If you are long enough in the stock market, surely you would have heard of the scandal of Transmile.

Before I did my research recently about what has happened to Transmile, I knew very little about it.

I roughly knew that the company owned some airplanes, was related to Robert Kuok and was involved in an accounting scandal. That's all.

As currently the stock market has been overshadowed by alleged accounting fraud issue, I decided to find out what has happened to Transmile.

Perhaps we can learn something from it.

Transmile's main business was to provide air transportation and related services (mainly cargo) to its clients such as DHL, UPS, POS etc.

It was founded in 1993, listed on second board in 1997 and then transferred to main board in 2002.

The scandal first broke out in year 2007. At that time, Transmile seemed to be a darling stock of every investors, including institutions, funds, foreign investors and of course, retailers.

It was a designated national cargo carrier.

Its share price rose from around RM2 in 2002 to a peak of RM15 in early 2007, only to fall hopelessly to less than one sen before being delisted in year 2011.

Even though I officially "entered" the stock market in 2006, I was not that aware of this scandal because I was not actively investing and I didn't read business news.

I remember one of my colleague mentioned that he didn't want to "play" in the stock market again because of Transmile.

What has actually happened to Transmile?

To make the story short, the top management of Transmile overstated the revenues and profits of the company for financial year 2004, 2005 & 2006.

It was only discovered in May 2007 when its external auditor refused to sign off its annual audited account of FY2006.

Instead of huge growing profits, it was actually making losses in both 2005 & 2006.

Those responsible directors were booted out and new directors were elected to steer the company back on track.

However, the timing was not on its side. Global financial crisis struck in 2007-08. Crude oil price rose sharply up to USD140/barrel and the high debts finally killed the company.

Transmile took only 4 years after it was founded to be listed on the second board in 1997. This was quite impressive.

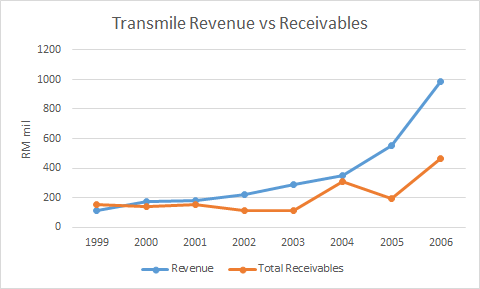

After making loss in 1998 during the Asian Financial Crisis, it started its remarkable journey of growth from a revenue of just over RM100mil in 1999 to almost RM 1 billion 7 years later in 2006.

Its PATAMI grew at a magnificent CAGR of 45% and it was an uninterrupted growth in both annual revenue and profit for 7 years!

The graph below shows the revenue and PATAMI of Transmile from 1999 to 2006 before the scandal broke out in 2007.

If I found out about this type of company at that time, most likely I would put my money in.

Nevertheless, despite the rise in net profit from 1999 to 2003, its EPS actually dropped due to a series of corporate exercises including bonus & rights issues.

Transmile carried out bonus issue (1:2) with rights issue (1:2, RM2.30 per right share) in year 2000. It had another bonus issue (2:5) in 2002.

Throughout the years, Transmile expanded its fleet quite aggressively with the acquisition of 10 new narrow body Boeing 727 and 4 new MD11 wide body aircrafts from 2000 to 2005.

Year 2005 was the exciting year as it acquired four MD11 aircrafts and two Boeing 727 in that year alone.

This high assets model and ever increasing debts played a big part in its downfall later.

The bar chart below shows the audited cash, total borrowings and net borrowings of Transmile. Its net debts surged in year 2005 because of the sudden increase in its aircraft fleet.

Anyway, it didn't seem to worry analysts and investors much, as the ever increasing fleet size was expected to bring in more revenue and profit to the company.

Year 2004 was an eventful year for Transmile which was full of excitement. This was also the year that the accounting fraud started according to the special audit.

First, Kuok Brothers Sdn Bhd suddenly became Transmile's largest shareholder after acquiring a 28.46% stake at RM6.25 per share through Trinity Coral.

