Summary of October 2022

Portfolio @ End of Oct22

In October 2022, both myNews & Hibiscus performed brilliantly by advancing 24.4% & 15.5% respectively.

However, tech related stocks continue to suffer. JHM lost the most at 16% this month while Gtronic and Krono both fell 11%.

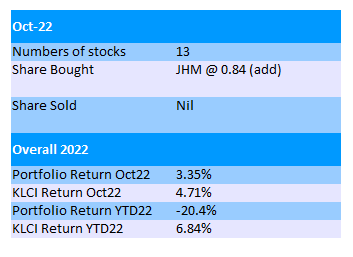

Overall, my portfolio manage to register a small gain of 3.3% this month but YTD is still losing 20%.

In Oct22, only Gtronic announced its FY22Q3 financial result.

Gtronic recorded revenue and net profit of RM46mil and RM12.8mil (EPS 1.91) respectively, which is above my expectation.

The net profit was higher than the preceding quarter of FY22Q2 (RM11.2mil), despite this FY22Q3 marks its first quarterly result without tax incentive.

FY22Q3 tax expense was RM2.3mil (15.2%) while it was merely RM0.6mil (5.4%) in FY22Q2.

Its latest result was saved by RM3.9mil of forex gain. Without the forex gain, its net profit should be around RM9-10mil.

Its revenue stays soft between RM40-50mil per quarter, mainly due to lower volume loadings from key customers and partly due to cessation of quartz crystal timing component business.

There seems to be quite a handful of new projects in the pipeline since last year but it is slow to materialize.

When the USD retreats against RM later, Gtronic's quarter result might look ugly.

Anyway, business wise I feel that it has already at the bottom waiting for taking off.

Of course, this depends on the capability of the new CEO.

MI has announced its FY22Q3 result in the first week of Nov22.

Similar to Gtronic, it has been saved by a forex gain of RM9mil.

Revenue and PATAMI for FY22Q3 is RM89.7mil & RM20.3mil (EPS 2.26) respectively. This is its second best ever profit performance in its history anyway.

Equipment business (SEBU) continue to slow down while material business (SMBU) continue to grow.

Quarterly SEBU's sales of RM34.9mil is its lowest since 2020, while SMBU's sales of RM54.8mil is its record high.

Cautious customer capital expenditure and deferment of order delivery are the main issue for its SEBU segment.

The management expects sales growth in its SMBU segment as its key customers had shown growth in market share.

The new SMBU plant in Ningbo still does not achieve commercial operation yet.

Besides, MI has also announced that it has moved its headquarter from Penang to Singapore, which also serves as HQ for its newly set up third business unit Semiconductor Solution Business Unit (SSBU).

Penang will remain as the HQ for SEBU, whereas Tainan is the HQ for SMBU.

It seems like this SSBU which is about advanced packaging technology will start from scratch so it will take time.

Even though its SEBU's sales has dropped recently from RM60+mil to RM40+mil per quarter, it's actually similar to pre-Covid level in 2018-2019 at around RM40mil per quarter.

I guess its SEBU revenue might pick up in the future if its products are competitive.

If this happens, then its share price will surely rebound.

JHM seems to be in big trouble as its share price keep falling. I guess the upcoming quarter result probably won't be good.

My only transaction in Oct22 was adding more JHM shares and it looks like a bad move.

Recently JHM announced a change of plan in which it will put on hold the construction of its Batu Kawan plant.

The plant is initially its expansion plan into new telecommunication equipment manufacturing business, or 5G related business which is one of the reasons I decided to invest more in it.

According to analyst, one of its key potential customers in the US has aborted its diversification plan into Malaysia on fear of global economic uncertainty.

I'm not sure whether it's bad luck or lack of awareness or not doing enough homework, those three tech stocks in my portfolio seems to suffer the same fate.

Gtronic closed down its KL plants, MI moved out of its new Batu Kawan plant, and JHM aborted its plan for a new plant.

No wonder their share prices dropped more than their counterparts.

Should I continue to hold their shares?

Other tech companies who have released their latest quarter results so far included Unisem, Vitrox, Dufu, Frontken & Penta.

I think both Frontken & Penta did extremely well, especially Penta who could still achieve decent growth despite massive loss in currency hedging.

Unisem and Vitrox did OK but Dufu suffered. The honest guidance by Dufu's management probably has caused its share price to dive 33% from RM2.40 to RM1.60 in one week.

Due to various reasons, most tech giants have readjusted their outlook lower. Thus it may affect our local tech companies negatively.

When this happens and the tech sector cools down, I guess a PE ratio of 15-20x, which was the level before the Covid-19, is fair.

Despite big drop in their share prices in the past one year, most of the proven resilient and great tech companies are still trading at PE of more than 30x.

I guess only continuous growth can support their share prices.

Malaysians will cast their votes to elect a new government next week. I'm not sure how will the election result affect the stock market.

Base on current situation with 3 corners fight, I don't think any coalition can form a strong government.

No matter who wins, I just hope that a clean, efficient and moderate government can be formed.

With this, only all of us can live in peace and harmony, and our stock market can perform well.

No comments:

Post a Comment