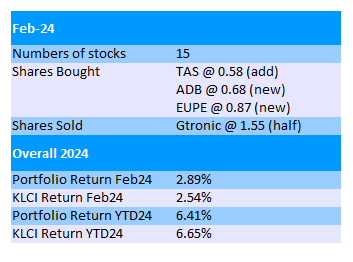

Summary For February 2024

Stock Portfolio @ End of Feb24

There was a net forex loss of RM1.8mil though.

Revenue from automotive segment dropped more than 50%. The management said that it was partially due to United Auto Workers strike started in Oct 2023.

From internet search, the strike took place in the USA, started from 15 Sep23 until 30 Oct23. I wonder whether this strike has really reduced JHM's sales to such an extent.

If it is, then may be the customers might order more in the next quarter?

Customers postponing new projects to replace the end-of-life projects might have a longer lasting negative effect on its business.

Gtronic's declining quarter result is widely expected. FY24 annual revenue of RM131.8mil is its lowest for at least 10 years. Net profit of RM26.4mil (EPS 3.94sen) is a 42% drop from FY23.

To me, the change in boardroom members is a very disappointing one. Those newly appointed executive directors also sit in the board of other listed companies which I don't think are fundamentally sound.

Why not appointing someone who has experience in technology space who will concentrate 100% in one company?

Nevertheless, I am surprised to see a well-known investor Mr Ooi KT keeps buying Gtronic's shares in millions even after the announcement of the boardroom changes.

Mr Ooi is famous for his successful investment in Frontken. He has been accumulating Frontken's shares since about 10 years ago and became its top 3 largest shareholders since 2013/14.

He has pared down its shares in Frontken since last year and has ceased to be a substantial shareholder. It's not a secret that he has changed boat to Gtronic.

As of today he already owns 76.9 million shares in Gtronic which means he should have become Gtronic's largest shareholder at 11.4%!

APB Resources who bought 70mil shares from the founder only has 10.4% stake in Gtronic.

Does he see some positives that I can't see? Does he has other plans for the company?

Initially I planned to dispose all my Gtronic shares but eventually I kept some to see what happens next.

The new directors might not be good at delivering marvelous financial results but they seem to be good at "delivering" the share price to the space. Just look at SCIB since Jun23, Artroniq since Apr22 & APB since May23.

Will their magic work in Gtronic?

T7Global FY23Q4 result looks great with record high revenue (RM250.7mil) and net profit (RM14.4mil, EPS 1.87sen).

It's good to see almost doubling of its quarter revenue but there is a RM8.5mil under other income which I'm not sure what is it.

It has proposed private placement of 10% as working capital. This resulted in drop in its share price as expected.

LEESK delivered a record high quarter net profit at RM4.1mil (EPS 2.55sen) in its FY23Q4. It will be better if not for its RM0.55mil one-off gratuity payment to a retiring director.

Besides a 3.5sen dividend, this time it also rewards shareholders with share dividend at 1:25 (4%). It has proposed a bonus issue of 1 for 2.

Its share price has dropped quite a bit after the ex of its entitlement. I hope that it can go back and stay above RM1 until next quarter's result announcement.

Rhonema also registered record high revenue (RM54.8mil) & net profit (RM4.8mil, EPS 1.52sen) in FY23Q4.

Other companies such as Maybulk, TMCLife, Hibiscus & MFCB are not too bad either.

As the number of stocks in my portfolio is getting more, I don't think I'll comment on every stocks here.

Hopefully I can have a chance to dispose some bad apples in my portfolio soon.

No comments:

Post a Comment