Regarding credit cards, there are always debate on its good and bad sides.

To me, the benefits of credit card outweighs the drawbacks.

The main disadvantage of credit card is that the users spend beyond their ability to pay back in full, resulting in late payment charge and high finance charge from 15% to 18% per annum.

As long as you plan your credit card spending carefully, I think credit card is a great tool that helps in financial planning.

Here are the advantages and disadvantages of credit cards.

Advantages of credit cards:

- Offer savings via cash back, reward points and special discount with certain merchants

- Convenient in making payment, either online or in physical stores

- Track & record our spending via monthly statement

- Able to do 0% or low interest instalment

- It's a zero interest borrowing as long as settled before due date

- Can be used as emergency fund when needed

- Other added benefits such as free personal accident or travel insurance, airport lounges access etc.

Disadvantages of credit cards:

- High finance interest charge if unable to make full settlement before due date

- At risk of fraud such as unauthorized transaction and theft of credit card

- The ease of using credit card increases the risk of spending beyond own means and ruining own financial health

- Annual fee and RM25 government tax

To reap the benefits of credit cards, one must be very disciplined to know how much his/her spending limit is and be aware of how much he/she has spent.

To me, I like credit cards, but ONLY cash back credit cards.

I don't like cards with reward points as I will end up redeeming things that I don't need. I do not travel a lot so a travel card is not my cup of tea.

Cash back is the most straight forward saving I can get. Even though the amount of cash back might not be huge at around RM50 per month per card, it's better than none.

Every bank has its own cash back credit card, but which bank offers the most attractive one?

There is no fix answer on this unfortunately, it depends on card holder's spending habit.

Banks always revise their cash back structure from time to time, and the new structure almost always becomes less rewarding.

To find out which cash back credit card suits you more, I think you should consider the following:

- Your annual income: at least you need to fulfill the minimum annual income requirement

- Your monthly spending amount on credit card each month: at least you have to meet minimum spending per month in order to qualify for the cash back. If you spend average RM1,000 on credit card per month, there is no point holding a card with minimum monthly spending of RM2,000.

- The categories of cash back that suit you the most: petrol, grocery, dining, utility, online purchase, E-wallet transaction, cinema, travel, insurance payment etc.

- The monthly capping of the cash back: the higher the better.

- The annual fee of credit card: there is no point earning cash back if the card has high annual fee which can't be waived.

RHB SHELL VISA CARD

The cash back credit card that I like the most at the moment is RHB Shell Visa Card. However, it will drop out of favour soon after 8th September 2025 when its new cash back structure kicks in.

This card only needs minimum annual income of RM24,000. Its annual fee of RM195 can be automatically waived with minimum 24 swipes per year.

However, to get the most cash back from this card, you need to spend at least RM2,500 per month. If you can do that, refueling at Shell can get 12% cash back capped at RM50 per month.

On top of this, spending under groceries, utilities, online & e-wallet top up gets you 5% cash back capped at RM50 combined. Other spending also gets 0.2% unlimited cash back.

With such a plan, I can easily get RM90 cash back every month. My monthly petrol bill is around RM320, which will give me RM38 cash back per month. My utility bills alone exceed RM1,000 per month which will give me the maximum RM50 cash back, without even spending on grocery & online.

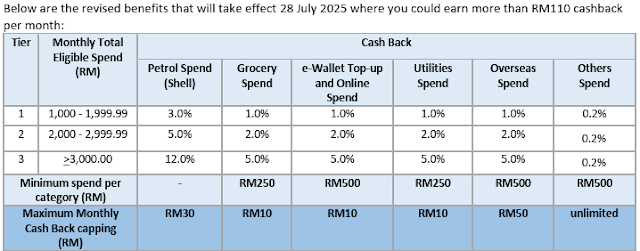

Nevertheless, starting from 8th September 2025, the cash back structure of RHB Shell Visa Card will be revised to the following:

Firstly, to obtain maximum cash back, the minimum overall monthly spending has been increased to RM3,000 from previous RM2,500.

Moreover, each category of grocery, online & utility has its own minimum spend to fulfill respectively (RM250 or RM500 per month), and has been capped at only RM10 per category. Shell petrol cash back has also been capped lower at RM30 per month.

There is an additional category in overseas spend with RM50 cap but it's useless to me.