Kuok Brothers belongs to Malaysia's richest man Robert Kuok. Who actually sold so many shares to Kuok?

The two largest shareholders of Transmile before this, who were the CEO (21.67% stake) and one NIED (14.63% stake), sold their shares at the same time.

From the following year's 2005 annual report, the CEO which was also the founder, had merely 0.21% stake remaining while that NIED was left with 0.05%.

The two largest shareholders and most important executive directors sold their shares like that and they were still running the company as usual. Is it a red flag to you?

Soon after this in April 2004, Dr Ling Liok Sik, the ex Transport Minister and MCA president joined the company as chairman. Surely he would bring a lot of business opportunities to Transmile.

Then, Pos Malaysia Berhad became the second largest shareholder after swapping its 30% stake in Transmile's major subsidiary for a 12.4% stake in Transmile at RM6.25 per share too.

Share placement of 7.9% was also given to Pos Malaysia Services Holding Berhad, a subsidiary of Pos Malaysia Berhad.

I can imagine how popular Transmile was at that time, especially with Robert Kuok on board, even though the Kuok did not take part in its daily operation.

Did the management face too much pressure to deliver until they decided to cheat?

It should be a good time for Transmile as more routes were opening up and it made its maiden flight to the US.

Did the company face cashflow issue despite the increasing revenues and profits?

The table below shows the cash flow of Transmile before the scandal (before special audit). Even with accounting fraud in year 2004 until 2006, it has already shown that the free cash flow was not good. For convenience, free cash flow here is Operating Cash Flow - Investing Cash Flow.

There seemed to be never-ending cash used in investing activities. The company needed to raise cash through share placement and borrowings.

There were multiple 10% private placement proposed every two years in 2001 (listed in Jan 2002 at RM2.29), 2003 (listed in Apr 2005 at RM9.20), 2005 (aborted) and 2006 (not completed due to scandal).

Besides, a share placement of 7.9% (RM98mil cash) was done for Pos Malaysia as mentioned earlier in 2004, and convertible bonds worth RM358.8mil was also issued in 2005.

Nevertheless, its operating cash flow looked very good indeed. Its net profit from year 2000 to 2005 was between RM20mil to RM50mil, but the operating cash flow was between RM80mil to RM120mil.

Was there any issue with Transmile's receivables and PPE?

Abnormally increasing receivables and PPE are usually linked to accounting irregularities. Can we spot something out of it?

- Increasing sales and profit but persistent poor free cash flow, ballooning receivables & PPE, increasing bank borrowings and needing multiple cash calls (private placement and rights issue)

At this point of time, its share price has already plunged from RM14 to below RM4.

Major shareholders such as Kuok Brothers and Pos Malaysia held on to their shares until the company was delisted.

This might have given investors a lot of confidence as they hoped that the new management team installed would bring the company back to profit.

Some investors might hold their shares or bought the shares when it dropped because of the Kuok Brothers.

Despite the accounting scandal, its most important cargo business was still running as usual, with strong relationship with DHL, POS and others.

However, we know that eventually the company could not be saved.

The bar chart below shows Transmile's revenue & profit before and after the scandal (audited in 2005 & 2006).

Transmile reported declining revenue and persistent losses after the scandal. There were overcapacity of air cargo, high fuel price and global financial crisis.

In May 2008, it started to default payment for its convertible bonds.

In Feb 2010, it was classified as PN17 when its shareholder equity was less than 25% of its issued and paid-up capital.

As it failed to come out with a regularization plan, it was suspended on 22 Feb 2011 and then delisted on 24 May 2011 after its appeal was denied.

If I'm not mistaken, it was only 6 sen per share before being delisted.

Now, Transmile has become Raya Airways after it was bought over by a private entity and restructured in mid 2013.

It seems like Raya Airways is profitable now and we might even see it publicly listed again some time in the future.

How about those masterminds behind the accounting scandal?

The audit committee, CEO and CFO were charged by the SC.

