Since the euphoria in the second half of 2020, the stock market has not been doing well for the past one and a half year.

It seems like my best investment so far since 2021 is the property I invested in, which is Sunway Belfield.

Of course it's still too early to make any conclusion to this investment. Anything can happen down the road and it might still be possible to turn into a bad investment.

Tower A & B of Sunway Belfield are almost fully sold. Tower C was launched in November last year and the launching price was more than 15% higher for the smallest unit compared to Tower A.

I'd expect at least 30% appreciation in price once the construction is completed in 2024 or 2025. This is the reason I invested in Sunway Belfield in the first place.

In other words, I bought the smallest unit at around RM750 psf and I hope it can reach RM1000 psf once it's completed.

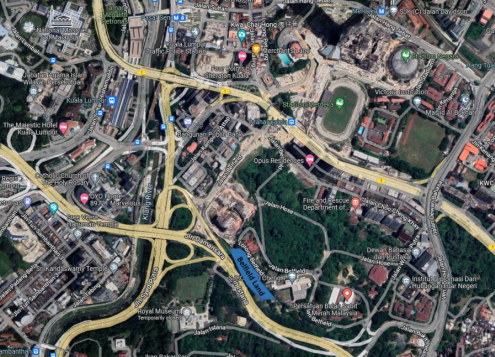

One thing for sure is, there will be much more supply of residential units in this Belfield or Kampung Attap area in the near future.

It is a 4.812 acres leasehold land acquired at a cost of RM125mil. In 2017, Sunway acquired its 4.53 acres Belfield land at RM165mil from Genting family.

When I first read that EUPE is acquiring a piece of land at Belfield, I thought EUPE will acquire it from Salcon.

It turns out to be another narrow tract of land fronting Jalan Istana which is slightly larger than Sunway Belfield's land.

It is between Sunway Belfield and SJKC Kuen Cheng 1.

EUPE plans high rise residential development on this piece of land which might be launched the earliest in year 2023. It will have 30% affordable housing though.

So there will be over 1,000 more residential units in this Belfield area.

EUPE is a decent property developer with good track records. I have written about this company last year.

Klang Valley projects completed by this Kedah-based developer include Novum Bangsar South and Parc3 Cheras.

Its on-going project Est8 Seputeh adjacent to Mid Valley City is still in the early stage.

Est8 has an extraordinary exuberant design but I'm not sure how well it will pan out in the future.

To me, I'd rather this EUPE land does not exist, or it is used to build shop offices.

Anyway, it all depends on how EUPE is going to plan its project here.

As EUPE's land is leasehold and further away from monorail station and Merdeka 118, Sunway Belfiled should have an advantage.

If EUPE wants to sell fast, then it should be mostly small units, either SoHo or 1-bedroom unit (eg. ~500 sq ft).

If its starting psf price is similar to Sunway Belfield at around RM750 psf, then 500 sq ft will cost RM375k which is quite affordable.

However, it's just next to the famous SJKC Kuen Cheng 1 primary school. So, larger units catered for family might be there as well.

There are 30% affordable units in this development and I'm keen to know how much is the price and how EUPE is going to plan it.

I wonder whether the affordable units will be mixed into a same building with other "luxury" units just like Quay West Residence in Penang.

Merdeka 118 and its shopping mall seem to be on track to be completed by the end of year 2023. Salcon and Tradewinds must be busy planning the development of their respective Belfield lands now.

Nevertheless, property market does not seem to be good to me since 2014. It's been more than 10 years since the last property boom around 2010.

Low interest environment will be gone soon and property price in most areas I know still stays rather depressed.

Even though property market seems to be soft, certain new projects are still selling quite well besides Sunway Belfield.

ASTRUM Ampang is a 6.85-acre leasehold development with GDV of RM1.68 bil located just adjacent to Jelatek LRT station and the very special LINQ Sky Residence featuring a sky ring bridge.

This transit-orientated development comprises 6 towers and it will house a whopping 5,228 units which are mainly SoHo.

Sunway Belfiled has 1,330 units in a 4.53 acres but it's still a far cry from ASTRUM which can squeeze 5,228 units into a 6.85 acre land.

Phase 1 consisting Tower A (712 units affordable SoHo & serviced apartments) & Tower S (1,360 units SoHo) was launched back in Sep21 and recently I read that it has been 98% taken up!

The Edge pinned its news article about ASTRUM for almost a month and I guess all readers can see it.

The affordable units in Tower A (Rumah Mampu Milik for first time buyers) with size of 450 sqft (SoHo) & 550 sqft (1-bedroom) are priced at RM230k & RM250k respectively.

The price of "non-affordable" SoHo units in Tower S starts from RM230k for a 280 sqft studio. This means RM820 psf.

A quick check online on PropertyGuru shows the LINQ Sky Residence is priced at RM852k for its 557 sqft studio which is a hefty RM1,500 psf if it's true. This is about the price of BBCC.

Anyway, I think that property investment is not easy since year 2014. The possibility of property price drop is there and we really have to find one which is way below market value in order to succeed in short to mid term.

When our interest rate was at record low in 2020 thanks to Covid-19 pandemic, many people were expecting a new cycle of property market boom.

However, it doesn't seem to be the case at least until today. Property price remains rather stagnant and supply seems to outstrip demand.

Affordability seems to be the main reason since it's hard to imagine another significant rise in property price of 30-50% just like a decade ago, unless one thing happens: Inflation.

Yes, the whole world is facing huge inflation pressure now.

I have just received a notice from insurance company that the insurance premiums for my whole family will be adjusted upwards by 25-35%!

After a round of significant inflation and salary hike, then only property price has room to rise.

Thus, inflation is a friend of property investors and it has been well proven in the history.

No comments:

Post a Comment