Even though RHB labels this change as "enhanced benefits", I think 99% of existing users will think otherwise.

After such changes, my maximum monthly cash back from this card will drop to RM40 per month. My "effective cash back rate" drops from 3.6% to 1.3%.

Effective cash back here means maximum cash back earned divided by minimum spending required per month.

The problem is, is it still worth to fulfill the minimum RM3,000 monthly spending just to get such cash back when I still have other cash back credit cards?

UOB ONE PLATINUM CARD

I think UOB ONE Card should be a popular cash back card. My previous Citibank cash back master card with similar features was converted to UOB ONE after the acquisition of Citibank by UOB bank.

The minimum annual income requirement is RM36,000 and the annual fee is RM195 (ONE platinum) & RM120 (ONE classic).

Effective 1st Jan 2026, the annual fee can be automatically waived if card holder spends more than RM20,000 and RM15,000 on platinum & classic card respectively.

Both ONE classic & platinum card holders will get 10% cash back on each of four categories: petrol, groceries, dining & Grab, the difference is only the monthly capping which is RM10 per category for ONE classic and RM15 per category for ONE platinum.

The minimum spending for ONE platinum is higher at RM1,500 per month compared to ONE classic at RM800 per month. The RM800 figure was recently revised upward from RM500 starting 1st June 2025.

Spending in other categories can get you 0.02% unlimited cash back in both cards.

If you spend RM150 a month on each category of petrol, groceries & dining with platinum card, which I think is "normal" for most middle income family, you can get at least RM45 cash back a month, or an effective cash back rate of 3%.

If you use Grab a lot every month, you can add another RM15 to your cash back, increasing the effective cash back rate to 4%.

AMBANK CASH REBATE VISA PLATINUM CARD

AmBank Cash Rebate Visa Platinum card offers 8% cash back on groceries, pharmacies & online spending with minimum monthly spending of RM1,500.

The cash back is capped at RM15 per month for each of the 3 categories. Possible monthly cash back of RM45 represents an effective cash back rate of 3%.

This card is quite similar to UOB ONE with the same minimum spend, just the cash back rate is slightly lower at 8% compared to 10% in UOB ONE.

Only one category of grocery overlaps between this AmBank Cash Rebate card and UOB ONE card, making both complementing each other nicely.

If you spend RM338 on grocery, RM188 on online purchase, RM188 on pharmacy purchase, RM150 on petrol, RM150 on dining and RM150 on Grab per month, you can potentially get RM105 cash back a month if your total spending is RM1,500 monthly per card.

There is no annual fee for this AmBank card, with no conditions attached. It only requires annual income of RM24,000 to apply.

HONG LEONG WISE CARD

Hong Leong WISE card used to be the best cash back card but now it has dropped down the order after a series of revisions to its cash back structure.

Nevertheless, it is still a good cash back card to hold, with minimum annual income requirement of only RM24,000.

The drawback is that you need to spend on weekends to get the maximum cash back. I normally dine out in weekends, I can refuel my car every weekend but I don't do grocery shopping in weekends.

The latest structure, already in effect from 1st Jan 2025, requires a minimum spending of RM1,000 a month to get the maximum cash back, up from previous RM500.

The weekend cash back rate increases to 15% (dining) & 10% (grocery & petrol) from 8% previously, but online spending & e-wallet top up has dropped tremendously to only 1% from 8%.

The monthly capping of grocery & petrol categories stay the same at RM15 but there is an increase in dining category to RM20 which is nice.

HL WISE's cash back categories are quite similar to UOB ONE, but its grocery category includes pharmacies.

If you spend RM135 on dining per month, RM150 on petrol and grocery respectively per month, all in weekends, then you can get RM50 cash back per month as long as the minimum RM1,000 spending is fulfilled.

This is a superb 5% effective cash back rate, even excluding the online spending.

Last time I used to top up RM188 per month in Touch & Go e-wallet to get the RM15 cash back but now I can't do that anymore.

The annual fee of HL WISE card is RM98 which can't be waived! This annual fee, together with limitation to weekend spending, make this card slightly less attractive.

However, its relatively low minimum monthly spending of RM1,000 makes up for it.

HSBC AMANAH MPOWER PLATINUM CARD

HSBC Amanah MPower credit card-i is also a decent cash back card with minimum annual income requirement of RM36,000.

