When I bumped into SKP Resources in early 2013, I thought I have found a jewel.

Its revenue and net profit increased tremendously in year 2012. It is extremely cash rich with zero debt, and gave very good dividends too.

Its biggest customer Dyson appoints it to manufacture and assemble its uprights vacuum cleaner. If I'm not mistaken, SKP even builds new factory just to cater for Dyson's order.

Its biggest customer Dyson appoints it to manufacture and assemble its uprights vacuum cleaner. If I'm not mistaken, SKP even builds new factory just to cater for Dyson's order.

At the same time, Dyson, who has the world's largest vacuum cleaner market share, is entering China market.

I bought SKP's shares in early May 2013, but sold all with minimal gain after it announced its poor FY13Q4 financial result about one month later.

SKP is over-dependent on one customer which is Dyson. The significant drop in revenue and profit in FY13Q3 was actually a warning sign. I made a mistake as I still bought its shares afterwards. I've learned now that I should be extra careful with any unexpected drop in financial results without a good reason. It's either a NO BUY or SELL.

At that time, I remember that TA is still very bullish on SKP, giving reasons such as less working days during festive period & stocking for China market opening. I'm actually thinking, are these good reasons or just excuses? TA even gave SKP higher target price at that time!

I sold SKP because first, its FY13Q4 result was worse. Secondly, while investors are hoping the new China market can increase SKP's order from Dyson, China market actually doesn't sell the Uprights vacuum cleaner which is manufactured by SKP!

Dyson China website: Uprights is missing

Now, after almost one year, SKP's performance is still not up to mark, struggling with less orders from major customers and increasing wages and later electricity tariff.

In its latest FY14Q3 result released this week, both revenue and net profit crashed to a new low since calendar year 2011.

Nevertheless, its cash continues to pile up with RM98.5mil cash and no debt. It gives 2.2sen dividend for FY2013 ended Mac13. At 0.31sen per share, it's a good 7.1% yield. Its ROE for FY14 should be around 13% though.

From previous year's trend, SKP should declare its interim dividend in early March. Will it still pay good dividend as its business is declining?

From previous year's trend, SKP should declare its interim dividend in early March. Will it still pay good dividend as its business is declining?

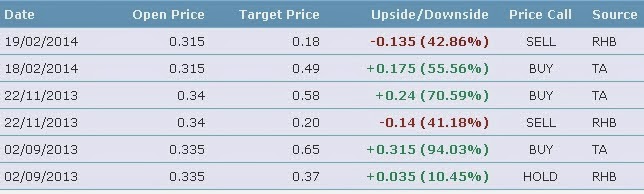

Just look at the most recent target price given by TA and RHB. TA gives a buy call with 55% potential upside, while RHB says sell with 43% potential downside.

Which one will you follow?

Sell sell sell ... haha ...

ReplyDeletemanagement team busy doing trade at market for the past 1,2 years instead of trying to improve the company performance.

Yup, directors buy sell buy sell non stop...

ReplyDeleteHi Bursa. What do you think of the recent turnaround by SKPRes? It seems quite compelling, esp with the 2 huge contracts from Dyson. Perhaps it is time to buy now? Tx and keep up the good work!

ReplyDeleteI have regretted big time over this stock. It's hard to predict its future earning level and its PE now seems relatively high. Anyway, I think it's a safe company to invest in long term.

Delete