From the title above, I guess all readers will think that GPacket has a great financial quarter.

However, when you try to find out how much profit it made, you might vomit blood.

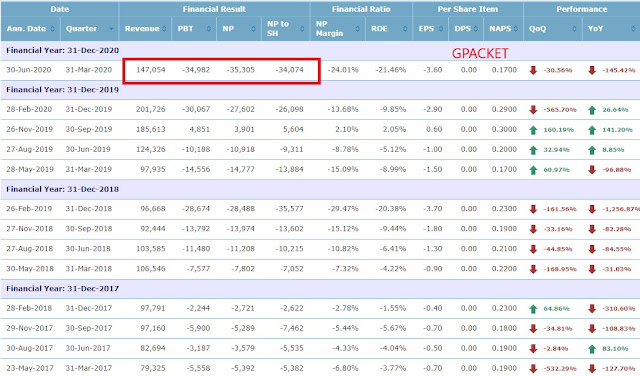

Revenue increased 50% YoY but it suffered loss after tax of RM35mil.

OK, there's one-off item inside. Without it, the EBIDTA is still a loss of RM11mil and the loss has widened YoY, perhaps affected by Covid-19.

It's actually not a surprise at all when GPacket reported a loss-making result, I think investors are already used to it.

What I want to bring out here is why "The Star" is helping GPacket to "beautify" the report?

I have seen news title like this before in which revenue or profit increases by so much and so much but actually QoQ everyone knows that it's a very bad result.

For example, previous year similar quarter (YoY) profit was RM1mil and current quarter profit at RM2mil, the news title will be "100% increase in profit" or "profit doubled", but the usual quarterly profit is at RM10mil.

This result of RM2mil profit is a "gap-down" result by current standard.

This time The Star seems to deliberately and totally ignore the loss-making part. The whole article only talks about how much revenue has increased in all the business segment and doesn't mention whether it is making a profit or a loss.

I don't mean that GPacket is a bad company. Its revenue increases significantly and it seems to be in the right industry of AI, digital and communication service.

However, there must be a reason why it's always hard to make profit, and I think I know the reason.

Then what do you think the reasons are ? Part 2 ? :P

ReplyDeleteOf course it's the top management issue :)

Delete