Summary of July 2022

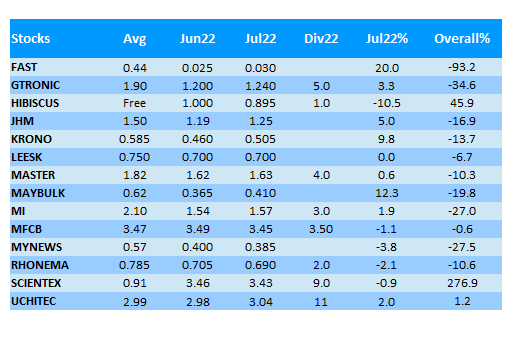

Portfolio @ End of Jul22

July seems to be a better month as KLCI went up 3.3% while my portfolio gained a modest 2.1%.

Most technology stocks staged a good rebound this month, especially Unisem which gained almost 50% from RM2.10 to RM3.10 after releasing a superb quarterly result.

Besides Unisem, Frontken and Dufu also achieved a commendable set of financial results.

Hibiscus was in the news for the wrong reason and its share price continues to fall from RM1 level to 80sen.

I guess the fall of its share price from RM1.50 earlier was related to this issue.

The management of Hibiscus has earlier warned investors regarding its tax dispute with Sabah state government and now it has exploded.

Sabah government will cancel Hibiscus's non-Sabahans work permits from 1st of Oct22 onwards if the sales tax and penalty are not settled.

Hibiscus's operation in Sabah includes the pre-existing North Sabah and the newly required Kinabalu field.

Since this SST was first implemented in Apr20, Hibiscus has not paid the tax as it was deemed to be unnecessary by its legal advisers, while Repsol's Kinabalu asset paid the tax under protest.

After the Kinabalu assset was sold to Hibiscus, Hibiscus stopped the tax payment straight away and surely this has made Sabah government jumped.

Sabah government demanded RM97.31mil from Hibiscus (RM66mil sales tax & RM31.31mil late payment penalty). However, Hibiscus said that the tax figures were inaccurate.

If Hibiscus is forced to pay the tax for its two Sabah assets, it is estimated to be around RM70mil a year which is 11% of FY23 earnings according to analyst.

This issue has been there for over 2 years and it's still unresolved. So I think it might take a long time to settle and if it drags on, it will only be bad for Hibiscus.

Anyway, Hibiscus will announce its latest quarter result of FY22Q4 soon, I'd expect its net profit to be over RM100mil.

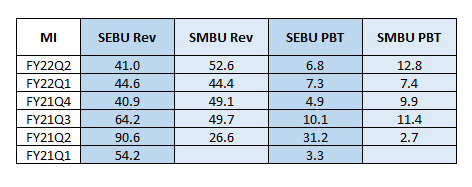

MI has released its FY22Q2 result and it was a rather disappointing one. It was "saved" by a RM8.3mil forex gain.

Its semiconductor equipment business unit (SEBU) does not seem to do well recently and the management blamed it on cautious customer capex spending amidst global uncertainties.

I hope that it's not the case that its customers turn to other equipment manufacturers.

Nevertheless, its semiconductor material business unit (SMBU) does offer some form of optimism, even though the exceptional forex gain might play a part.

Revenue from SMBU grows 18.5% and pre-tax profit jumps 74% in current quarter compared to immediate preceding quarter of FY22Q1.

Brent oil has dropped to below USD100/bbl and currently it is at USD95.

Certainly Hibiscus's share price will suffer no matter how good its upcoming financial results might be.

For other companies in my portfolio who are going to release their results in August, I do expect relatively good results from them.

Hopefully there will be no negative surprise.

No comments:

Post a Comment