Summary For November 2022

My Portfolio @ End of Nov22

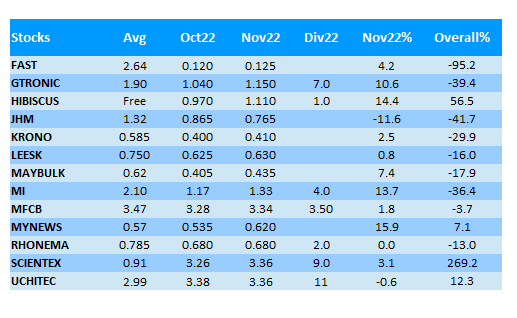

In the month of Nov22, tech-related stocks staged a good rebound. MI & Gtronic both rose 13.7% & 10.6% respectively but JHM dropped 11.6%.

The downtrend of JHM continues and it has already lost 25% in two months.

Meanwhile, the share price of Krono and Uchitec stay relatively flat.

MyNews is the top performer in my portfolio this month with a 15.9% gain, followed closely by Hibiscus at 14.4% gain.

Overall, Nov22 was dominated by General Election 15 and it was a good month for Malaysia's stock market.

The outcome of the election with the resulting "Unity Government" seems to be welcomed by most investors.

The quarterly revenue falls 18.5% from RM93.1mil to RM75.8mil in preceding quarter of FY22Q2. As a result, PBT drops significantly from RM12.1mil to RM7.1mil.

JHM has already announced earlier that it will include an additional tax of RM4.89mil and tax penalty of RM0.73mil (total RM5.62mil) in this quarter.

This makes its PATAMI only RM0.93mil. If not for the forex gain of RM3.7mil, this FY22Q3 will drop into red.

Anyway, the additional tax is one-off item but the main issue to me is the drop in revenue. The jump in revenue in the past one year is the main reason I keep my investment in JHM.

JHM management claims that the lower revenue is due to slower demand in automotive segment resulted from the global supply chain disruption.

Uchitec's FY22Q3 result continues to break its record high in Q3, with revenue of RM54.7mil and net profit of RM32.5mil (EPS 7.18).

The profit in this quarter include a forex gain of RM3.8mil and currency hedging loss of RM3.9mil.

At current share price of RM3.34, Uchitec's trailing PE ratio is just 13x. This might be because of its expiring tax incentive next year.

Anyway, it has proposed an interim dividend of 12sen for its FY22, normally to be ex-ed at this year end. It is 33% higher than 9sen in the corresponding period last year.

I predict that it might distribute another 15sen final dividend for FY22, bringing the total dividend to 27sen for FY22. This translates into a dividend yield of 8%.

The FY22Q3 result of Maybulk is so-so as expected. Its revenue stays flat at around RM38mil while net profit is RM12.3mil (EPS 1.23).

There is an one-off gain of RM2mil this quarter. Excluding this, its quarterly PBT will be around RM10mil which is kind of expected.

In mid Nov22, Maybulk announced that it has terminated the agreement to acquire grocery business under the brand of TMG.

Pursuant to this, Maybulk has announced a special dividend of 6.5sen per share. Another 3.5sen special dividend was added later, making it 10sen altogether which will be ex-ed on 22 Dec22.

Its share price was 38sen before the special dividend announcement.

The total special dividend distributed will be exactly RM100mil, which is not too much compared to its current net cash of RM360mil.

Even though its acquisition of TMG grocery business fell through, I'm not disappointed at all.

I hope that it can come up with a better acquisition in the future.

LeeSK's latest FY22Q3 revenue of RM31.7mil and net profit of RM2.4mil (EPS 1.50) are a bit disappointing as I expect EPS of 2.0sen each quarter.

There is another one-off impairment loss of RM1.5mil under its Italhouse investment but there is also an insurance compensation claim of RM1.99mil received for business disruption due to flood in Dec21.

The management guided that export market remains weak but Italhouse retail operation has since achieved turnaround after taking full control of it since Aug22.

Rhonema's FY22Q3 revenue of RM51.4mil and net profit of RM3.97mil are its highest in the history. However, PATAMI of RM3.2mil (EPS 1.45) is not its highest ever.

The segment of animal health products & equipment seems to register encouraging growth but the food ingredients and dairy business do not seem to do very well.

There is no news on its dairy project with Kulim Bhd and I guess it will take a long time to bear fruits if it were to be successful.

MFCB's FY22Q3's revenue and PATAMI are also its highest ever achieved, excluding quarter of FY21Q4 with massive one-off gain.

Its EPS in FY22Q3 is 12.64 sen.

There is improvement in revenue QoQ across the board but PBT in packaging drops slightly due to higher raw material and finance cost.

Under the "share of profit in JV and associates", there is an one-off gain of RM16.9mil for Edenor.

However, operationally, Edenor slipped into red with a share of lost of RM4.9mil after two consecutive quarters of profit due to sharp decline in CPO/CPKO price and depreciation of RM against USD.

The crown jewel of MFCB is certainly its Don Sahong hydroelectric dam. It has a 25-year concession which was just started in 2020.

Its tariff will increase 1% annually in the first 10 years, then reduced by 20% after 15 years and increase 1% annually again until the 25th year.

It is also exempted from income tax in the first 5 years.

The 5th turbine is under construction and is expected to be operational by Q3 of 2024. It will add another 65MW (25%) to its existing 260W.

The hydro dam will bring in massive cash flow to MFCB and it depends on how well the management utilize the cash to grow the group.

I guesstimate its FY22Q4 can at least achieve an EPS of 10sen, bringing the FY22 EPS to 42sen.

At current share price of RM3.36. It's only trading at PE ratio of 8x.

I'm a bit puzzled by the lackluster performance of MFCB's share price. It might be due to worry that Laos may go bankrupt, or the 20% reduction in tariff after 15 years or over reliance on the hydro dam.

In its latest FY23Q1, Hibiscus reported revenue of RM604.8mil and a net profit of RM135.3mil (EPS 6.72).

It seems like there are not too many one-off stuff in this quarter. There was only one take-off from its North Sabah operation.

The realized oil price for this quarter was quite high at around USD110 per barrel, except USD97 per barrel in UK.

Brent oil has dropped sharply since early Dec22 from USD89 to USD76 now.

OPEC+ are cutting their production while China is loosening its Covid restriction. I'm not sure why the crude oil price suddenly drop so much.

Is it related to the Russian oil cap at USD60 per barrel set by the G7 countries?

Anyway, it's impossible to predict price movement accurately. I think no matter what, Hibiscus should be able to produce EPS of at least 15sen in FY23.

Year 2022 will come to a conclusion soon and I hope that the stock market will end with a bang.

What lies ahead in year 2023?

The inflationary pressure is here and the recession risk is still looming.

After a series of aggressive interest rate hike, logically it should slow down in 2023 and this seems to be good to the stock market.

China has started to loosen its zero Covid policy. So we might see China fully back to its pre-Covid state next year. How will the stock market react to it?

People might forget about the Russia-Ukraine war and a cease fire agreement might be signed.

Back in Malaysia, I have some concern regarding the stability of our unity government.

I hope that under the new government, Malaysia will attract more foreign investment, and achieve significant steps in areas like 5G, EV, RE, MRT3, HSR etc, apart from instilling peace and harmony among all Malaysians.

No comments:

Post a Comment