Summary of November 2024

Portfolio @ End of Nov24

My portfolio's value continue to drop 0.9% in the month of Nov24, mainly due to the drop in the share price of EUPE & TAS.

Good gain in Hiaptek & MI did help to limit the overall loss though.

Year-to-date my portfolio gain has shrunk to 10%, from a 40% gain in Jun24.

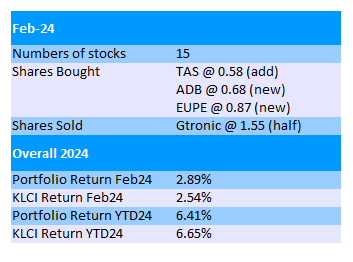

Finally I sold all my remaining Gtronic shares at 60sen, which indicates a loss of 35%. I should have sold all at RM1.55 back in Feb24 when I knew about the line up of the new management team.

My initial plan was to sell all of its shares but only when I was about to key in the number of shares I suddenly decided to change to half.

This decision has resulted in the widening of loss from 10% to 35%.