After M Suites and M City at Jalan Ampang, now comes M Sentral. Although Mah Sing just set to develop 4.08 acres of the total 58 acres mega regeneration project at the moment, it says that it is optimistic to carry out further future development at this site.

If Mah Sing is the prime developer, I guess this project will definitely be a great success, not like the awful Plaza Rakyat project, which remains a hopeless eye sore in one of the most congested area in KL. However, the selling price will not be cheap from the "premier lifestyle developer".

From The Star

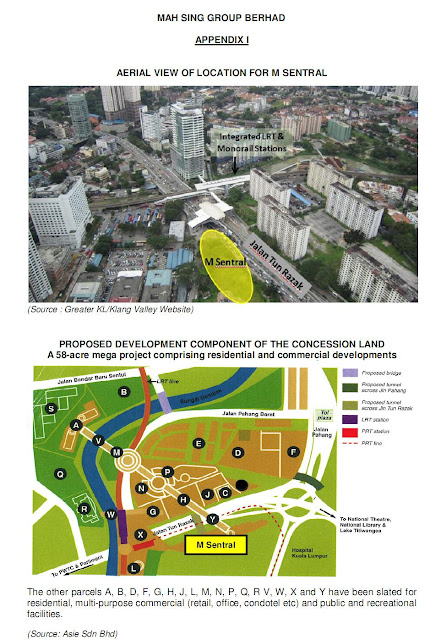

To be known as M Sentral, the project will comprise serviced residences and retail units along Jalan Tun Razak-Jalan Pahang and forms part of a privatised urban regeneration project in Kuala Lumpur, the property company said in a statement yesterday.

According to Mah Sing’s press release, the entire regeneration project has an estimated GDV of RM9bil, and covers 58 acres. Mah Sing also said that this is the largest privatised urban regeneration project in the city centre, with M Sentral being the first part of the entire project.

M Sentral: Part of the largest privatised urban regeneration project.

For its venture, Mah Sing’s wholly-owned subsidiary Grand Pavilion Development Sdn Bhd together with private company Asie Sdn Bhd which has full rights to develop the 58 acres and its subsidiary Usaha Nusantara Sdn Bhd will develop 4.08 acres into “smaller sized and more affordable” serviced residences as well as some retail units.

No additional information was provided about Asie. But earlier media reports indicated that the urban renewal development of the decades-old Pekeliling flats dated back to as far as 1997, when the project was approved by Kuala Lumpur City Hall.

The flats will be demolished soon

Asie was then said to be among several companies that vied for this major renewal project. It is unclear what had stalled the project up to now.

Under the RM900mil GDV joint-venture project between Mah Sing and Asie, there is a provision for a sky bridge connection to the balance of the 58 acres, “with the understanding that Mah Sing may be the potential joint-venture partner for other parcels within the land subject to terms and conditions to be mutually agreed upon,” Mah Sing said.

“I think it stands a good chance (of developing the rest of the land) owing to its track record,” CIMB Investment Bank Bhd research head Terence Wong said.

Analysts noted the project “could not afford to fail” given its prime location in the city centre.

Subject to relevant approvals, the proposed development M Sentral is expected to start by the first half of next year and will be developed over a span of five years.

Wong said the project would be “positive” for Mah Sing in terms of earnings and had inputed a 5% to 10% earnings increase from it together with Mah Sing’s latest acquisition of 205.72 acres of freehold land in Johor Baru for the development of its Mah Sing i-Parc, an integrated industrial and business park.

Mah Sing group managing director Tan Sri Leong Hoy Kum said in the statement: “Acquisition of strategically located land is part of our growth strategy, and urban renewal projects allow access to prime land in the city centre.

“M Sentral is just the beginning as we would like to take part in more urban regeneration projects by both the Government and the private sector.”

Mah Sing’s well-known property development projects include M-Suites and M-City, both located along Jalan Ampang, KL.

Leong said M Sentral was poised to be “the next major transit hub” and the target market for the project included local executives and expatriates.

Up til Titiwangsa lake.

M Sentral is within the catchment area of Kuala Lumpur, Jalan Ipoh, Sentul and also Petaling Jaya as it is close to transportation facilities such as light rail transit (LRT) and monorail stations, he said, noting that the Titiwangsa Monorail Station and the Titiwangsa LRT stations were within walking distance while the Sentul KTM station was about 3 km away.

A future mass rapid transit has also been planned for Titiwangsa, according to Leong.

Under the joint-venture agreement, Mah Sing’s unit Grand Pavilion will be granted the right to undertake the development of the land for RM106.6mil. This amount will be partly settled in cash (RM63.96mil) and partly by giving Asie’s unit Usaha Nusantara, a 40% stake in Grand Pavillion.

No comments:

Post a Comment