Summary of October 2024

Portfolio @ End of Oct24

The stock market has not been good to me since July 2024.

October 2024 continue to be lackluster. My portfolio value shrank 1.8% while KLCI retreated 2.8% in the month.

I decided to add FocusP into my portfolio. Even though it's not very undervalued, I think its downside is rather limited while offering some space of growth in the near future.

I don't have high target price for it. It will be great if it can reach RM1 next year.

EUPE's FY25Q2 result is not that bad. It registered RM103mil revenue & RM14.8mil PATAMI (EPS 10.1sen).

There was a RM7.2mil fair value gain and RM2.3mil fixed assets written off in the quarter.

Without these one-off items (net gain of RM4.8mil), its PBT for this quarter will still be slightly higher than preceding quarter of FY25Q1.

To me, EUPE's near future will depend on how soon it launches its big projects in Circadia Belfield & Edgewater Estate.

For Circadia Belfield, the plan is to build a total of four 30-storey service apartments with 765 + 696 units on top of a block of 8-storey podium.

As for TAS, its FY25Q1 revenue of RM44.3mil is its highest in the past 10 years. However, net profit of RM5.97mil (EPS 3.34sen) is a bit disappointing.

This reduction in margin is caused by RM1.9mil of forex loss & investment fair value loss in the quarter.

Recent strengthening of MYR especially against SGD is not friendly to TAS.

According to its FY24 annual report released in Sep24, it has successfully delivered 10 tugboats valued at RM67mil in FY24, and it still has RM210mil worth of remaining contracts.

From my own calculation, it still have about 29 vessels to be delivered in the next 2 years.

TAS has just announced in 23rd Oct24 a contract win of 8 tugboats worth RM49.1mil to be delivered in Q2 of year 2025.

Together with this recent contract, the order book stands at RM259mil. I predict that it might post revenue of at least RM140mil for FY25, which is double the figure of RM72mil in FY24.

The FY25Q1 result of TMCLife is a very disappointing one. Revenue is OK at RM81.9mil but the net profit is just RM2.9mil (EPS 0.17sen).

The depressed profit margin in previous FY24Q4 seems to continue into this quarter.

This happens since its CEO was suspended and now this ex-CEO will be removed permanently in the upcoming EGM.

I'm not sure how long such pathetic profit margin will persist and I have to think twice before averaging down.

Its share price has dropped to 51sen now, which is exactly its latest NTA. I guess 51sen should be a strong support for its share price.

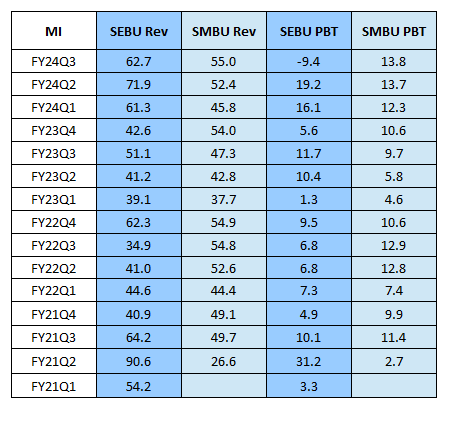

MI's FY24Q3 plunged into loss of RM7.2mil from revenue of RM117.7mil. However, the forex loss in this quarter alone is a whopping RM29.5mil.

It has just announced a "surprise" 2nd interim dividend of 3.5sen, making total 6sen of dividend so far for FY24. It might announce another dividend for FY24 in February next year.

No comments:

Post a Comment