The first 6 months of 2015 has passed. Though KLCI drops 3.1%, a lot of small-mid cap stocks actually register good gain.

These high-flying stocks are mainly furniture & other export-orientated stocks.

I'm more than happy that my portfolio gains 37.7% in 1H15, temporarily exceeding my target of 30% a year.

However, anything can happen in the second half just like last year.

Portfolio Performance from Jan15-Jun15

| Stocks |

End Dec14 |

End Jun15 |

% |

| GESHEN |

N/A |

0.73 |

N/A |

| GTRONIC |

4.30 |

5.95 |

38.4 |

| HEVEA |

N/A |

3.48 |

N/A |

| HHGROUP |

0.43 |

0.670 |

55.8 |

| HUAYANG |

2.05 |

1.92 |

-6.3 |

| INARI |

2.54 |

3.25 |

28.0 |

| INARI-WB |

N/A |

1.37 |

N/A |

| JOHOTIN |

N/A |

1.51 |

N/A |

| LATITUD |

3.65 |

5.85 |

60.3 |

| MATRIX |

2.70 |

3.10 |

14.8 |

| SCIENTEX |

7.09 |

6.89 |

-2.8 |

| TAMBUN |

1.62 |

1.66 |

2.5 |

Two tech stocks in my portfolio Globetronics (YTD +38.4%) & Inari Ametron (YTD +28.0%) have been doing quite well, with continuous high demand for smartphones and depreciation of MYR against USD.

If you ask me what is the stock in my portfolio that I like the most, it is Gtronic. I don't really know why. Perhaps it is because of its superb dividend payout & management team, as well as foreseeable high growth potential.

However, it has the highest PE ratio among all stocks in my portfolio, which means it is more likely to suffer most when time is bad. Its share price will also unlikely to advance rapidly at this stage.

Gtronic will start the production of new imaging sensors from end of 2015. Revenue from its sensor division is expected to double in 2016.

As my shareholding in Gtronic is relatively small, I will not sell them unless its business deteriorates significantly.

Anyway, most Gtronic related posts in this blog get the least pageview. This shows how unpopular this stock is compared to others.

In contrary, Inari is a very popular stock, though it has been quiet lately.

Inari has been busy increasing its floor space. Its newly acquired factory building in Bayan Lepas has just started operation. It will also build a new 6-storey building next to it later this year.

Will it get a new outsource contract from Avago soon? I don't know.

Global Smartphones Shipments trend

When I started to buy Geshen (+27.0%) shares in Mac15, I have the intention to promote it to my core portfolio because I feel that it has the potential for a 100% gain.

At below 60sen, I think it was undervalued after disposal of loss-making businesses and acquisition of profitable peer.

Furthermore, low crude oil price and stronger USD should be favourable for export-orientated plastic injection molding industry.

Nevertheless, I have been too cautious in buying more Geshen's shares and I'm still looking for a good top-up point.

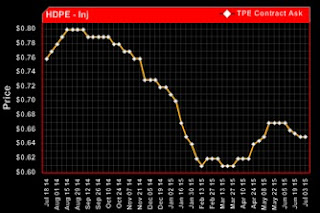

HDPE price - one of the raw materials in plastic injection molding

The heat on furniture & wood-based stocks seems to continue in 2015.

I have sold some shares of Latitude Tree (YTD +60.3%) in Feb15 at RM5.40 only to regret it later. Fortunately the fund has been used mainly to buy Geshen so it's a consolation.

Latitude which is the best performer in my portfolio in 1H15, still carries the most weight in my portfolio and it has pulled up overall portfolio return significantly.

Besides the external or broad market factor, I still find no reason to sell Latitude's shares at this stage. I expect its upcoming FY15Q4 result to be "enhanced" or "augmented" by relatively poorer FY14Q4 & FY15Q3 due to Vietnam riot & US West Port strike respectively.

Though Q4 is not traditionally a strong quarter for Latitude, I expect its PATAMI for FY15 to exceed RM80mil, which means FY15 EPS of at least 82sen.

As for Heveaboard (+12.3%), I felt that I must be crazy to start buying its shares as high as RM3.10 in end of May15. I just bought a little first, and waited for its share price to fall so that I can average down.

But its share price never really drop until now, and I actually feel a bit frustrated.

I always like Hevea and have plenty of chances to invest in it well below RM2.00 but I never take action, mainly due to worry of the high dilution effect of its warrants.

With such an impressive quarterly results for 2 consecutive quarters, I just feel that I should grab it first no matter what.

US New & Existing Home Sales

Heng Huat (YTD +55.8%) is my second best performer in 1H15. This is mainly helped by news of bonus issue and main board transfer I guess.

However, its financial results are not as good as what I anticipated, though they are not bad either.

As this company has expansion plan which is on track, I will keep its shares and continue to monitor it.

Johore Tin (-1.9%) is not a good investment so far. In longer term, I still hope that it is.

Its recent profit, balance sheet and cash flow do not looks good, that's why its share price stays depressed.

Its new milk packaging factory is expected to start operation only in Q3 of 2015. So shareholders are likely to endure another "unimpressive" quarterly result in August.

Anyway, I still hope for a positive surprise.

Whole Milk price hit a low in Jul15 - positive or negative to Johotin?

