Summary for January 2022

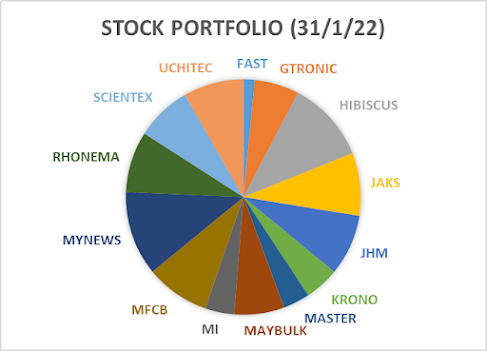

Portfolio @ End of Jan22

The first month of year 2022 was not a good month to the stock market as KLCI dropped 3.5%.

Tech-related stocks led the drop with approximately 20% slash in their share prices.

My portfolio could not escape from the bad sentiment and registered 1.2% loss in the month of January 2022.

The share price of the hopeless Fast Energy fell the most at 26% but it did not affect the overall portfolio much as the value is already very small.

JHM & Gtronic were the worst performers apart from Fast but overall loss was minimized by the 23.9% rise in Hibiscus's share price.

I sold part of my Hibiscus shares earlier at 88sen which was at the wrong timing again.

Besides Hibiscus, I sold all my LeonFB shares at 87.5sen, also shortly before its share price advanced to RM1 level.

I realized a bit of profit from myNews just to hold a bit more cash. All these selling acts were in anticipation of upcoming Omicron wave after Chinese New Year.

Today, new Coivd-19 cases in Malaysia has already surpassed 17,000 cases, which is five to six times more than 3,000 cases recorded in less than one month ago.

Nevertheless, KLCI rose 21 points or 1.4% today when there is 17,134 new Covid-19 cases. The index actually gains since the new Covid-19 cases grow.

So I guess Omicron wave will not have too much negative impact on our stock market, as there should be no further strict lockdown or MCO.

Now the government is even discussing about reopening the country's border as early as March without the need of quarantine.

Most tech stocks have dropped 20-30% from their peak. Is it a good time to grab some?

After a sharp fall in the first half of January, share prices of tech stocks seem to consolidate in the past 2 weeks.

However, the truth is that the PE valuation of most tech stocks are still on the high side.

Their share price might go up back to previous high or drop further to another lower level.

For investors who are fans of technology stocks, I think it's not wrong to collect a portion of shares at this stage.

I myself have some tech stocks in my watchlist since the end of last year.

After a brief study into some of those tech stocks, I like MPI the most but plan to buy Unisem first.

To my own surprise I ended up investing in MI first.

I've been watching MI for quite some time and I like its 10-year roadmap with "horizontal" diversification.

Initially I thought it only set up sales offices in Taiwan, South Korea & China but now it seems like there will be manufacturing sites there.

Because of high capex throughout the years, MI's free cash flow has been in the negative territory since it was listed in 2018.

This remains a concern to most investors and might have contributed to its sluggish share price compared to its peers.

Apart from this, dilution of earnings from new shares issued for acquisition of Accurus as well as from private placement to partly fund the acquisition of Talentek reduced its attractiveness in the eyes of investors.

To me, those are magnificent acquisitions and they should pave a broad way for its growth to another level in the future.

Generally I like what MI is doing but I have to monitor its cashflow closely.

There was one stock which I planned to buy in Jan22 but failed. One of the reasons I sold shares in January was to prepare for this investment. It was Coraza.

Its IPO price was 28sen and I already have a plan to act on its IPO day.

If its opening price is below 40sen, I will buy 100% with my allocated cash. If it's between 40-50sen I will buy 50% first. If it's between 50-60sen, I will buy 30%. If it's over 60sen, then I shall watch first as the sentiment for tech sector was bad.

Despite poor market sentiment at that time, I predicted that Coraza should probably open between 50-60sen.

It exceeded my expectation to open at 70sen but closed the day lower at 64.5sen.

I waited below 60sen but it never reached there. It went all the way up to 90sen in 4 days time.

This month there will be lots of companies in my portfolio releasing their quarter results again. Hopefully there will be no negative surprise this time.

"However, the truth is that the PE valuation of most tech stocks are still on the high side."

ReplyDeleteThe valuation of Bursa's tech stocks is indeed much higher than tech stocks in other countries. This phenomenon has been happening since a few years ago and to all Bursa's tech stocks. This was the main reason that stopped me from investing or even looking into Bursa's tech stocks in 2020/2021. I quote a few examples below :

Eg 1 : As of Apr'21, Busy Weekly reported that Frontkn in Bursa was selling at 60x PE multiple, whereas its Taiwanese competitor, who also provided services to TSMC, was selling at merely 12x then and its major customer, TSMC, who is such a great company was at 30x.

Eg 2 : Penta in Bursa is selling at 38.5x now even after the recent sharp drop in stock price, versus Penta listed in HK was at merely 10.27x.

The reasons I can think of for the PE gap above are :

ReplyDeletei) Bursa participants value tech stocks higher due to there are very few other stocks in other industries that can show high and consistent growth as in tech stocks.

ii) There are less high-performing tech stocks in Bursa if compared against other countries; for example, I learn that more than half of the listed stocks in Taiwan market consist of tech stocks and there are many great tech stocks. Another example is in HK market, Penta HK is compared against companies like Tencent & Alibaba and this explains why HK players give lower preference and valuation to Penta HK.

The above are the explanation I give to myself for why Bursa's tech stocks can continue to enjoy such relatively high valuation with the local investment bank analysts agree with their high PE, and give them high target price.

I collect antiques, and I can share with you that Nyonya ware (Nyonya porcelain) which was used by Baba and Nyonya in late 19th century can fetch very high valuation (just like Bursa's tech stocks) in Malaysia and Singapore. But, if we bring the Nyonya ware to auction market in other parts of the world, their valuation will be much lower (maybe just 25% of its price in Malaysia & Singapore) because international market would not give such high valuation to those local antiques.

ReplyDeleteI think the above can be used to give explanation in different angle for why rich valuation in Bursa's tech stocks.

Thanks for sharing your thought. You're right, Penta in Malaysia is a superb stock but in HK it looks ordinary compared to those giants. If I'm not wrong, last time may be 10 years ago, tech stocks average PE valuation was around 15x only.

Delete"To my own surprise I ended up investing in MI first."

ReplyDeleteI also bought MI in Jan/Feb'22. In fact, it is one of the several tech stocks I collected, I bought many :p

I think I have "accepted" the relative high valuation given to Bursa's tech stocks since Dec last year; it took me some times to "accept". I aim to keep them for long term bcos I am very positive on their prospect and growth in years to come. I hope my decision will not turn out to be a mistake (again) and hope my "acceptance" is not too late.

You surprise me that you invested in MI, I rarely hear you mention about it before :)

DeleteI think you must have bought MPI, Greatech and D&O. The latter two are still too "expensive" to me, MPI & Unisem are still acceptable. I guess Unisem should give a very good FY21Q4 result. For MI, it's more like a long term project and I hope that its share price will go up to previous high. At the moment Gtronic is the worst in OSAT and MI is the worst in ATE so their share price dropped the most. I still have confidence in both of them.