The minimum spending requirement per month to get the maximum cash back is slightly higher at RM2,000. Annual fee is RM240 which can be waived with one swipe a month and spending at least RM6,000 a year.

This card offers 8% cash back on petrol, grocery & e-wallet capped at RM15 per month respectively. Basically it's a RM45 cash back per month if you can spend at least RM188 on each category.

The effective cash back rate is 2.25%.

However, the grocery spending is limited to Lotus, Giant, Aeon Big & Mydin only.

ALLIANCE BANK VISA SIGNATURE CARD

Alliance Visa Signature card has minimum annual income requirement of RM48,000. Its annual fee is RM148 which can be waived with minimum spending of RM24,000 a year.

However, starting from 1st Aug 2025, the annual fee will NOT be waived after the first year which is a great drawback. To get annual fee waiver, card holder needs to have home loan with the bank, or have at least RM100,000 in savings or investments.

Anyway, if you can spend at least RM3,000 on this credit card on any retail purchases (without limitation to categories), you can get at least RM55.50 cash back per month.

There is no minimum spend required but it will be bad if you spend below RM2,000 a month with this card.

Even though the effective cash back rate is a modest 1.85%, I like this card as it is "hassle-free".

OTHERS

BSN Visa Cash Back Card has a maximum 5% cash rebate for 3 categories of petrol, grocery & dining capped at RM15 per category per month.

The minimum monthly spending to qualify for 5% cash back is RM3,000, with effective cash back rate of 1.5%. This makes it less attractive compared to other credit cards above such as UOB ONE, AmBank Cash Rebate, HL WISE & HSBC Amanah MPower.

There is no annual fee for this card though, and there is unlimited 1% cash back on oversea retail spending.

The minimum annual income requirement is RM48,000.

Bank Islam Visa Infinite Card-i offers 8% cash back on grocery, dining, online & auto-billing.

The minimum spending requirement per month is RM2,000. This makes it quite similar to HSBC Amanah MPower card but too bad the monthly cash back is capped at only RM30 which represents an effective cash back rate of 1.5%.

Cash back of 5% is given to monthly spending of RM1,000 to RM1,999, with similar monthly cap at RM30. This seems to be more appealing with an effective cash back rate of 3% if you can spend exactly RM1,000 per month on those 4 categories combined.

Its annual fee is high at RM777 but can be waived automatically with at least 12 transaction per year. Minimum annual income requirement is RM100,000 though.

Maybank 2 Platinum/Gold American Express (AMEX) credit card offers 5% cash back on all retail spending on weekends only, except government services, utilities & e-wallet top up. It comes with some reward points too.

Monthly cash back is capped at RM50 and there is lifetime annual fee waiver. There seems to be no minimum spending requirement per month.

Basically you only need to spend RM1,000 per month during weekends to get the full RM50 cash back, which is an attractive effective 5% cash back.

If you spend with this AMEX card on weekdays, you can get 5x Treatspoints even though there is no cash back.

Nevertheless, AMEX is not as widely accepted in Malaysia compared to Visa and Master cards. This issue, together with weekend spending, have reduced its attractiveness at least to me.

Individual with annual income of RM60,000 & RM30,000 can apply for this Maybank 2 Platinum & Gold cards respectively, which comes with 2 cards: AMEX & Master/Visa cards.

Its Master/Visa card is only for Treatspoints collection without cash back.

Maybank Visa Signature card, comes with high monthly cash back cap of RM88 but the cash back is only 5% for category grocery & petrol.

However, there is no minimum monthly spending requirement but the annual fee is ridiculously high at RM550, which can only be waived from spending more than RM30,000 a year, which is equivalent to an average monthly spending of RM2,500.

CIMB Petronas Visa Infinite-i card is quite similar to RHB Shell Visa card. It offers 12% cash back for Petronas related transaction (RM60 monthly cap) & 6% cash back for groceries, dining & cashless parking (another RM60 monthly cap).

Card holders need to spend at least RM4,000 a month in order to qualify for this maximum cash back, which makes it not that attractive to most people.

For spending between RM1,500 and RM4,000 per month, the cash back rate will be halved to 6% for Petronas & 3% for groceries, dining & cashless parking.

Even though the high RM60 monthly cap remains the same, it's unlikely to maximize it from lower cash back rate in limited categories.