Keep? Sell? Keep? Sell? Keep? Sell? Keep? Sell?

These questions have been spinning in my mind since end of last year. It is about property stocks.

I still have 3.5 property stocks in my portfolio. Some people may think that I am either crazy or stupid by not disposing all of them.

Yes, they are right, as these property-related stocks except Matrix Concept have negatively affected my portfolio return in 1H15.

I have been telling myself to limit exposure to property stocks since early 2014.

Nevertheless, property stocks were the star performers in KLCI that year until Sep14. Remember?

Somehow this has reduced my "defensiveness" and discipline in avoiding property related stocks.

As a result, I still added a few property stocks such as Asian Pac, Protasco & Hua Yang in year 2014 just before it crashed in Oct14.

Though Hua Yang is the only one remaining now, it turns out to be the worst performer in my portfolio so far.

For Hua Yang, Tambun Indah & Matrix, the more their share price fell, the more reluctant for me to sell their shares now.

Tambun (YTD +2.5%) was my heavyweight shareholding last year, I have sold quite a lot of its shares until it reached the level I'm comfortable to hold amid slow property market.

I opine that Tambun's Pearl City township will still have good demand, as development in south Seberang Perai gathers pace along with Batu Kawan.

Besides, I also like its latest land acquisition in Bukit Mertajam. I do hope that it will strike another good and huge land deal soon.

For Matrix (YTD +14.8), it is the same. Though I have never been to Sendayan, I feel that this township is viable and will have good demand.

It feels great to be part of the prestigious Matrix Global School and d-Tempat Clubhouse too!

Matrix has incorporated a wholly-owned subsidiary in Australia recently. So it may venture oversea in the near future.

Huayang (YTD -6.3%) is a bit worrying for me though, mainly due to its high gearing. I'm a bit disappointed that its land deal in Mukim Batu has been called off, though its balance sheet can take a breather.

Anyway, Tambun, Matrix and Huayang are supported by decent unbilled sales which more or less guarantee that profit & dividend in year 2015 & 2016 will still be good.

With great dividends, there is not much harm to hold their shares and wait for property market turnaround.

When will property market recover? I thought that it will take quite a long time perhaps 3-4 years but some analysts say that we can see it in year 2016.

Really? Though no one can predict the future accurately, I hope that they are right.

I bought Scientex (YTD -2.8%) shares almost at the same time when buying Inari shares. Inari has shot up to the sky but Scientex is still slowly crawling up the hill.

Declining crude oil & resin price should benefit Scientex's manufacturing segment but it seems like the company passes the cost-saving to its customers, resulting in lower revenue.

I don't hold a lot of Scientex's shares and also not buying more mainly because I think its profit depends too much on property previously.

However, this "problem" of overdependent on property will probably be "solved" in the near future.

I feel that I will hold Scientex longer than any other stocks in my portfolio currently. It is no doubt a great company that keeps on enhancing shareholders value.

In order to keep those 3.5 property stocks in my portfolio, there is a compromise to be made - I will not add more property-related stocks into my portfolio.

So, Mitrajaya, MKH, Fututech, OSK, Sunway, and even the attractive-looking Tropicana etc, all I give them a miss.

What to expect in the 2nd half of 2015?

European countries might be negatively affected by Greece issue. Personally I don't feel that it can be too serious.

Among the stocks that I have, Geshen seems to have more exposure to Europe through Polyplas. I don't think that worldwide smartphones/tablets demand will be affected significantly.

Foreign fund continue to flee Malaysia, and MYR continue to depreciate against USD & SGD. Net exporters will continue to benefit while net importers will continue to suffer.

One quarter has passed since the implementation of GST.

I'm sure all of us can feel the post-GST effect, in which price of almost everything has gone up.

Even though international crude oil price drops substantially, RON95 fuel price that Malaysian pay at the moment (RM2.15) is even higher than 2014's level (RM2.10) after fuel subsidy was removed since Dec14.

I believe that cost of doing business generally went up, even though most GST can be claimed back. How will it affect the profit margin of all listed companies?

Can billions worth of existing construction contracts still able to generate enough profit to cover the escalating cost? Can property developers still able to enjoy high margin? Can manufacturing sector still able to protect their already thin margin?

How about pre-GST effect?

Investors have to beware of "false" jump in revenue & profit of some companies between Sep14 and Mac15 which is pre-GST period.

These companies are mainly in sectors such as consumer, pharmaceutical, local trading and even property sector.

It's a common sense that end-consumers, retailers and wholesalers will stock up more products or buy early in anticipation of imminent price increase in post-GST era.

This will directly increase revenue and profit of related companies but their subsequent results post-GST might be even worse than before.

I heard news that the government has been very slow in refunding 6% GST claimed back by manufacturers, wholesalers & retailers. This can seriously affect a company's cash flow.

As a result, borrowings might increase and will this benefit financial sector?

Another worrying part for me is potential local political turmoil. It has reached an unprecedented situation.

Anyway, if anything happen, it can be either good or bad for the country.

Other than these, I think Malaysia's economy is still not in a very bad shape at near term despite low crude oil & CPO price.

All my opinions here might not be accurate though.

In conclusion, I think I should be more cautious in stock market in 2H15.

The problem is, can I have the discipline to practice it?