Summary For March 2022

Portfolio @ End of Mac22

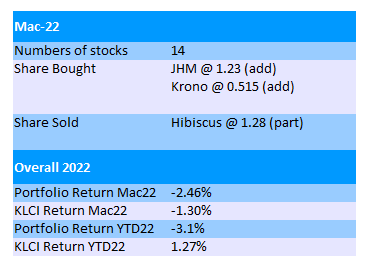

After a challenging month of Feb22, Mac22 was a volatile month for tech-related stocks in Bursa in which they fell heavily in the first week but then staged a V-shape recovery.

I just added a bit of Krono and JHM during this period of time. I still haven't averaged down on MI as its share price has already rebounded strongly before I made my move.

I planned to add MI's shares at RM1.50 but it didn't reach this level even though it was close.

In Mac, my portfolio suffered a 2.5% loss. Year-to-date the loss has widened to 3%.

Oil & gas stocks especially upstream Hibiscus have the exact opposite fate as the tech stocks.

The share price of Hibiscus rallied since the end of Jan22 from RM0.88 to reach RM1.38 on 9th Mac22, before falling 26% to almost RM1 in the next 4 days.

I sold my second batch of Hibiscus shares at RM1.28. I keep the rest to see how the market will respond to its upcoming quarter result which includes approximately 2 months contribution from acquired Repsol assets.

Scientex's FY22Q2 result was not that great as rising raw material and freight cost negatively affected its packaging division.

Its share price has retreated gradually from RM5 early this year to around RM4 now.

Scientex has an ambitious plan of doubling its revenue every 5 years. If everything goes as plan, then its FY2023 (ended Jul23) should achieve a revenue of RM5.2bil and FY2028 (ended Jul28) RM10.4bil.

Its revenue in most recent FY21 (ended Jul21) was RM3.66bil which is its record high.

I think for it to surpass RM5bil revenue in FY23, it has to come out with a huge merger & acquisition.

The latest FY22Q1 of myNews was within my expectation. It registered loss before tax of RM8.8mil, a 45% improvement from RM15.8mil loss before tax in immediate preceding quarter.

I don't expect it to jump straight into profit from a quarter LBT of RM15.8mil.

Its latest quarter revenue of RM139.4mil was almost its historical high and I'd expect it to break new high next quarter even though Feb & Mac 2022 were dominated by skyrocketing Omicron cases.

myNews has launched 40 new CU stores (total 61) and 2 Supervalue stores (total 9) in FY22Q1 from Nov21 to Jan22.

Anyway, I think it's still a big challenge for myNews to breakeven in its subsequent quarter of FY22Q2.

The share price of myNews has been hit rather hard in Mac22 in which it fell from 80sen to 70sen.

Is the worst over for myNews or it will continue to be stuck forever in losses?

As Malaysia enters endemic phase from Apr22, CU has announced extension of operating time to 24 hours a day for most of its stores.

Optimistic person will see increasing sales while pessimistic person will see increasing costs. We shall see how it pan out at the end of the year.

Krono reported a fairly good quarter of FY22Q4 with record high revenue of RM99.5mil. However, PATAMI of RM6.6mil (EPS 1.06) was slightly below my expectation.

As usual, the management is rather optimistic in the company's growth so I'd wait and see.

I will keep my guesstimated RM28mil annual profit from Krono in FY23 ended in Jan23.

From Mac22 onwards, I will adjust my average cost price of a stock after partially selling some shares to better reflect my temporary gain or loss position.

For example, my average cost per share for Jaks was 47sen before I sold partially at 78sen as well as selling all its free warrants.

Even though its share price has dropped to 33sen per share now, I roughly know that I should still sit in the positive territory but I'm not sure where is the breakeven point.

After calculation, I got the breakeven price for Jaks at 20sen. At 33sen, my overall temporary gain from this investment is just 19%.

Besides Jaks, I did the same adjustment to Hibiscus, Maybulk, myNews and Rhonema.

For Hibiscus, the remaining shares are considered "free shares" now.

In Mac22, US first interest rate hike since 2018 was confirmed at 0.25%. Market seems to breath a sigh of relief and all the US stock indices including our KLCI went up in response to it.

Banking sector did fairly well this month while plantation sector took a breather after a very good month in February.

From the 1st of April, Malaysia is going into endemic phase officially. Recovery stocks such as Genm and Capital A should see improvement in their financial results going forward.

Despite the approval of MRT3 circle line, I read that most analysts are still neutral on construction sector.

I have a plan to add at least one construction stock into my portfolio but it did not reach my target entry price.

The construction index has staged a good rebound in Mac22. Construction heavyweight such as Gamuda, Sunway & IJM have registered good share price gain in the month.

Currently my cash:shares ratio is at "historical high" of 35:65. Previously before the pandemic, my cash ratio was always below 10%.

Even with cash on hands, I'm not too clear regarding which stocks I should put my money in at the moment.

For the potential of growth, I still see tech-related stocks as the stand-out one.

However, I have to be careful not to put too much weight into tech-related sector, as they have already made up almost half of my portfolio.

Most plantation stocks will report record high profits in their Q1. However, since breaking RM8,000/T in early Mac22, locally traded CPO price has descended to around RM6,250 in early Apr22.

Compared to RM2,000+ before pandemic, current level of CPO is still very high and plantation companies should be able to grow their cash just like the gloves companies.

The performance of plantation stocks in later part of 2022 is very much depending on the movement of CPO price.

Will CPO go back to below RM3,000/T level, or it will find a new support at RM5,000/T level? Anyway, I don't think it can revisit the RM8,000/T level.

Current theme of the world is inflation. Which stocks in Bursa Malaysia do you think will benefit from it?

No comments:

Post a Comment