Just a couple of weeks after Notion announced that it is still in talk of a possible stake sales, now seems like the talk has already collapsed!

Notion just announced its 3rd quarter 2011 results. There is no major surprise. However, it's good that it is on track to register a record revenue and net profit year, after breaking those records every year since listed in 2005.

In 2011Q3, Notion's revenue rises steadily, the net profit though increases 240% YoY, but reduces 6% QoQ. As an 80% importer mostly done in USD, the weakening of USD has a significant impact on Notion. However, the impact is slightly offset by its USD hedging at RM31.2-3.22.

| RM mil | Revenue | Net Profit |

| 2006 | 90 | 24 |

| 2007 | 105 | 26 |

| 2008 | 146 | 33 |

| 2009 | 173 | 36 |

| 2010 | 227 | 37 |

| 3Q2011 | 175 | 34 |

Bear in mind that Notion is primarily a hard disc drive (HDD) component manufacturer. While other counterparts in Malaysia such as JCY, Dufu and Eng suffers significant reduction in revenue and profit since the beginning of this year, Notion is able to sail through it convincingly, thanks to its shift from HDD to camera/auto segment (detail in previous post).

Notion announces recently that it has secured a new 4+3 years contract from TRW Automotive to manufacture parts for hydraulic braking system. This will contribute about RM20mil revenue in FY2012 with estimated margin of 15%. This is not bad as this single contract in Notion's smallest automotive segment already contribute ~10% of 2010's revenue. Moreover, the new aluminum ingot plant is starting to generate a new source of income.

TRW: One of the largest automobile safety products provider

The management of Notion still remain cautious regarding future earning due to economy concern in the US and Europe. Its guided revenue for the final quarter 2011 is RM60-65mil.

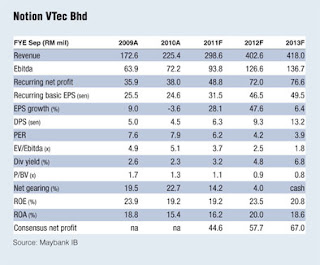

Below is the latest analyst report by Maybank IB.

Notion VTec Bhd

(Aug 12, RM1.97)

(Aug 12, RM1.97)

Maintain buy at RM1.95 with target price of RM2.40: 9MFY11 net profit of RM34 million (+17% year-on-year) made up 71% and 76% of ours and consensus full-year forecasts. We maintain our “buy” call as valuation is inexpensive at 4.1 times CY12 PER, backed by a solid growth trend (38% two-year net profit CAGR). Our RM2.40 target price pegs Notion on 4.5 times FY11 EV/Ebitda, reflecting regional peers’ (ex-Japan) valuations. Our target price also indicates an undemanding forward PER of 5.1 times, significantly below the eight times average for our small-cap universe.

Despite a seasonally soft quarter, Notion reported stronger revenue of RM61 million (+13% quarter-on-quarter) owing to growth from all segments, especially camera (+20% q-o-q). Growth in camera sales was underpinned by lens body mount and lens sub-assembly works for Nikon, which commenced in April this year. Product mix continued to be skewed towards the camera segment, accounting for 48% of total revenue, while HDD and auto account for 36% and 16%, respectively.

Net profit of RM10 million was, however, down 6% q-o-q, primarily due to higher tax rate of 23% (+12 percentage points q-o-q). Pretax profit rose 9% q-o-q despite a slight contraction in earnings before interest, tax, depreciation and amortisation (Ebitda) margin by 1.8 percentage points on higher costs (i.e. labour, packaging, transport) and the weaker US dollar. Additionally, Notion reported a RM2 million derivative gain on its hedge contract in 3Q (2Q: RM3 million).

We understand that the company is in the midst of securing new customers/orders: Nidec (2.5” HDD baseplate), Axix (camera), TRW (auto) and Continental (auto). However, we also caution that there may be a pullback in orders due to the global recession outlook. We maintain our 38% two-year net profit CAGR forecasts for now, pending an analysts’ briefing. — Maybank IB Research, Aug 12

Decent EPS and ROE. The forecast is rather optimistic here.

Notion Latest Target Price

| Aug 2011 | Target Price |

| Maybank | 2.40 |

| ECM | 2.43 |

| OSK | 2.25 |

No comments:

Post a Comment