The audit committee was made up of 3 directors (two INEDs and one NIED). They did nothing after being alerted by D&T that the FY06Q4 quarter result was suspicious.

Those two INEDs in audit committee were sentenced to one year jail and RM300k fine each in 2011. Both of them did not hold any shares in Transmile.

The other NIED in the audit committee, who was also former second largest shareholder was charged separately.

However, this NIED who was not only in the audit committee but was also involved in the company's day to day operation, was later acquitted of the charge in 2016!

The charge against the CFO (Chief Financial Officer) was also withdrew earlier in 2008 after he paid RM700k compound.

Can the accused simply pay compound to get free from being sued? May be the CFO was instructed by somebody else to fake the account?

Then we have the CEO, who was the founder and former largest shareholder. The shares that he disposed to Kuok Brothers in 2004 were worth at least RM200mil.

He denied any wrongdoing, claiming that he only knew for the first time the overstatement of revenue for FY06 after the CFO "confessed" to him in a private meeting between the two on 8 May 2007.

Wow, he only found out one month after his company was being red flagged.

If the CEO was right, then the CFO must be the main culprit. However, this CFO was just fined and not jailed.

Why a CFO wanted to fake the company's account? I don't think he held a lot of its shares. He was also not the responsible person if the company perform badly.

Or how many millions has the CFO siphoned out of the company? Why he was not charged?

Anyway, the CEO was found guilty 13 years later in 2020 but was only been sentenced to one-day jail (no typo) and RM2.5mil fine.

Somehow the CEO appealed the court decision but later didn't turn up in the court. He was said to have absconded and arrest warrant was issued against him in Oct 2021.

I don't think he has problem paying RM2.5mil, it's only 1% of the value of shares he sold to Kuok Brothers. One day in jail he can just treat it like staying in a bad hotel for one night.

Perhaps he's really innocent? I can't comment much.

A CEO who did not know massive overstatement of revenue and profit in his company for 3 years. He must be sleeping on his job I guess.

Besides being charged by SC, new management of Transmile also sued the CEO and CFO in 2010 but the suits were dropped in 2019 due to lack of funds.

In the end, CEO jailed one day, CFO fined RM700k and NIED was "innocent".

Those two INEDs who were jailed one year and fined RM300k must be feeling extremely hard done by.

I think the jurisdiction system is the most inefficient thing exists. That's why people are still dare to fake company's account.

This comment has been removed by the author.

ReplyDeleteThanks for the article above, I able to understand the previous Transmile case now.

ReplyDeleteI think I can guess the reasons why Transmile started and kept this accounting scandal after reading your article.

Both the disposal of stocks by major shareholders and the accounting scandal started in year 2004, I guess the major shareholders wanted to inflate the earnings in 2004 to attract Robert Kuok to acquire Transmile. After that, they (had very low shareholding) became careless in operating Transmile and over-expanded the fleet capacity with increased debt in 2005. In 2005 and 2006, the earnings had to continue to inflate so that the good story planted since 2004 could continue..a bigger lie was needed to cover up the initial lie planted.

This summary was great, shed more light than one local academic journal that wrote Transmile case study.

ReplyDeleteOverall as you said, I also would have confidence given Kuok Brothers, POS MY, ex-MCA president are invested into it! Seems like it was really hard to pick out obvious red flags without benefit of hindsight.

If you are just looking at free cash flow alone, a lot companies out there are also having persistently negative CF but doesnt means all of them are fraud. The only solid case can be argue is that investors should be wary when top management do not have skin in the game and they are just earning salaries.

Another point might be their div yield, whether do they give any or not. But then again, just looking at div you cant definitively say it is a fraud (US co. like Amazon or BABA never give div, ever!)

I guess this is what keeps investor awake at night!

I find it very strange for a company's founder to sell all his shares and still hold the top job. In this case most likely it was requested by the new major shareholders. The high pressure to deliver and carelessness in operating the company probably led to the accounting fraud.

ReplyDelete