The card is free for life but it requires minimum annual income of RM120,000.

CIMB Petronas Visa Platinum-i card has much lower annual income requirement at RM24,000 but its cash back is less attractive at 8% for Petronas and only 2% for groceries, dining & cashless parking.

Both categories' cash back are capped at RM50 each and the minimum monthly spending is RM2,000.

AEON Platinum Master or Visa Card gives its card holders 10% cash back at all AEON, AEON BIG & AEON Wellness stores but only on 20th & 28th of each month.

The cash back is capped high at RM100 per month. There is no minimum spend per month required.

Besides, there is also a 2% cash back on online spend, capped at RM25 per month.

The annual fee is RM200 which can be waived by spending above RM18,000 per year or average RM1,500 per month.

If you spend RM400 in AEON per month with this card, get RM40 cash back per month but in the end need to pay RM200 annual fee, it doesn't sound good.

AEON Gold Master or Visa Card might be better for some people, as the annual fee is much lower at RM95 and can be easily waived by minimum 12 swipes annually.

Even though its cash back rate at AEON related stores is lower at 8% compared to 10% in platinum card, it has a 5% of dining cash back capped at RM25 per month.

AEON Platinum & Gold cards require minimum annual income of RM60,000 and RM36,000 respectively to apply.

Affin DUO cards come with 2 cards which are Affin Visa Cash Back & Affin Mastercard Rewards. As its name implies, cash back is only for its Visa card.

Affin Visa cash back offers 3% cash back on online transaction, e-wallet reload & auto-billing, capped at RM50 per month if the previous month's statement balance is RM3,000 or above. If not, the monthly cap will drop to RM30.

This means that there is no minimum monthly spending requirement and you get effective 3% cash back. The drawback to me is the limited cash back categories but it will suit some people well.

Affin DUO+ cards, which also comes with 2 cards, have higher requirement of previous balance at RM8,000 but its monthly cap increases to RM100 and any "contactless transactions" besides government services & charity are eligible for 3% cash back.

For spending below RM8,000, the monthly cap is at RM50 but it is still a good effective cash back rate of 3%.

Unfortunately, it seems like the cash back is applicable only to transactions of RM250 and below.

The annual fees of Affin DUO & DUO+ are RM75 & RM100 per card respectively. All are free for 3 years then waived with minimum 12 retail swipes of any amount per year.

Standard Chartered Simply Cash credit card has a "high" cash back of "up to 15%" on petrol, grocery & dining.

However, the monthly cash back is capped at RM40 and user needs to spend at least RM2,500 per month to qualify for it, which is equivalent to 1.6% effective cash back rate.

The marketing gimmick of 15% cash back seems too much.

It requires minimum annual income of RM96,000 and has an annual fee of RM250 which is only waived in the first year. Sometimes the subsequent annual fee can be waived by special request depending on how much you spend with the card.

Public Bank Visa Signature card used to be a good cash back credit card many years ago but it is not that attractive now.

Annual income has to be at least RM80,000 to be eligible for this credit card but I don't think no one is willing to own it now.

It only gives 2% cash back for only dining and online transactions, capped at RM30 combined per month. To make things worse, each swipe has to be more than RM100 to be eligible for the cash back.

Annual fee of RM388 can be waived with 12 swipes per year though.

The only plus point is that it does not require a minimum spending per month.

I mention it here because it used to be a very good cash back card.

In summary, at the moment I think UOB ONE, AmBank Cash Rebate Visa Platinum & Hong Leong WISE credit cards are decent primary cash back credit cards to hold.

Affin DUO+ Visa (below RM250 transaction) or Maybank 2 Platinum (AMEX & weekend only) can be added as additional card if needed.

Since Affin DUO+ & Maybank 2 come with 2 cards, I suppose we can cancel one of them before the anniversary date.

Banks will keep on changing their credit card cash back structures. The best card now might not be the best anymore suddenly, just like the RHB Shell Visa card in my case.

Nevertheless, if chosen correctly, an average person can still enjoy RM500 to RM1,000 of cash back annually.

The bottom line is, do not fall into the trap of spending more than what you need just to fulfill the minimum spending to qualify for cash back.

Good stuff with lots of work being put into, shared

ReplyDeleteThanks :)

Delete