forummers and believe in our own judgement. Inari proves to be a big success for me.

KESM

I came across an article or news shared by someone in i3investor about KESM in Jan 2016. It looked good to me and I decided to study it further. I saw that there was significant jump in its latest 2 quarters and by simple forward PE estimation, it was deemed undervalued for me. At that time its share price was falling from RM6 and I got it at RM4.80 and then around RM3.90 when it dropped further, with average price of RM4.42.

It's lucky for me that its financial performance were good and share price kept increasing to over RM22. I sold some at RM20 and the rest at only RM8+.

Geshen

I can't remember exactly how I came to know this company, which was a very cold and unknown company. From my record, I bought its shares on Mac 2015. I think may be from its previous quarterly result announcement in Feb 2015 which showed a significant jump in its net profit. It's not a very exciting result but I found out that it has just disposed its two loss-making subsidiaries and planned to acquire a growing profit-making peer. I felt that it would start a new page of growth and bought its shares. It was a great investment for me.

YOCB

This was just a coincidence. I was studying a company with a name of Yokohama in Aug 2013. When I searched for it in Bursa website, I saw another company alongside it with a strange name of "YOCB" which attracted my attention. That's how I started to study this company out of curiosity. I bought it because of its low PE ratio and good dividend. It was not a bad investment for me though I might have sold it too early.

Tambun

This is easy. I bought my first property from Tambun Indah and I certainly knew it well. As I was more focused in property investment at that time between 2008 and 2013, I knew a lot of other property companies and their projects.

At that time Tambun bought a vast landbank cheaply at Bandar Tasek Mutiara, which is located at Seberang Perai Selatan of Penang. We know that the nearby Batu Kawan is the next big thing. New projects were launched aggressively and each of them was rapidly sold out. So, it's also a no-brainer during such a property boom.

Huayang

Not every property stocks I bought at that time made money. Of all my completed buy-sell transaction up to today, the largest loss was Huayang, followed by Tropicana, both are property stocks. Huayang needs no introduction to investors at that time. Its revenue & profit was growing steadily, gave away mouth-watering dividends and multiple bonus issues.

I felt like I missed the boat and always dreamed of owning its shares. Finally I became its shareholder in Sep 2014 at RM2.32, the price level which later proved to be at the peak. Even though subsequent quarterly results were good even with EPS of 11sen for 5 consecutive quarters, its share price just didn't go up but continued to drop instead. If we give a PE of 10x the share price should be at least RM4. Finally I cut loss at RM1.83 after 1 year and 4 months. Property was in the negative trend and we could not beat the trend.

PPHB

I found out this stock after it released its FY19Q1 results in May19. The result was nothing spectacular, just that the market gave it a low PE of around 5x. After studying it like usual, there seemed to be slow growth in this company and I believed that its products have more demand nowadays. I bought in May19 and only in the end of 2019, the stocks price started to jump.

I would say that most of the time I find a company to invest through its quarterly financial report, while PE ratio and growth prospect are the main things I look at to decide whether to invest in it, although the debt ratio & simple cash flow still play a part.

So, how should you filter or select a company to invest in? The answer is read more, and do your own homework.